Financial consolidation is meant to deliver clarity — a single, reliable view of group performance.

Yet for many finance teams, consolidation remains one of the most time-consuming, error-prone parts of the reporting cycle.

Manual data collection, spreadsheet-based eliminations, late adjustments, and constant reconciliation issues often turn consolidation into a monthly firefight rather than a controlled process.

This is where automated financial consolidation changes the game.

What Is Automated Financial Consolidation?

Automated financial consolidation refers to the use of a dedicated reporting system to systematically collect, align, eliminate, and aggregate financial data from multiple entities into consolidated financial statements — with minimal manual intervention.

Unlike traditional spreadsheet-based approaches, automation ensures that:

- Data flows are structured and repeatable

- Rules are applied consistently every period

- Adjustments and eliminations are traceable

- Reports are generated faster and with greater confidence

Importantly, automated consolidation does not replace accounting systems. Each entity still records its numbers in its own GL or ERP. Automation begins after the books are closed, focusing purely on group reporting accuracy and efficiency.

Why Manual Consolidation Breaks Down

Manual consolidation usually works when groups are small and simple. But as organizations grow, cracks quickly appear.

Common pain points include:

- Multiple versions of spreadsheets with unclear ownership

- Inconsistent charts of accounts across entities

- Late discovery of intercompany mismatches

- Manual FX calculations and adjustments

- Limited audit trails and documentation

- Heavy dependence on a few key individuals

Over time, these issues don’t just slow reporting — they undermine trust in the numbers.

How Automated Financial Consolidation Works

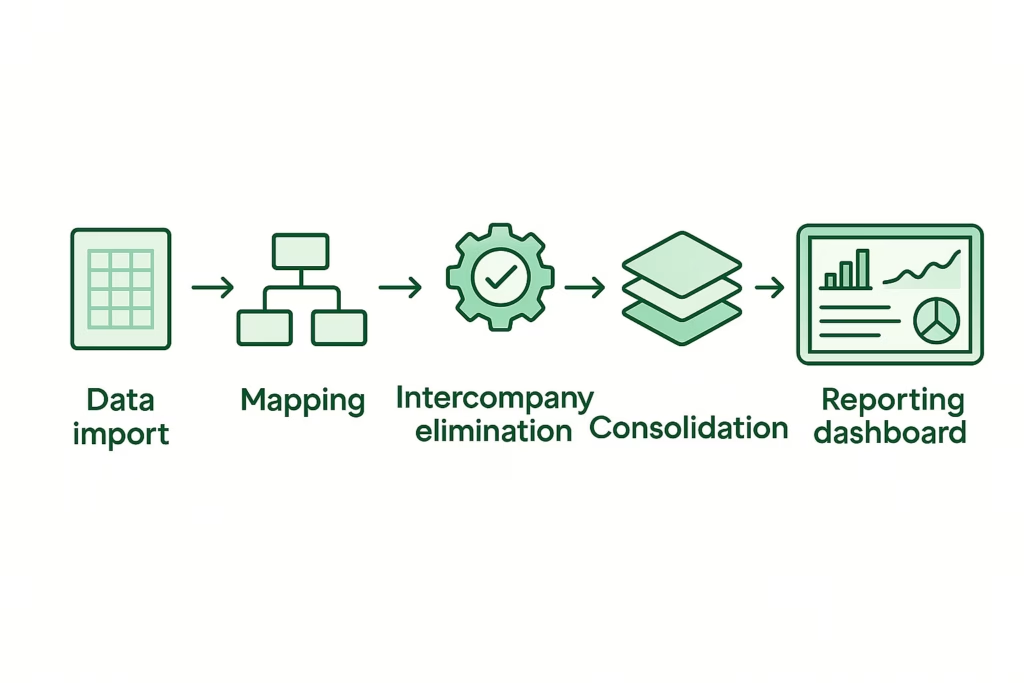

While tools differ, most automated consolidation processes follow a structured flow.

1. Structured Data Collection

Financial data is imported directly from accounting systems, templates, or connectors into a centralized reporting environment. This removes repetitive exports and reformatting.

2. Standardization and Mapping

Local charts of accounts are mapped to a group reporting structure. Once defined, mappings are reused every period, ensuring consistency.

3. Intercompany Matching and Elimination

Intercompany balances and transactions are automatically identified, matched, and eliminated based on predefined rules. Exceptions are flagged early instead of being discovered at the end.

4. FX Translation and Adjustments

Multi-currency balances are translated using consistent exchange rate logic, reducing volatility caused by manual handling.

5. Consolidation and Aggregation

Entity results are rolled up based on ownership structures, producing consolidated financial statements that reflect economic reality.

6. Reporting and Analysis

Final outputs — balance sheet, profit and loss, cash flow, and management reports — are generated directly from the consolidated dataset.

Key Benefits of Automated Financial Consolidation

Faster Close Cycles

Automation removes repetitive tasks, allowing finance teams to close and consolidate significantly faster.

Improved Accuracy and Consistency

Rules-based processes reduce human error and ensure the same logic is applied every reporting period.

Early Issue Detection

Intercompany mismatches, mapping gaps, and data inconsistencies surface early — not days before reporting deadlines.

Stronger Auditability

Clear audit trails show where data came from, what adjustments were made, and why — simplifying audits and reviews.

Scalability as the Group Grows

New entities, currencies, and reporting requirements can be added without rebuilding spreadsheets from scratch.

What Automation Does Not Mean

Automated consolidation is often misunderstood. It does not mean:

- Eliminating accounting judgment

- Removing the need for review and oversight

- Replacing GL or ERP systems

Instead, it allows finance professionals to spend less time assembling numbers and more time interpreting them.

When Does a Company Need Automated Consolidation?

Most mid-sized groups reach a tipping point when:

- They operate across multiple entities or countries

- Intercompany activity increases

- Reporting timelines tighten

- Management expects deeper insights, not just totals

At that stage, manual consolidation becomes a risk — not just an inconvenience.

Automation as a Reporting Strategy, Not Just a Tool

Automated financial consolidation is not about technology alone. It’s about creating a controlled, transparent, and repeatable reporting process that supports confident decision-making.

The real value lies in:

- Trustworthy group numbers

- Faster response to management questions

- Reduced dependency on spreadsheets

- A finance team focused on insights, not mechanics

Final Thoughts

As groups grow more complex, consolidation needs to evolve from a manual exercise into a structured reporting discipline.

Automated financial consolidation provides the foundation for:

- Reliable group reporting

- Scalable finance operations

- Clear visibility into performance

For finance teams looking to move from chaos to clarity, automation isn’t a luxury — it’s a necessity.