For many small and medium-sized enterprises (SMEs), carbon accounting still sounds like something meant for large multinationals with sustainability teams and complex reporting frameworks.

But that perception is changing — fast.

Today, carbon accounting is becoming increasingly relevant for SMEs, driven by customer expectations, supply-chain pressure, investor requirements, and evolving regulations. The key question is no longer “Is carbon accounting relevant to SMEs?” — it’s “How should SMEs approach it in a practical, manageable way?”

This article explains what carbon accounting is, how it works, and how it realistically applies to SMEs — without overcomplicating the process.

1. What Is Carbon Accounting? (In Simple Terms)

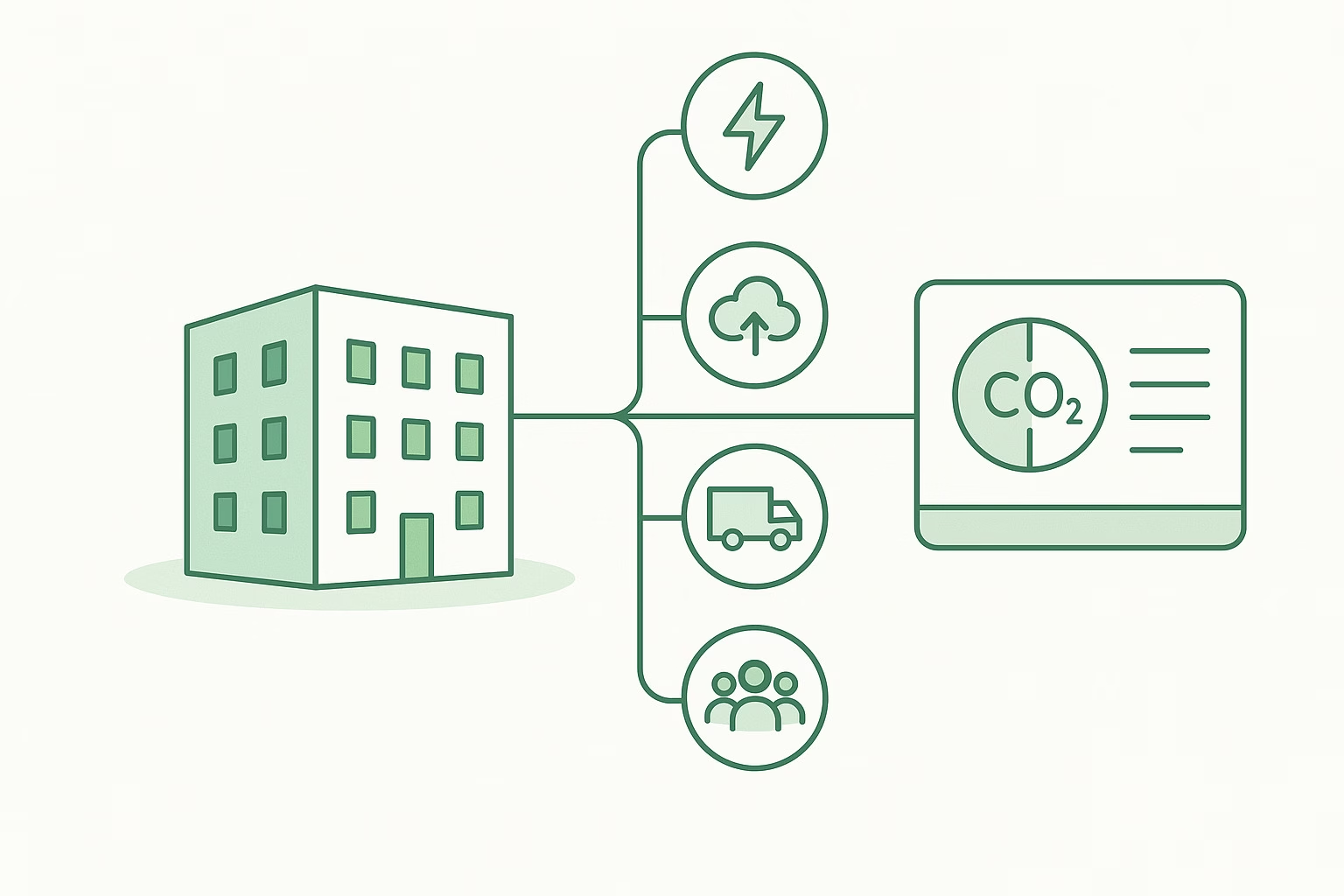

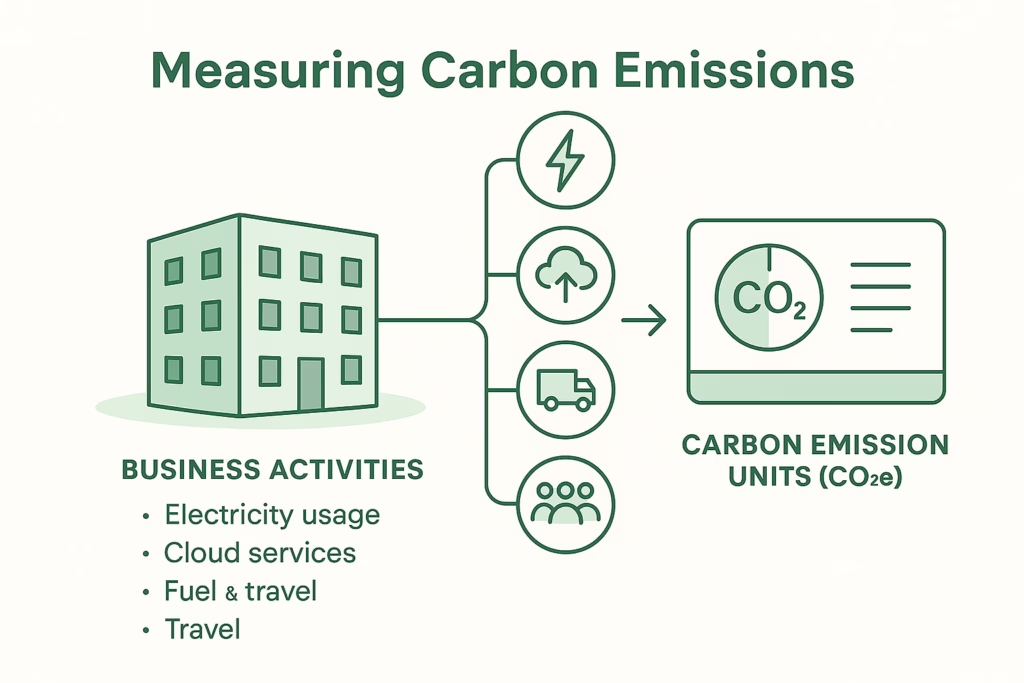

Carbon accounting is the process of measuring, tracking, and reporting greenhouse gas (GHG) emissions generated by a business’s activities.

Instead of tracking dollars and cents, carbon accounting tracks carbon dioxide equivalents (CO₂e) — a standardized unit that converts different greenhouse gases into a single comparable measure.

The goal is to understand:

- Where emissions come from

- How much is produced

- How emissions change over time

- What actions can reduce them

For SMEs, carbon accounting is less about perfection and more about visibility and transparency.

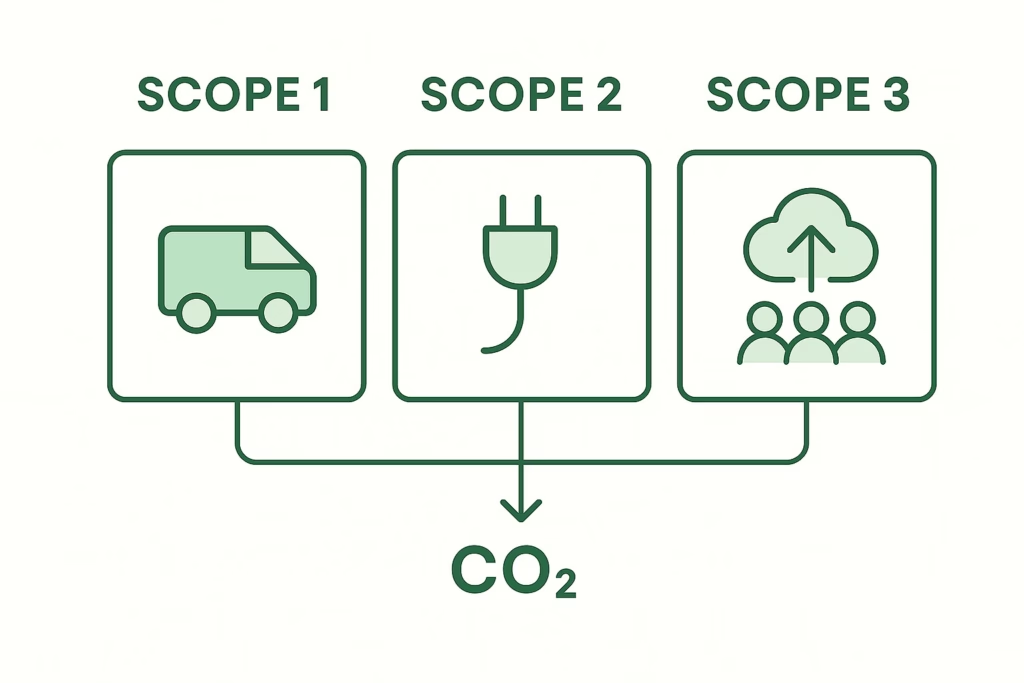

2. The Three Emission Scopes (What SMEs Need to Know)

Carbon accounting is typically structured using the GHG Protocol, which divides emissions into three scopes.

Scope 1 – Direct Emissions

These are emissions that come directly from sources owned or controlled by the business.

Examples for SMEs:

- Company-owned vehicles

- On-site fuel combustion (generators, boilers)

- Manufacturing equipment using fossil fuels

If your business owns or operates equipment that burns fuel, you likely have Scope 1 emissions.

Scope 2 – Indirect Energy Emissions

These are emissions from purchased electricity, heating, or cooling.

Examples:

- Office electricity usage

- Data center electricity

- Factory power consumption

For most SMEs, Scope 2 is the easiest and most important place to start, because the data already exists in utility bills.

Scope 3 – Other Indirect Emissions

These are emissions that occur up and down your value chain, but are not directly controlled by you.

Examples relevant to SMEs:

- Cloud hosting and SaaS usage

- Purchased goods and services

- Business travel

- Logistics and delivery services

- Employee commuting

Scope 3 is usually the largest but most complex category. For SMEs, it’s common to start with key categories only, rather than trying to measure everything at once.

3. How Carbon Accounting Actually Works (Step by Step)

Carbon accounting doesn’t start with calculations — it starts with data you already have.

Step 1: Identify Relevant Activities

SMEs should focus on activities that are:

- Material (significant impact)

- Measurable

- Relevant to stakeholders

For example:

- Electricity usage

- Fuel usage

- Cloud services

- Key suppliers

You don’t need to measure everything on day one.

Step 2: Collect Activity Data

This includes:

- Electricity bills (kWh)

- Fuel invoices (liters)

- Travel records

- Vendor spend data

Most SMEs already have this data in accounting systems, invoices, or expense reports.

Step 3: Apply Emission Factors

Emission factors convert activity data into carbon emissions.

Example:

- 1 kWh of electricity × country-specific emission factor = CO₂e

These factors are published by governments and recognized organizations and are typically embedded in carbon accounting tools.

Step 4: Calculate Total Emissions

The system aggregates emissions by:

- Scope

- Category

- Period

This produces a carbon footprint similar in structure to a financial report.

Step 5: Review, Report, and Improve

Carbon accounting is not a one-time exercise. SMEs typically:

- Review results annually or quarterly

- Track trends

- Identify reduction opportunities

- Share results with customers or partners

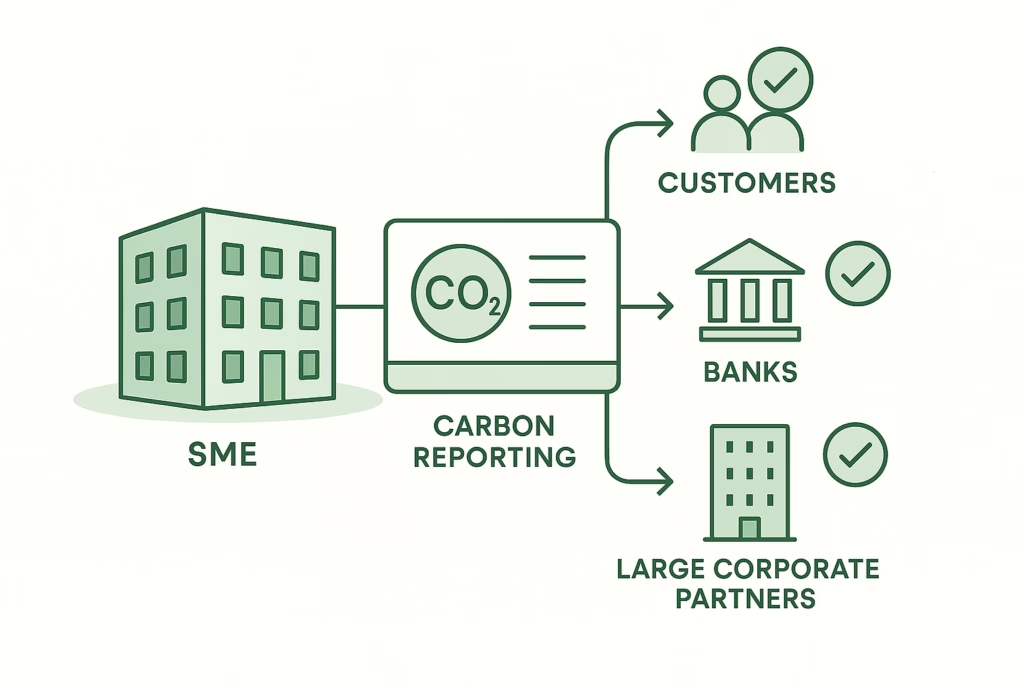

4. Why Carbon Accounting Is Becoming Relevant for SMEs

1. Customer and Supply Chain Pressure

Large companies increasingly require suppliers — including SMEs — to disclose carbon data.

If your SME is part of a larger supply chain, carbon reporting may soon be a commercial requirement, not a “nice-to-have.”

2. Investor and Lender Expectations

Banks and investors are starting to assess climate risk, even for smaller companies.

Carbon data helps SMEs:

- Demonstrate awareness and preparedness

- Improve ESG scoring

- Access sustainable financing options

3. Regulatory Direction (Not Just Today, but Tomorrow)

While many current regulations target large companies, SMEs are often included indirectly through customers, industry standards, or future policy expansions.

Starting early avoids last-minute compliance stress.

4. Cost Visibility and Efficiency

Carbon accounting often reveals:

- Energy inefficiencies

- High-cost vendors

- Wasteful processes

Reducing emissions frequently aligns with reducing operating costs.

5. Common Misconceptions SMEs Have

“Carbon accounting is only for large companies”

Not anymore. SMEs are increasingly expected to participate at a proportionate level.

“It’s too expensive and complicated”

Modern tools and simplified frameworks make entry-level carbon accounting manageable and affordable.

“We don’t emit much anyway”

Even service-based SMEs generate emissions through electricity, cloud usage, travel, and suppliers.

6. A Practical Approach for SMEs (What Actually Works)

For SMEs, the key is progress, not perfection.

A realistic approach:

- Start with Scope 2

- Add key Scope 1 sources if applicable

- Include 2–3 meaningful Scope 3 categories

- Use estimates where precise data isn’t available

- Improve accuracy over time

This mirrors how financial reporting matures as a business grows.

7. How Carbon Accounting Fits Into SME Finance and Reporting

Carbon accounting doesn’t replace financial accounting — it complements it.

Similarities:

- Periodic reporting

- Use of standardized frameworks

- Auditability and transparency

- Trend and variance analysis

Many SMEs find it easiest to integrate carbon data into existing finance and reporting workflows, using familiar structures and review processes.

Conclusion: Carbon Accounting Is Becoming a Business Skill, Not a Burden

For SMEs, carbon accounting is no longer just a sustainability topic — it’s a business capability.

Those who start early gain:

- Better customer relationships

- Stronger positioning in supply chains

- Improved operational insight

- Reduced future compliance risk

And importantly, carbon accounting for SMEs doesn’t have to be complex.

With the right scope, the right data, and the right tools, it becomes just another way to understand and improve how your business operates.

The question isn’t whether SMEs will need carbon accounting —

it’s how prepared they want to be when it becomes unavoidable.