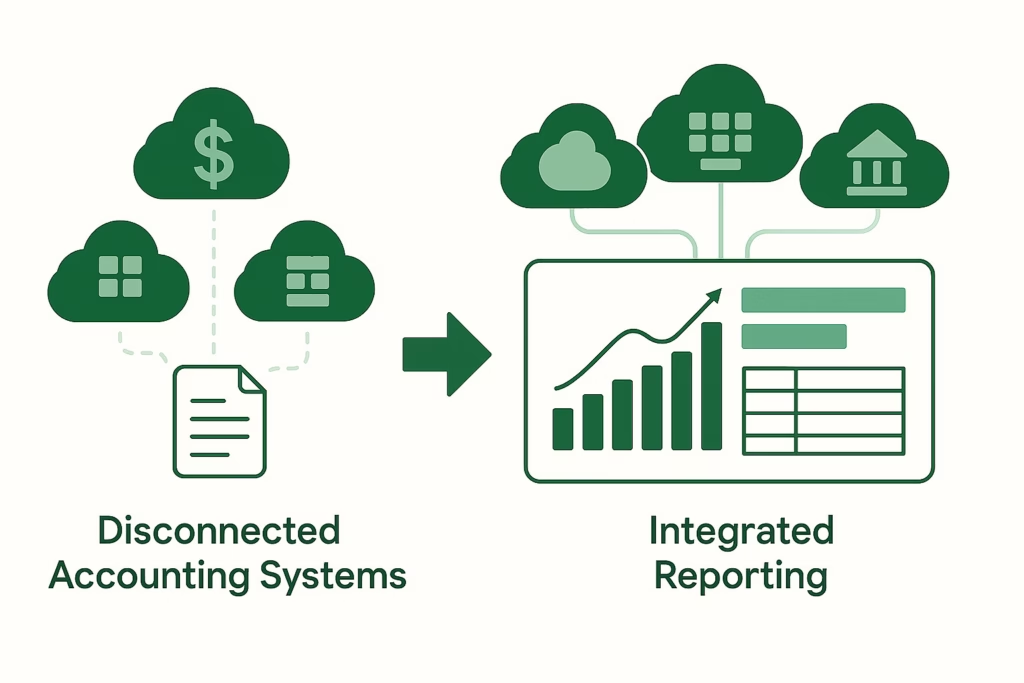

Cloud accounting has transformed how businesses record transactions, manage day-to-day finance operations, and close their books. But for growing companies, accounting data alone is not enough.

As organizations add entities, regions, and reporting requirements, the real challenge begins after the books are closed — when data needs to be consolidated, standardized, and turned into meaningful insights.

This is where integration options become critical.

Why Integration Matters in Cloud Accounting

Most mid-sized companies today operate in a connected finance ecosystem rather than a single system. Accounting platforms are only one part of that ecosystem.

Without proper integrations, finance teams often face:

- Manual data exports every reporting period

- Inconsistent reporting formats across entities

- Time lost reconciling and rechecking numbers

- Limited visibility into group performance

Strong integrations allow cloud accounting systems to feed accurate, timely data into reporting and consolidation tools, reducing friction across the finance function.

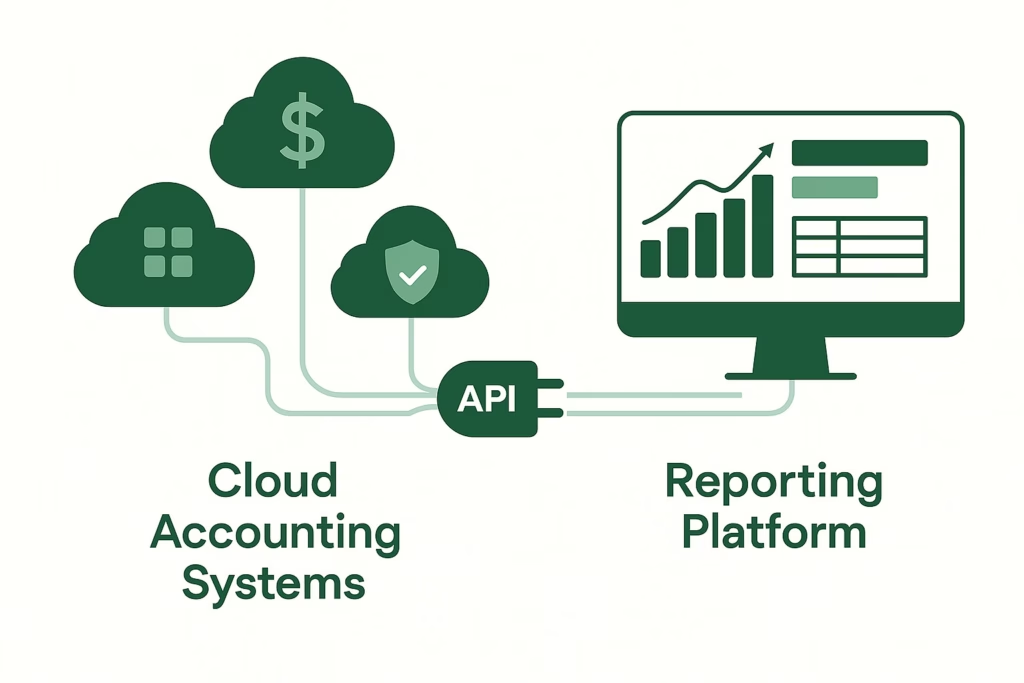

Integration Option 1: Direct API-Based Connectors

Direct API integrations are among the most reliable options for connecting cloud accounting systems to reporting platforms.

How It Works

The accounting system exposes financial data through APIs, allowing authorized reporting tools to pull balances, journals, and metadata automatically.

Why It Matters

- Eliminates manual exports

- Ensures data consistency every period

- Enables scheduled and repeatable data refreshes

For finance teams, this creates a predictable reporting process that scales as the business grows.

Integration Option 2: Template-Based Data Imports

Not every accounting system offers deep API access, especially for smaller or regional platforms. In these cases, standardized templates remain an effective integration option.

How It Works

Entities export trial balances or reports into predefined templates that follow a group-wide structure.

Why It Matters

- Provides structure without heavy IT dependency

- Works across diverse accounting systems

- Supports consistent mapping and consolidation

Template-based integration is often a practical stepping stone toward full automation.

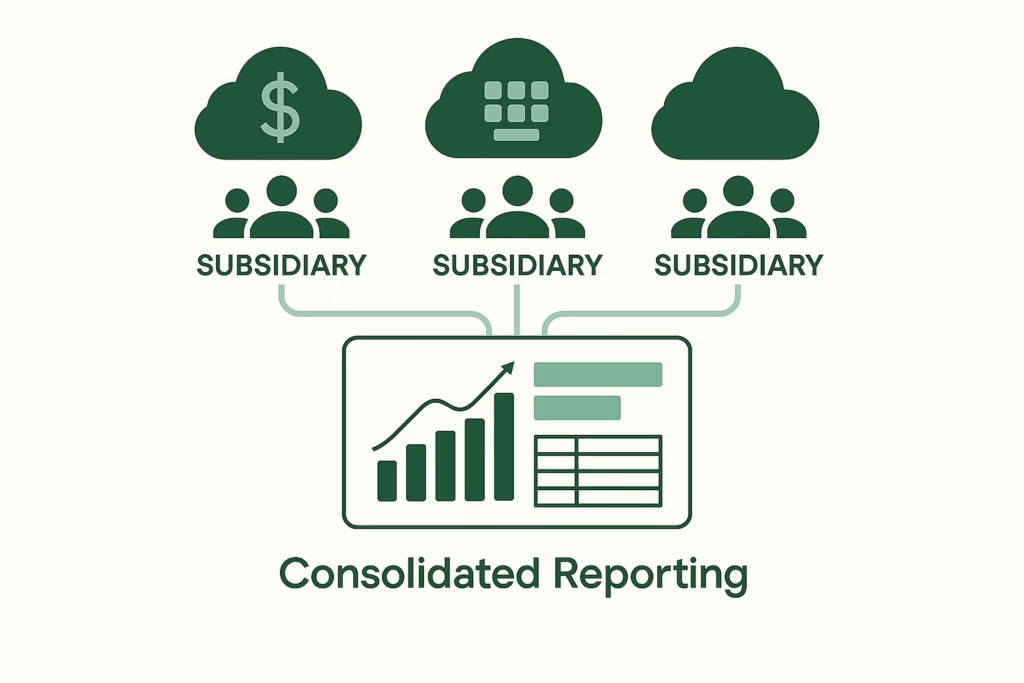

Integration Option 3: Multi-System Integration Across Entities

Many mid-sized groups operate with different accounting systems across subsidiaries due to acquisitions, geography, or business models.

How It Works

A reporting platform integrates with multiple cloud accounting systems simultaneously, consolidating data into a single reporting layer.

Why It Matters

- Avoids forced system standardization

- Enables group-wide visibility

- Supports gradual system alignment over time

This flexibility is especially important for fast-growing or acquisitive companies.

Integration Option 4: Master Data Alignment and Mapping

Integration is not just about moving data — it’s about making data comparable.

How It Works

Local charts of accounts are mapped to a standardized group reporting structure. Once set up, the mapping is reused every period.

Why It Matters

- Ensures consistency across entities

- Reduces manual adjustments

- Makes consolidated reporting reliable and repeatable

This layer of integration is critical for accurate group reporting.

Integration Option 5: Intercompany Identification and Matching

Cloud accounting systems record intercompany transactions locally, but they rarely manage eliminations at group level.

How It Works

Integrated reporting tools identify intercompany balances using entity tags, counterparty fields, or predefined rules.

Why It Matters

- Flags mismatches early

- Reduces late-period surprises

- Improves confidence in consolidated results

This integration turns raw accounting data into group-level insight.

Integration Option 6: Multi-Currency and FX Integration

Global groups often operate across multiple currencies, creating FX noise in consolidated reports.

How It Works

Exchange rates are integrated into the reporting process and applied consistently across entities.

Why It Matters

- Ensures transparent FX impact

- Reduces volatility caused by manual handling

- Improves comparability over time

FX integration is essential for clear group reporting.

Integration Option 7: Reporting, BI, and Presentation Tools

Accounting data gains value when it is accessible and understandable to stakeholders.

How It Works

Consolidated data integrates with dashboards, board reports, and management presentations.

Why It Matters

- Speeds up decision-making

- Reduces reporting preparation time

- Aligns finance output with business needs

This final integration closes the gap between numbers and insight.

Choosing the Right Integration Strategy

For mid-sized companies, the best integration strategy is not always the most complex one. It should be:

- Scalable as the group grows

- Easy to maintain with lean teams

- Compatible with existing systems

- Focused on reporting clarity, not system replacement

The goal is to connect systems without adding operational burden.

Integration as a Foundation for Better Reporting

Cloud accounting provides the data.

Integration determines how useful that data becomes.

With the right integration options in place, finance teams can move beyond manual consolidation and toward a controlled, transparent, and insight-driven reporting process.

Final Thoughts

As finance ecosystems grow more interconnected, integration is no longer optional.

For mid-sized companies, choosing the right cloud accounting integration options is a strategic decision — one that directly impacts reporting accuracy, efficiency, and confidence.

Strong integrations don’t just move data.

They turn accounting outputs into trusted group insights.