For many mid-sized companies, financial reporting starts out simple. A few legal entities, a manageable volume of transactions, and spreadsheets that seem to “do the job.”

But growth changes everything.

As soon as a business expands across entities, regions, or currencies, consolidation stops being a mechanical exercise and becomes a strategic reporting challenge. This is the point where many finance teams realize that spreadsheets are no longer enough — and where dedicated consolidation tools become essential.

The Reality of Reporting in Mid-Sized Companies

Mid-sized companies sit in a difficult middle ground.

They are too complex for manual consolidation, yet often lack the resources or justification for large enterprise systems. Finance teams are expected to deliver:

- Faster month-end closes

- Accurate group financial statements

- Clear management and board reporting

- Confidence in intercompany eliminations and FX impacts

All while operating with lean teams and increasing pressure from stakeholders.

Without the right tools, consolidation becomes fragile, slow, and risky.

Why Spreadsheets Stop Working as Complexity Grows

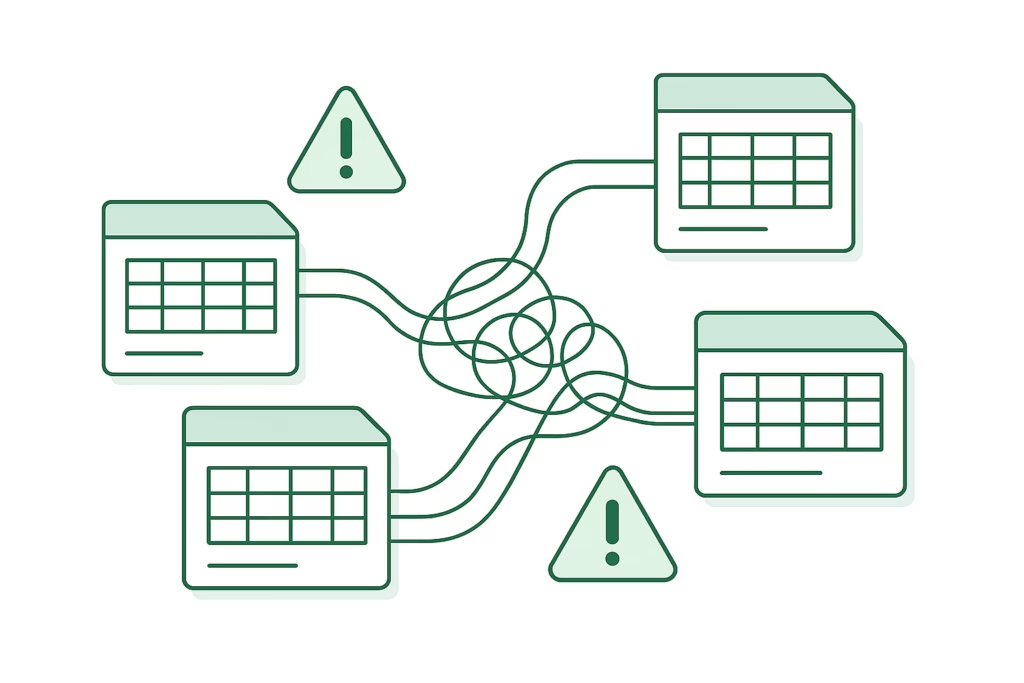

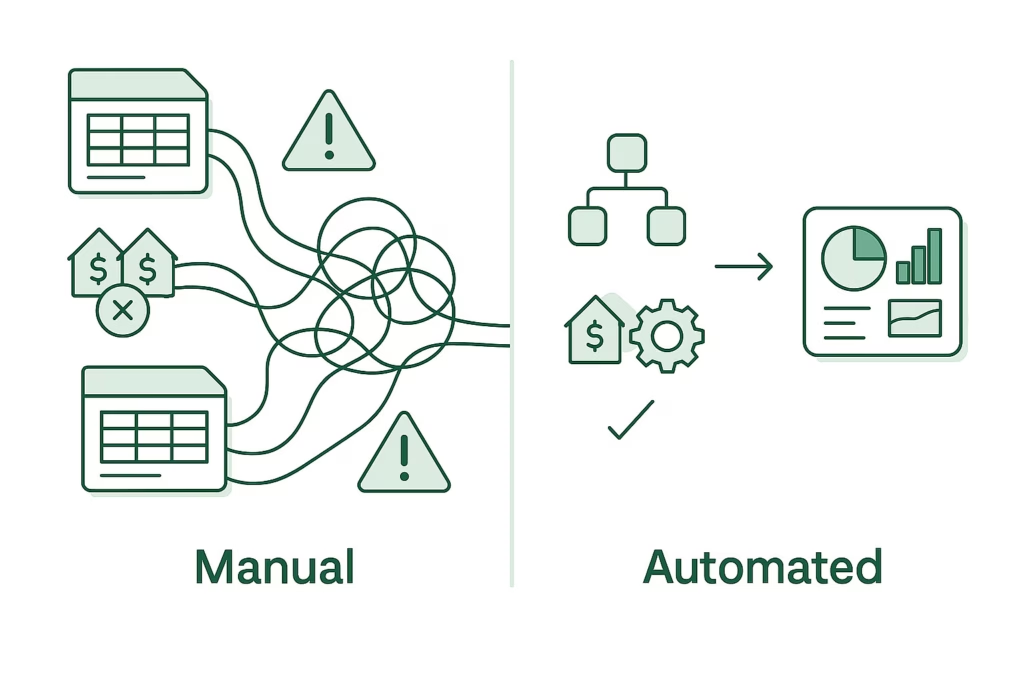

Spreadsheets are flexible, familiar, and easy to start with — which is why most groups rely on them initially.

Over time, however, they introduce serious limitations:

- Multiple versions of truth across files

- Manual copy-paste errors that are hard to trace

- Inconsistent mapping and elimination logic

- Heavy reliance on individuals rather than processes

- Limited visibility into how numbers were derived

What once felt “under control” quickly turns into a reporting bottleneck.

What Consolidation Tools Actually Do

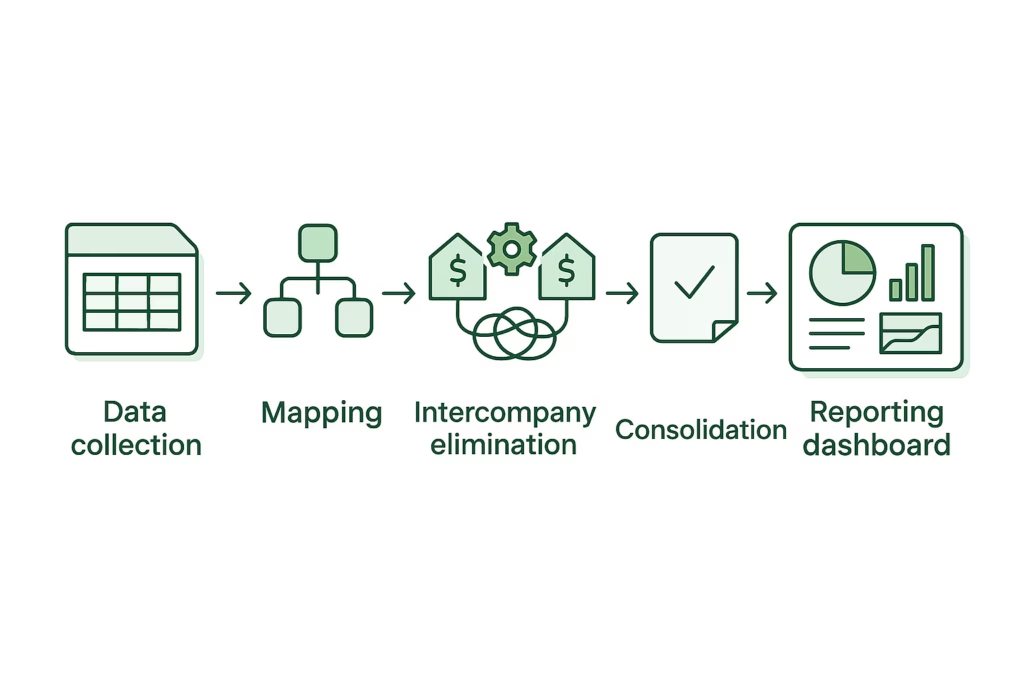

A consolidation tool sits above accounting systems, not in place of them.

Each entity continues to post transactions in its own GL or ERP. The consolidation tool then:

- Collects financial data in a structured way

- Aligns local accounts to a group reporting structure

- Identifies and eliminates intercompany activity

- Applies consistent FX and ownership logic

- Produces consolidated financial statements and reports

The goal is not automation for its own sake — it is repeatability, transparency, and trust in the numbers.

Key Challenges Mid-Sized Companies Face Without Consolidation Tools

Intercompany Complexity

As intercompany transactions grow, mismatches become common. Without systematic matching, eliminations are often incomplete or corrected too late.

Multi-Currency Exposure

Manual FX handling increases volatility and inconsistencies, making it harder to explain performance.

Reporting Delays

Month-end closes stretch longer as finance teams spend more time fixing data instead of analyzing it.

Limited Auditability

When adjustments live in spreadsheets, it’s difficult to explain what changed, why it changed, and who changed it.

How Consolidation Tools Address These Challenges

Dedicated consolidation tools introduce structure and discipline into group reporting.

They enable:

- Early detection of intercompany mismatches

- Consistent application of consolidation rules

- Clear audit trails from source data to final reports

- Faster consolidation cycles with fewer surprises

- Easier onboarding of new entities

For mid-sized companies, this often results in more predictable closes and greater confidence at management and board level.

Consolidation Is About Insight, Not Just Compliance

While statutory reporting is important, consolidation tools deliver value far beyond compliance.

They help finance teams:

- Explain performance drivers clearly

- Compare entities and segments consistently

- Support budgeting and forecasting processes

- Respond quickly to management questions

This shifts the finance function from report production to business insight.

When a Mid-Sized Company Is Ready for a Consolidation Tool

Most companies reach readiness when:

- They manage more than a few legal entities

- Intercompany activity becomes material

- Reporting timelines are tightening

- Stakeholders demand better visibility and explanations

At this stage, the cost of not having a consolidation tool often exceeds the investment required to implement one.

Choosing the Right Type of Consolidation Tool

For mid-sized companies, the right tool should:

- Be easy to implement and maintain

- Integrate with existing accounting systems

- Scale as the group grows

- Focus on reporting clarity rather than accounting complexity

The goal is to support finance teams — not overwhelm them.

Final Thoughts

Growth brings opportunity, but it also brings reporting complexity.

For mid-sized companies, consolidation tools are no longer an enterprise luxury — they are a practical necessity. They provide the structure, control, and confidence needed to deliver accurate group reporting without overburdening finance teams.

The question is no longer if consolidation tools are needed, but when a growing company decides to move beyond spreadsheets and toward clarity.