Introduction

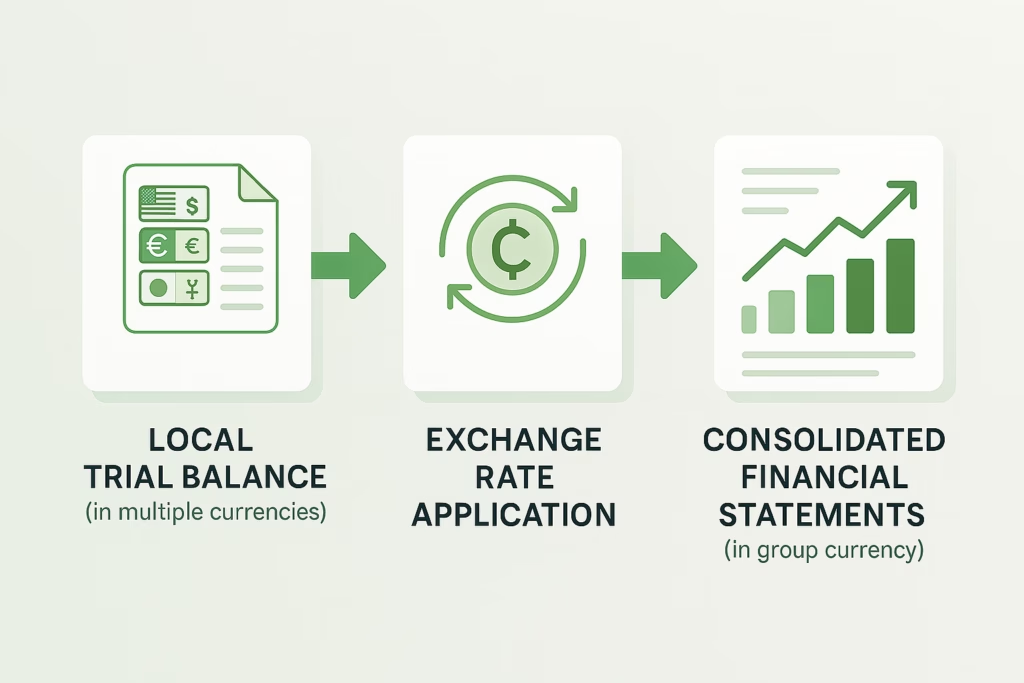

In today’s global business landscape, most corporate groups operate across multiple countries — and therefore, multiple currencies. While this diversification brings opportunity, it also introduces one of the most persistent challenges in consolidation: foreign currency translation.

When each subsidiary maintains its books in a local currency, group accountants must translate financials into a single reporting currency (e.g., USD, EUR, SGD) before consolidation. The process is far more than a mechanical conversion — it affects group performance, balance sheet integrity, and how stakeholders interpret results.

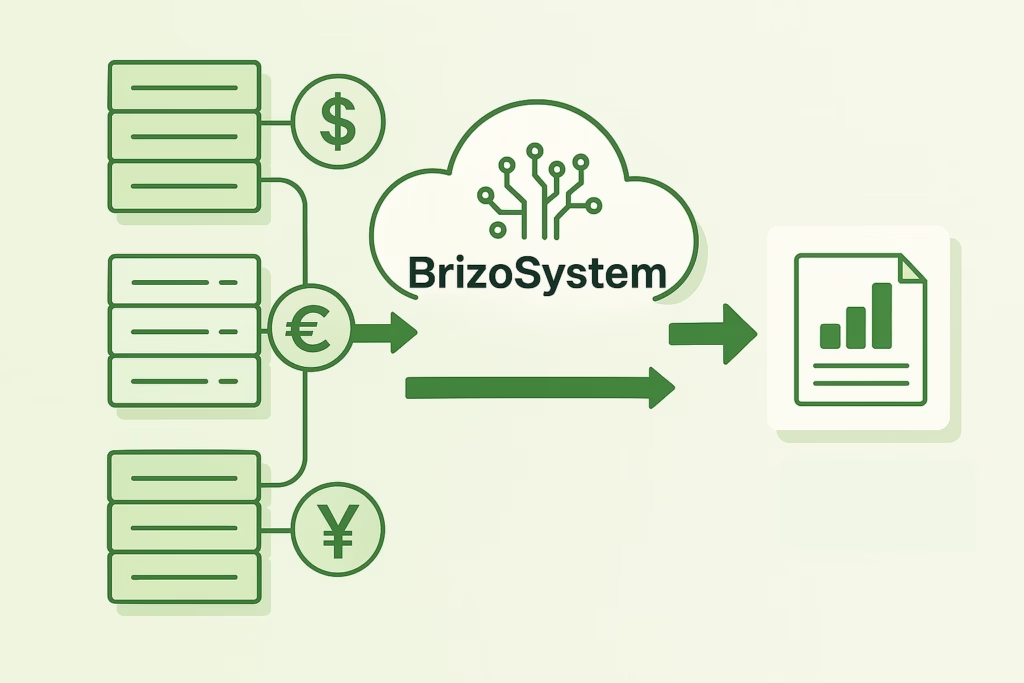

In this post, we’ll unpack the principles, techniques, challenges, and best practices of foreign currency translation in consolidation — and show how automation tools like BrizoSystem help simplify it without losing accuracy.

1. Understanding the Purpose of Foreign Currency Translation

Foreign currency translation ensures that all group entities are presented in one consistent currency, allowing users to understand overall performance without distortion.

The main goal is comparability — a common currency that reflects the true financial position and performance of the group as a single entity.

It’s not about converting cash; it’s about translating representation.

Key objectives include:

- Presenting consolidated results in the parent’s reporting currency

- Ensuring consistency between income statement, balance sheet, and equity movements

- Capturing and disclosing translation differences transparently

2. Common Translation Methods

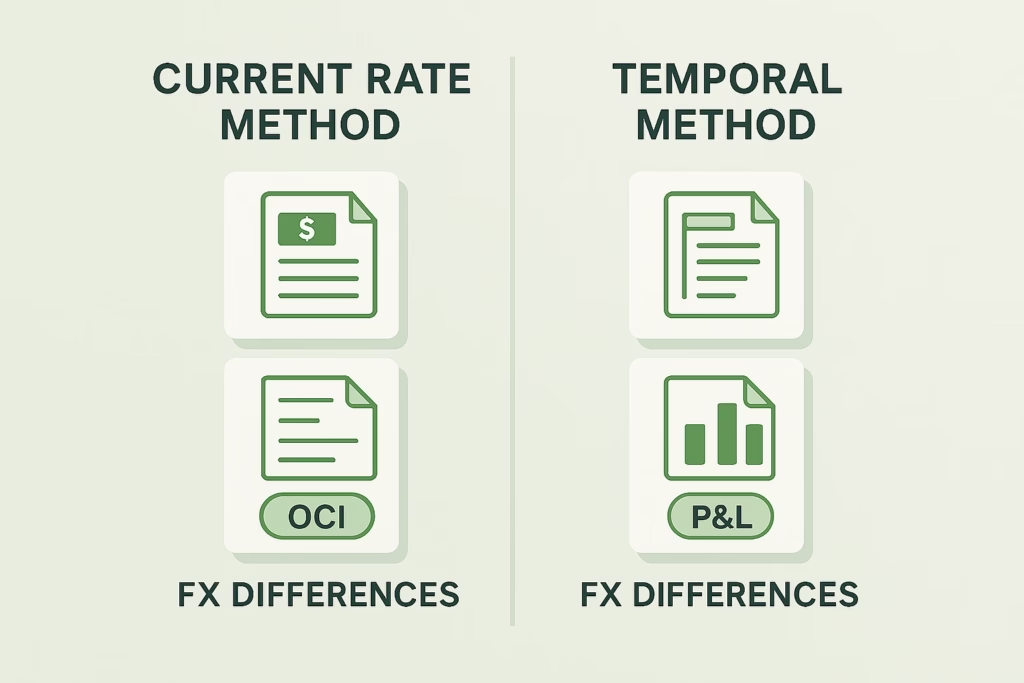

Depending on accounting standards (IFRS or US GAAP), there are several methods used for translation. The two most common are:

a. Current Rate Method (Closing Rate Method)

This is the standard approach under IFRS (IAS 21) for subsidiaries whose functional currency differs from the parent’s reporting currency.

- Assets and Liabilities: Translated at the closing rate (rate at balance sheet date).

- Income and Expenses: Translated at the average rate for the period.

- Equity (Share Capital & Reserves): Translated at historical rates.

- Translation Differences: Recognized in Other Comprehensive Income (OCI) as a Cumulative Translation Adjustment (CTA).

Use case: Most common for independent foreign subsidiaries.

b. Temporal Method

Used when a subsidiary’s functional currency is the same as the parent’s or when it operates in a highly inflationary economy.

- Monetary items (cash, receivables, payables): Closing rate

- Non-monetary items (inventory, fixed assets): Historical rate

- Income statement items: At the rate applicable to the underlying balance sheet items

- Exchange differences: Recognized directly in P&L, not OCI

Use case: When the subsidiary’s operations are an extension of the parent company rather than independent.

3. Step-by-Step Translation Process

Here’s how a typical foreign currency translation works during group consolidation:

- Identify each subsidiary’s functional currency

– Based on the primary economic environment of its operations. - Determine the parent’s reporting currency

– Usually the currency in which the group reports to shareholders. - Collect exchange rates

– Closing rate, average rate, and historical rates where necessary. - Translate trial balances

– Using rate rules defined by the chosen method. - Post translation differences

– Recognize translation adjustments in OCI or P&L as per policy. - Review the consolidated CTA balance

– Ensure reconciliation with retained earnings and equity movements.

4. Common Challenges in Foreign Currency Translation

Despite clear principles, many finance teams face recurring difficulties:

a. Inconsistent Rate Application

When local teams apply different exchange rate sources or update rates inconsistently, it leads to unreconciled variances at consolidation.

b. Tracking Historical Rates for Equity Accounts

Share capital and retained earnings often require historical rates, which can be difficult to trace back in multi-year, multi-entity environments.

c. Unrealized Translation Differences

FX fluctuations can create large translation gains or losses that don’t reflect operational reality, leading to confusion in performance discussions.

d. Manual Translation and Spreadsheet Errors

Manual processes using Excel increase the risk of formula errors, version control issues, and missing rate updates.

e. CTA Reconciliation Across Periods

Without automated tracking, ensuring that cumulative translation adjustments roll forward correctly can be time-consuming and error-prone.

5. Best Practices for Managing FX Translation in Consolidation

a. Define and Enforce a Consistent Rate Policy

Establish a clear policy defining:

- Rate sources (e.g., Bloomberg, central bank)

- Frequency of rate updates (daily, monthly)

- Handling of mid-month acquisitions or disposals

Consistency across all entities ensures accurate consolidation.

b. Automate Rate Management

Systems like BrizoSystem can automatically import and store exchange rates by date, apply them to relevant accounts, and flag inconsistencies.

Automation ensures:

- All entities use the same official rate

- Average and closing rates are applied correctly

- Historical rates are preserved for equity accounts

c. Maintain an FX Translation Matrix

A translation matrix helps map which rate applies to which account type (e.g., balance sheet, P&L, equity).

This structure also ensures IFRS or GAAP compliance and eliminates confusion for local teams.

d. Integrate FX Adjustments into Consolidation Logic

When intercompany balances, unrealized profits, or eliminations involve different currencies, the consolidation system must automatically calculate FX effects — not leave them for manual entries.

BrizoSystem’s automated engine ensures that every elimination triggers the corresponding translation adjustment instantly, keeping the group view consistent.

e. Provide Transparent CTA Reporting

A well-structured CTA report helps management understand where FX impacts arise:

- By entity

- By currency

- By account category

This transparency prevents misinterpretation of FX-related movements and supports effective communication with auditors and stakeholders.

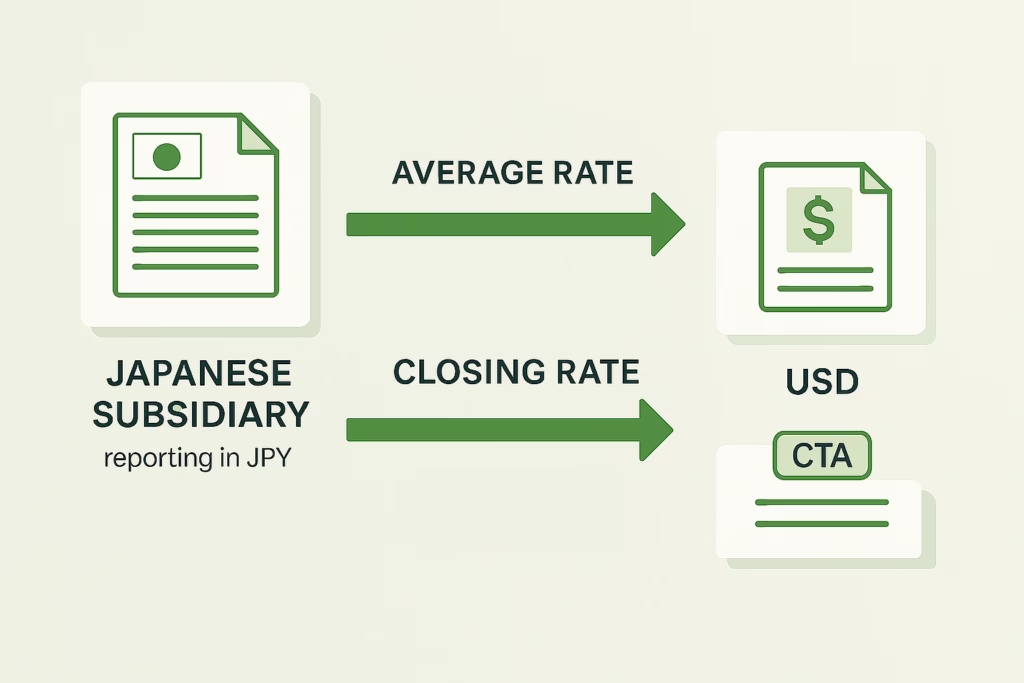

6. Example of a Practical Translation Scenario

Let’s say the parent company reports in USD and has a subsidiary in Japan with JPY as its functional currency.

- Closing rate (31 Dec): 1 USD = 145 JPY

- Average rate (for income statement): 1 USD = 142 JPY

The subsidiary’s trial balance in JPY:

- Assets: ¥1,450,000

- Liabilities: ¥800,000

- Equity: ¥300,000 (historical)

- Net income: ¥350,000

Translation:

- Assets → $10,000 (1,450,000 / 145)

- Liabilities → $5,517 (800,000 / 145)

- Income → $2,465 (350,000 / 142)

The difference between translated net assets and retained earnings represents the CTA, recorded in OCI.

BrizoSystem automates this process by storing rate tables, applying translation logic automatically, and reconciling CTA with equity every period-end.

7. The Role of Automation in Simplifying FX Translation

Foreign currency translation doesn’t have to be a manual nightmare.

Automation can handle:

- Rate imports and validation

- Translation of trial balances

- CTA calculation and rollforward

- Multicurrency eliminations

BrizoSystem integrates all of this into a single consolidation workflow, ensuring accuracy, transparency, and consistency across reporting periods.

Conclusion

Foreign currency translation is both an art and a science — balancing compliance, accuracy, and interpretability.

While accounting standards define what to do, execution often determines how smooth the consolidation close can be.

By enforcing consistent policies, centralizing exchange rates, and using automated consolidation tools like BrizoSystem, finance teams can:

- Eliminate manual effort

- Prevent FX-related surprises

- Present a clear, unified financial picture across borders

In a world where numbers cross currencies, clarity is everything — and with the right system in place, you can make FX translation a seamless part of your consolidation process.