Foreign exchange (FX) volatility has always been a double-edged sword for multinational companies. While it reflects global business reach, it also brings unpredictability to financial results.

When currencies swing, reported revenues, costs, and profits can fluctuate even when the underlying business performance stays consistent.

The challenge? Translating these movements into clear, meaningful reporting that helps management and investors understand what’s real performance — and what’s FX noise.

At BrizoSystem, we believe transparency in FX reporting isn’t just about calculation accuracy — it’s about telling a consistent, comprehensible story across all entities and currencies.

1. Understanding the FX Impact on Consolidated Reporting

Before we can make FX reporting transparent, we must understand how it enters the consolidation process.

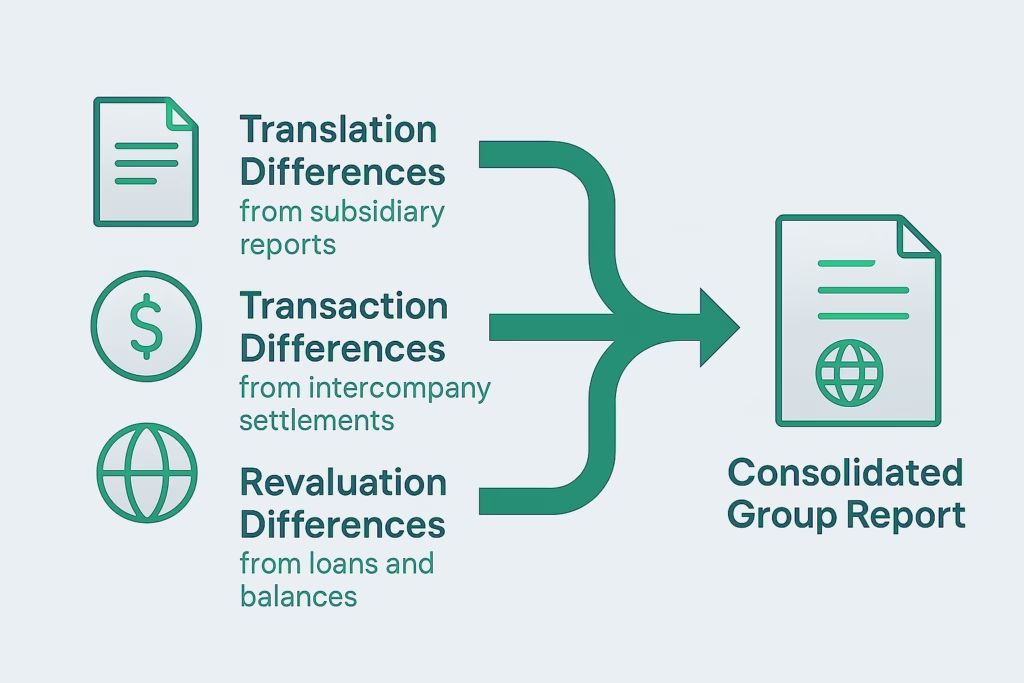

There are three main areas where FX impacts the group’s financials:

- Translation Differences — When converting subsidiaries’ financial statements from local currencies to the group’s reporting currency.

- Transaction Differences — When intercompany or external transactions are settled in a currency different from the entity’s functional currency.

- Revaluation Differences — When monetary items like loans, receivables, or payables are restated at closing rates at period-end.

Each of these creates FX gains or losses, but not all affect cash flow. Properly distinguishing between realized and unrealized effects is the first step to clarity.

2. Why FX Volatility Distorts the View

Imagine a group with entities in the US, Europe, and Japan.

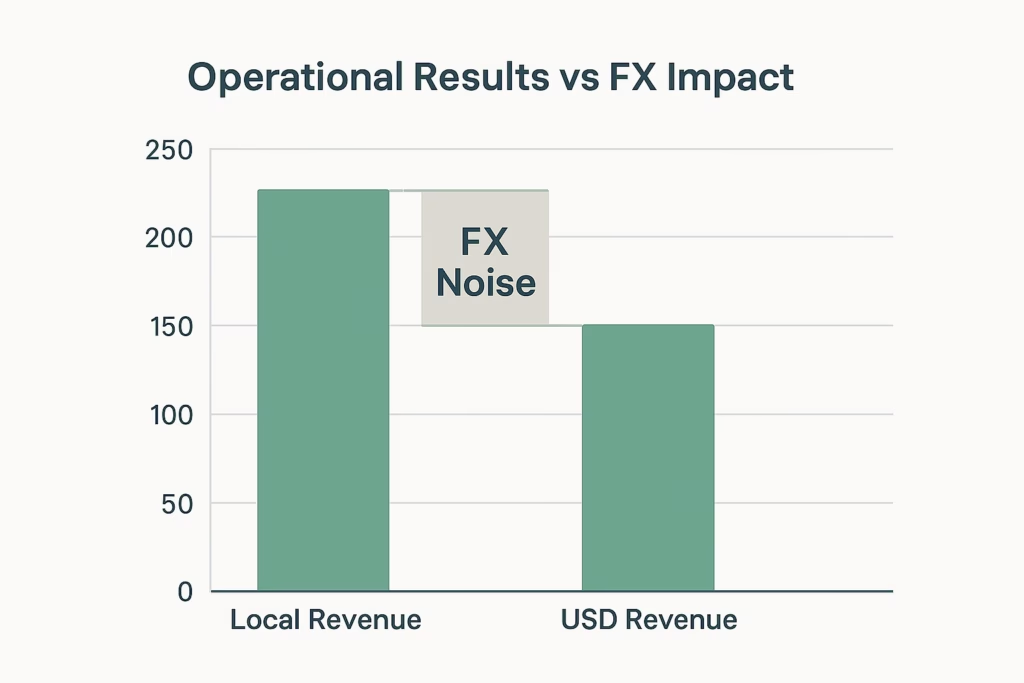

When the USD strengthens, the revenue reported from foreign subsidiaries (in USD terms) appears to decline — even if sales volumes stayed the same.

This “FX distortion” can lead management to misread performance, especially if reports don’t separate operational results from currency effects.

Worse, when local entities apply inconsistent translation methods or use different exchange rate sources, group reporting becomes messy, confusing, and unreliable.

3. The Building Blocks of Transparent FX Reporting

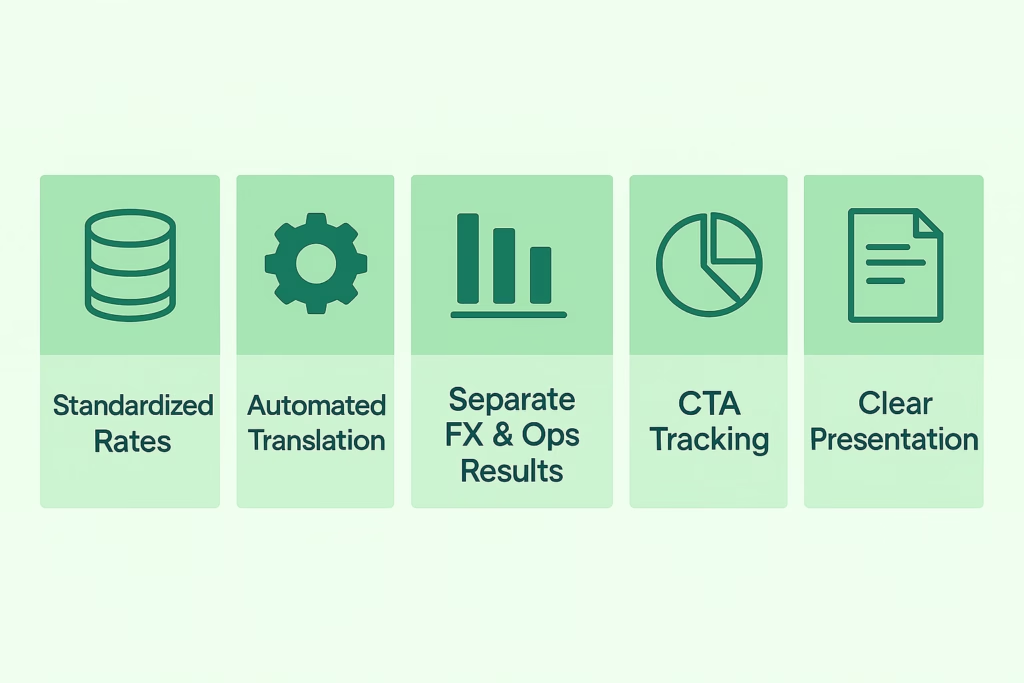

Transparent FX reporting begins with consistency. Here’s how best-in-class finance teams approach it:

a. Standardized Exchange Rates

Ensure all entities use the same set of monthly average, closing, and historical rates approved by group finance. Centralized rate management prevents mismatched conversions and inconsistent reporting.

b. Automated Translation Rules

Define and apply currency translation logic systematically — balance sheet items at closing rates, income statement items at average rates, and equity items at historical rates. Automation removes manual calculation errors.

c. Separate Operational and FX Effects

Clearly disclose both constant currency and reported currency performance in management reports. This allows decision-makers to distinguish between true business growth and FX fluctuations.

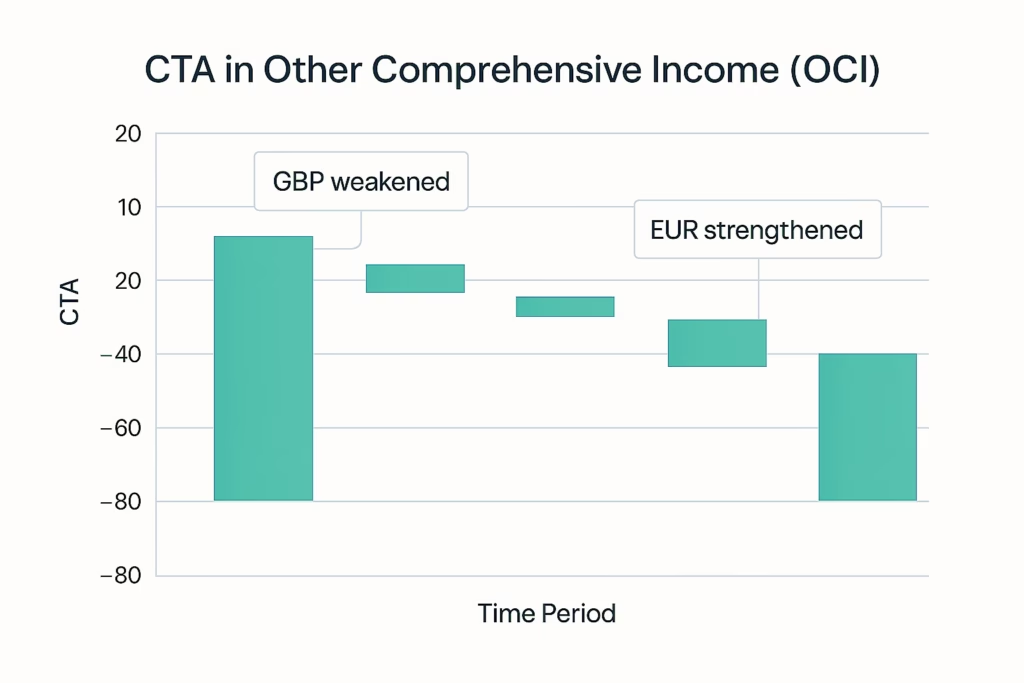

d. Transparent CTA Tracking

Use automated systems to track Cumulative Translation Adjustments (CTA) in equity. A consolidated CTA roll-forward ensures FX impacts are visible and reconcilable.

4. Common Challenges in Managing FX Impact

Even with a defined framework, finance teams often face persistent challenges:

a. Inconsistent Exchange Rate Application

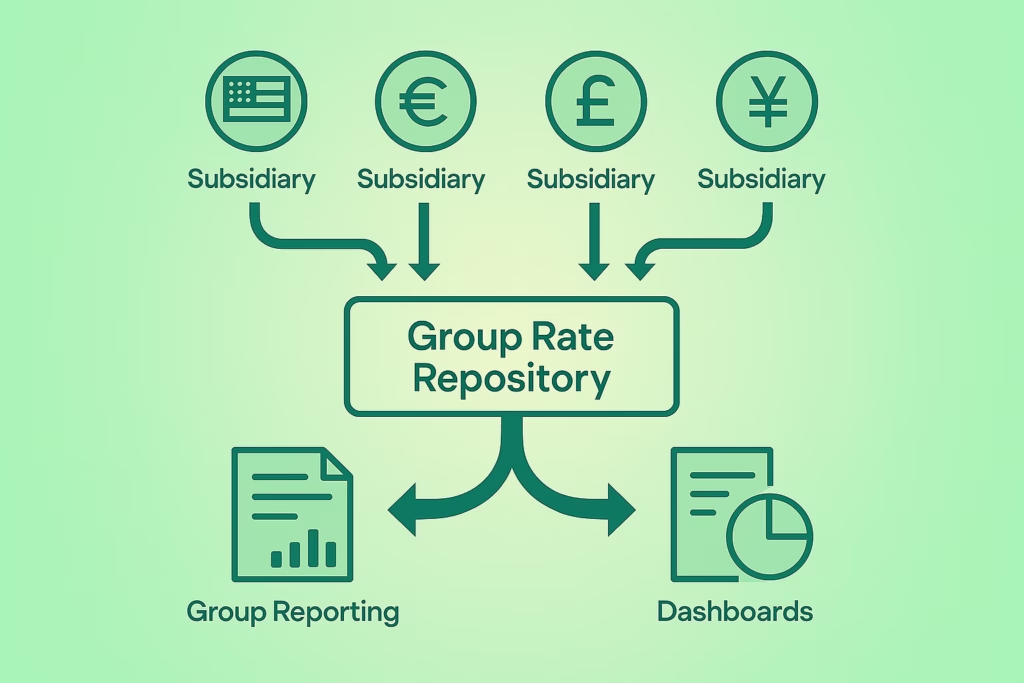

When subsidiaries use different rate sources or timing, consolidation becomes inconsistent. A central FX rate repository is essential.

b. Manual Adjustments and Excel Dependency

Manual conversion and CTA calculations increase the risk of formula errors and reconciliation failures — especially during group close.

c. Lack of Visibility into FX Movement Drivers

Without a clear link between operational performance and FX variance, it’s difficult for management to understand what drives changes in results.

d. Overcomplicating the Reporting

Some teams drown in details by presenting complex FX breakdowns that obscure rather than clarify. The goal is simplicity, not just accuracy.

5. Best Practices to Reduce FX Noise

To achieve transparency, forward-looking finance teams focus on structure, automation, and presentation.

1️⃣ Centralize and Standardize FX Rates

Create a single rate source and enforce its use across all subsidiaries. Systems like BrizoSystem can store and automatically apply approved FX rates during consolidation.

2️⃣ Automate FX Translation and Adjustments

Replace spreadsheets with automated currency translation logic that applies consistent accounting rules. Automation ensures repeatable accuracy and reduces close cycle times.

3️⃣ Introduce “Constant Currency” Reporting

Provide management with dual perspectives — reported vs constant currency results — to highlight the underlying performance without FX noise.

4️⃣ Visualize FX Movements

Include variance analysis charts or waterfall visuals that explain how exchange rate changes affect key metrics. Visual reporting helps turn complex movements into actionable insights.

5️⃣ Reconcile and Monitor CTA Movements

Regularly validate CTA balances against prior periods and translation movements. A clean CTA roll-forward reinforces confidence in reported results.

6. How BrizoSystem Brings FX Transparency to Life

BrizoSystem isn’t a GL — it’s where your accounting data becomes insight.

By integrating directly with entity-level financials, BrizoSystem:

- Automates FX translation using group-defined rates

- Clearly separates operational vs currency-driven variances

- Provides real-time dashboards to track CTA and FX impacts across entities

- Simplifies constant-currency and sensitivity reporting

With BrizoSystem, finance teams don’t just consolidate — they explain the numbers.

Conclusion: Turning FX Complexity into Clarity

FX volatility is unavoidable — but confusion isn’t.

With a structured approach and the right reporting tools, finance teams can turn volatile exchange movements into transparent, actionable insights.

When translation rules are consistent, rates are centralized, and reporting systems automate FX logic, CFOs gain the ability to explain performance with confidence.

Instead of defending the numbers, your finance team can tell the story — showing how the business performed beyond currency noise.

In global consolidation, clarity is the real currency of trust.