When most people think about financial consolidation, they think of journals, eliminations, FX translation, and reporting deadlines. But before any of that can happen, there’s a more fundamental layer that determines everything about your final consolidated results:

👉 Your entity structure and reporting lines.

The way a group is organized — ownership chains, subsidiary hierarchies, cross-holdings, functional reporting lines, and region structures — defines how data flows upward, how adjustments are applied, and ultimately how the consolidated financial statements look.

A strong entity structure leads to clarity, accuracy, and predictable outcomes.

A messy one leads to confusion, reconciliation overload, and misleading group numbers.

This guide breaks down how organizational structure affects consolidation results, why issues arise, and how modern reporting systems like BrizoSystem help bring order to complex organizations.

1. Why Entity Structure Is the Foundation of Consolidation

Every consolidation starts with a simple question:

Who owns who — and by how much?

Ownership and reporting relationships determine:

- Whether an entity is fully consolidated, proportionately consolidated, or equity accounted

- How results and assets flow into the group

- Where minority interest (NCI) applies

- How intercompany transactions should be eliminated

- Which subsidiaries contribute to which segment or region

- The path profit takes before reaching the parent

Even if the GL numbers are perfect, the group results can still be wrong if the ownership tree is wrong.

In other words: structure drives math.

This is why the entity structure is not just an admin task — it is part of the accounting logic itself.

2. Common Types of Entity Structures (and Their Reporting Impact)

Group structures come in many shapes. Here are the most common ones and how they shape consolidation.

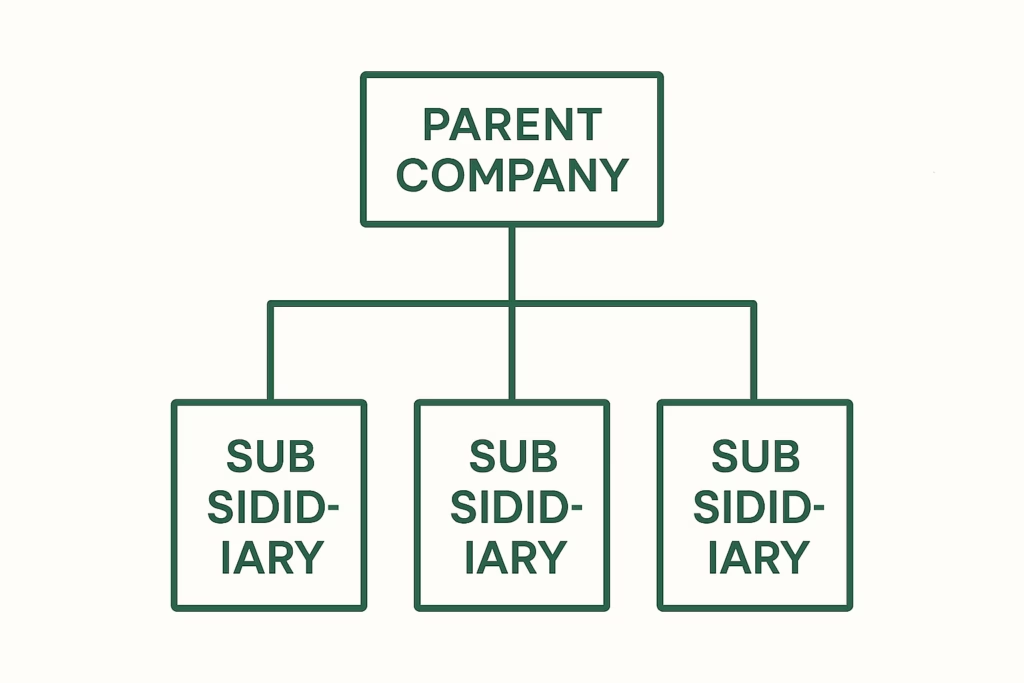

a. Simple Parent–Subsidiary Structure

Description:

Parent owns 100% of Subsidiary A.

Reporting behavior:

- Full consolidation

- No NCI

- All profit/loss flows directly to the parent

Impact:

Clean and straightforward. Errors usually arise only from intercompany eliminations, not ownership complexity.

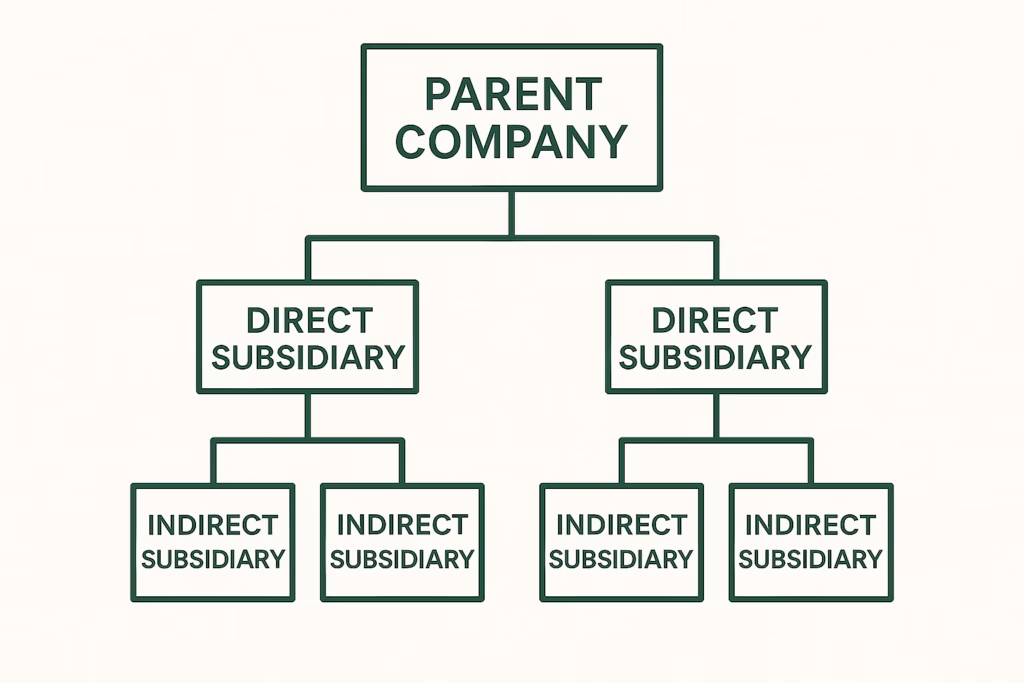

b. Multi-layered Subsidiary Chains

Description:

Parent → HoldCo → SubCo → Operating Subsidiary

Reporting behavior:

- Profit and balances roll upward through multiple layers

- NCI may exist at any of the lower levels

- Eliminations must consider every layer of the chain

Impact:

Companies often miscalculate eliminations because the trading entity and owning entity are not the same.

c. Partial Ownership / Joint Ventures

Description:

Parent owns less than 100% (e.g., 60%).

Reporting behavior:

- Full consolidation with NCI

- Allocation between parent and minority shareholders

- Eliminations are more sensitive because NCI is involved

Impact:

Errors in ownership % lead to distorted group profit or incorrect NCI.

d. Cross-Holdings and Circular Ownership

Description:

Entity A owns B, and B partially owns A — or entities hold minority stakes in each other.

Reporting behavior:

- Very sensitive elimination logic

- Typically requires equity method or special consolidation adjustments

Impact:

Manual spreadsheets often break under these structures, producing overstated equity or duplicated profit.

e. Regional and Segment Reporting Lines

Description:

Subsidiaries report to regional heads or segment managers rather than the immediate parent.

Reporting behavior:

- Parallel hierarchies: legal structure vs. management structure

- Consolidated segment reporting may differ from legal entity consolidation

Impact:

If segment reporting lines are not configured correctly, financial reports may allocate revenue/costs to the wrong region or segment.

3. How Reporting Lines Influence Consolidated Outcomes

Beyond legal ownership, reporting lines also define how consolidation results appear.

a. Reporting Lines Determine Functional Control

Sometimes control exists even without majority ownership — e.g., management agreements, brand licensing structures.

This determines whether an entity should be consolidated at all.

b. Lines Define Management Reporting, Not Just Legal Reporting

Finance teams often produce:

- Legal consolidation

- Management consolidation

- Segment reporting

- Regional/functional dashboards

Each hierarchy may be different.

If reporting lines are wrong, even perfect financials will show misleading trends.

c. Reporting Lines Influence Eliminations and Allocations

For example:

- Eliminations may roll up at a region or segment level.

- Profit attribution may differ for management vs. legal purposes.

- Allocations such as HQ charges may route through based on reporting lines.

This is why a system must support multi-dimensional consolidation trees.

4. Common Problems Caused by Weak or Outdated Entity Structures

These issues appear constantly in complex or fast-growing groups:

1. Ownership percentages not updated

M&A activity changes fast. GL teams may update the books, but group structures remain out-of-date — leading to incorrect NCI or consolidation method.

2. Entities mapped to the wrong parent

A subsidiary may legally sit under HoldCo A but operationally report to Region B; mixing them up causes:

- Incorrect segment results

- Wrong elimination paths

- Misstated revenue contribution

3. Parallel hierarchies not aligned

Legal reporting vs. management reporting often diverges. Without clear configuration, dashboards become inconsistent.

4. Cross-holdings and JV structures handled manually

This leads to:

- Duplicated balances

- Incorrect investment eliminations

- Blown-up equity accounts

5. Eliminations failing due to incorrect ownership chain

If ownership logic is wrong, system-based eliminations produce incorrect or partial results.

5. Best Practices for Structuring Entities and Reporting Lines

To ensure accurate group reporting, strong structure management is essential.

1. Maintain a Single Source of Truth for the Entity Structure

Avoid maintaining ownership in spreadsheets.

A centralized structure database ensures:

- Everyone works with the same data

- System-driven eliminations are correct

- NCI is calculated consistently

2. Keep Ownership Changes Versioned

Group structures change. Your reporting must reflect:

- Effective dates

- Pre- and post-acquisition structures

- Partial divestments

A good consolidation system allows versioning without breaking history.

3. Separate Legal Structure from Management Structure

BrizoSystem supports multiple hierarchies:

- Legal ownership

- Segment reporting

- Regional reporting functions

This prevents mix-ups and ensures stakeholders see accurate views.

4. Document Each Entity’s Role

Every subsidiary should have metadata defining:

- Legal ownership

- Functional owner

- Currency

- Reporting region/segment

- Consolidation method

- Intercompany roles (trading hub, manufacturing, holding entity)

This reduces confusion and speeds up onboarding of new team members.

5. Automate the Roll-up Logic

Let the system:

- Automatically calculate NCI

- Map eliminations based on structure

- Apply translation based on parent currency

- Roll up results through multi-layered chains

Manual adjustments should only be for special cases.

Conclusion: Structure Isn’t Admin — It’s Strategy

Entity structures and reporting lines are not back-office details. They are the core architecture of your financial story.

A clean, well-maintained group structure:

- Ensures accurate consolidated results

- Improves reporting transparency

- Reduces reconciliation workload

- Supports fast close cycles

- Keeps eliminations clean

- Makes segment and regional reporting meaningful

A messy structure, on the other hand, guarantees:

- Misstated profit

- Broken eliminations

- Wrong NCI

- Confusing dashboards

- Hours of unnecessary manual corrections

By designing the right structure — and using tools like BrizoSystem to manage it — finance teams unlock clarity, accuracy, and confidence in every reporting cycle.