As organizations grow beyond a single legal entity, financial reporting quickly becomes more complex. Multiple subsidiaries, currencies, charts of accounts, and intercompany transactions introduce challenges that traditional single-entity reporting tools were never designed to handle.

For finance teams, the goal isn’t just to produce reports — it’s to produce accurate, consistent, explainable group-level reports that leadership can trust.

This blog outlines the top features required for effective multi-entity financial reporting, and why they matter as complexity increases.

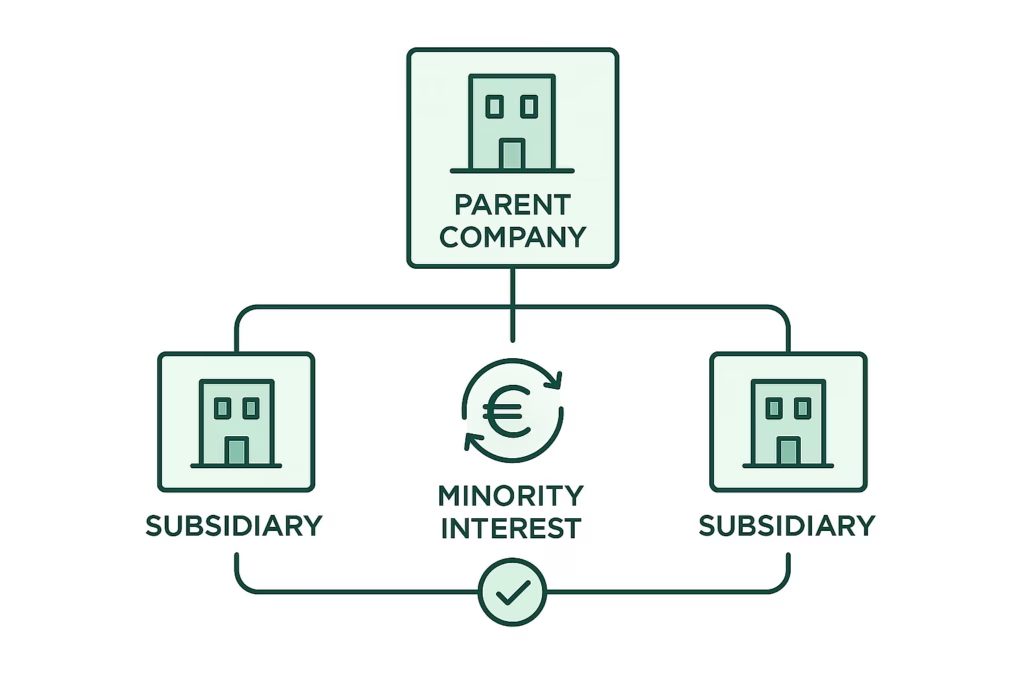

1. Flexible Entity Structure Management

At the heart of multi-entity reporting is a clear understanding of how the group is structured.

A robust reporting solution must support:

- Multiple legal entities and sub-groups

- Hierarchical ownership structures

- Changes in ownership over time

- Entity additions without reworking the entire model

Why this matters:

Without flexible entity management, finance teams resort to hard-coded spreadsheets that break every time the group structure changes. A reporting system should adapt as the business evolves — not the other way around.

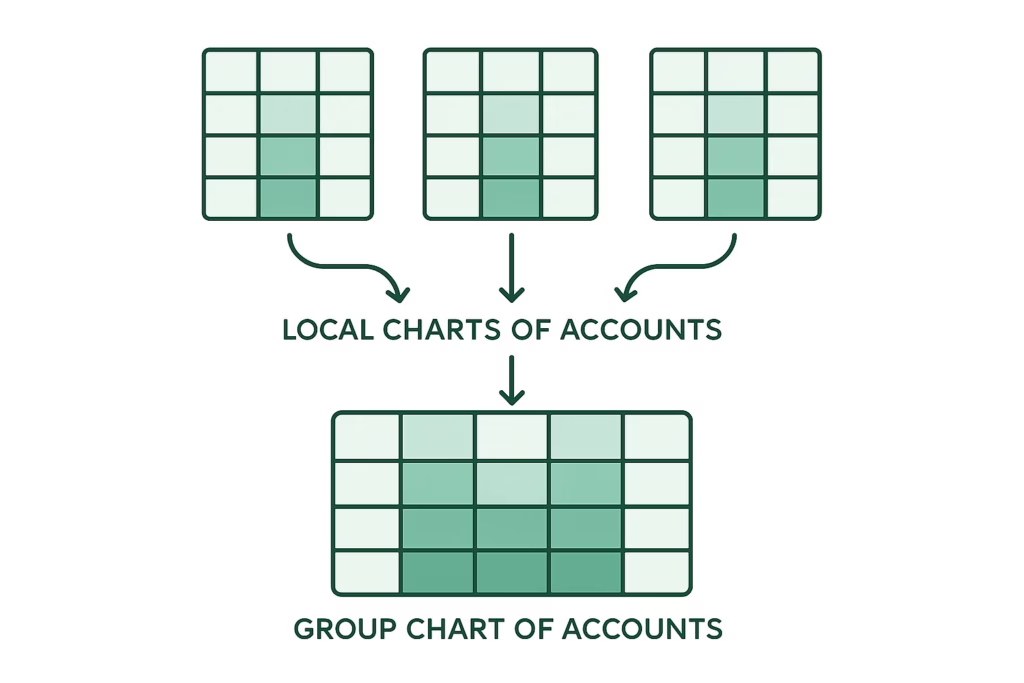

2. Centralized Group Chart of Accounts (CoA)

Different entities often use different local charts of accounts, even if they run the same accounting software.

A key feature of multi-entity reporting is the ability to:

- Define a group-level chart of accounts

- Map local accounts from each entity to group accounts

- Maintain consistency across all reports

Why this matters:

Without standardized mapping, consolidated P&L and balance sheet figures lose meaning. A centralized CoA ensures that “revenue,” “costs,” and “assets” mean the same thing across the group.

3. Automated Intercompany Identification

Intercompany transactions are unavoidable in multi-entity groups — and they are one of the biggest sources of reporting errors.

An effective reporting system should:

- Identify intercompany balances automatically

- Track counterparties clearly

- Separate third-party vs intercompany transactions

- Support consistent tagging across entities

Why this matters:

If intercompany data isn’t clearly identified at source, eliminations become manual, slow, and risky. Automation here dramatically improves accuracy and efficiency.

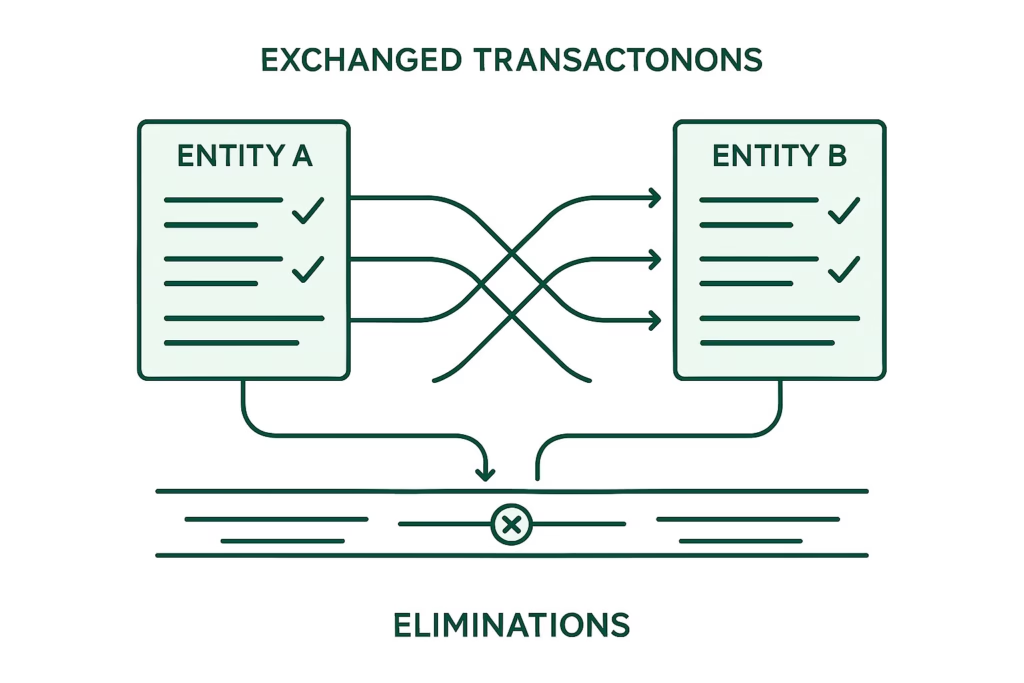

4. Built-In Intercompany Elimination Logic

Identifying intercompany transactions is only half the job. The system must also support structured elimination at consolidation.

Key capabilities include:

- Elimination of intercompany revenue and expenses

- Removal of intercompany balances (AR/AP, loans)

- Support for unrealized profit eliminations

- Transparent visibility into elimination entries

Why this matters:

Manual elimination spreadsheets are difficult to audit and easy to break. A reporting system should apply elimination rules consistently and transparently.

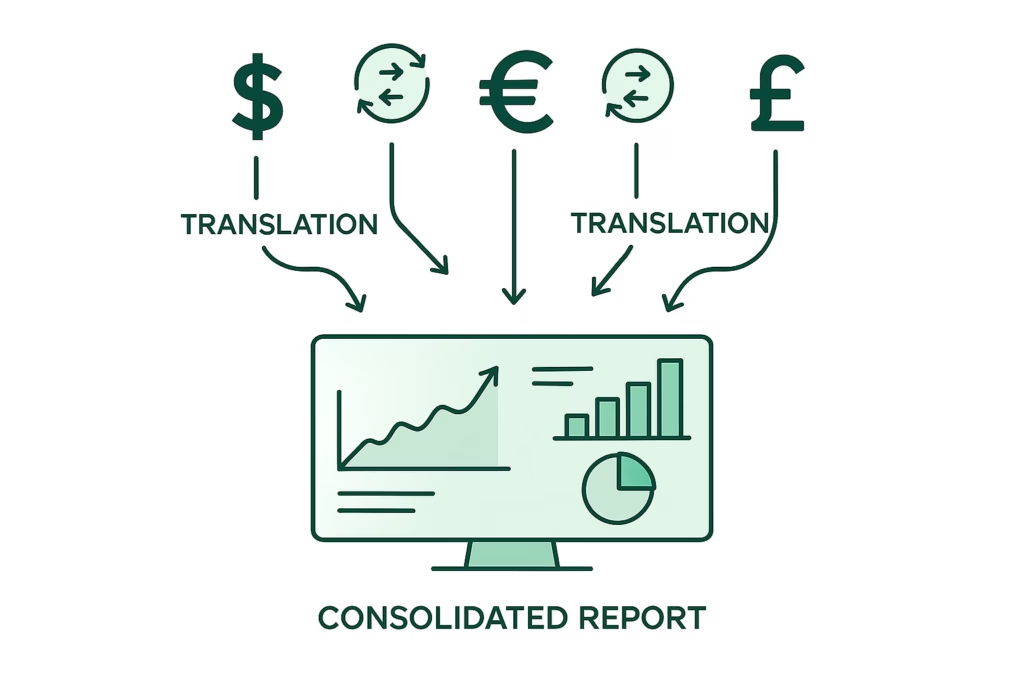

5. Multi-Currency Handling with Clear FX Rules

For groups operating across borders, currency translation is unavoidable.

Essential features include:

- Support for multiple functional currencies

- Centralized FX rate management

- Defined rules for average, closing, and historical rates

- Clear presentation of FX impacts at group level

Why this matters:

Inconsistent FX treatment can distort group performance. Clear, system-driven FX logic ensures comparability and explainability.

6. Period Control and Version Management

Multi-entity reporting involves many moving parts — and late changes can quickly undermine trust.

A strong reporting platform should provide:

- Period locking by entity

- Version control for submissions

- Clear status tracking (submitted, approved, adjusted)

- Ability to rerun consolidations without losing history

Why this matters:

When finance teams can track who submitted what and when, last-minute surprises and silent changes are minimized.

7. Drill-Down and Audit Trail Visibility

Group-level numbers are only useful if they can be explained.

Key capabilities include:

- Drill-down from consolidated totals to entity-level data

- Visibility into mapping and elimination logic

- Clear audit trails for adjustments

- Traceability back to source data

Why this matters:

Without drill-down, finance teams struggle to answer management and audit questions. Transparency builds confidence in the numbers.

8. Flexible Reporting Output

Different stakeholders need different views of the same data.

A modern reporting system should support:

- Consolidated financial statements

- Entity-level and segment reporting

- Custom report structures

- Board-ready output formats

Why this matters:

Finance teams shouldn’t rebuild reports for every audience. Flexible reporting ensures consistency while meeting varied requirements.

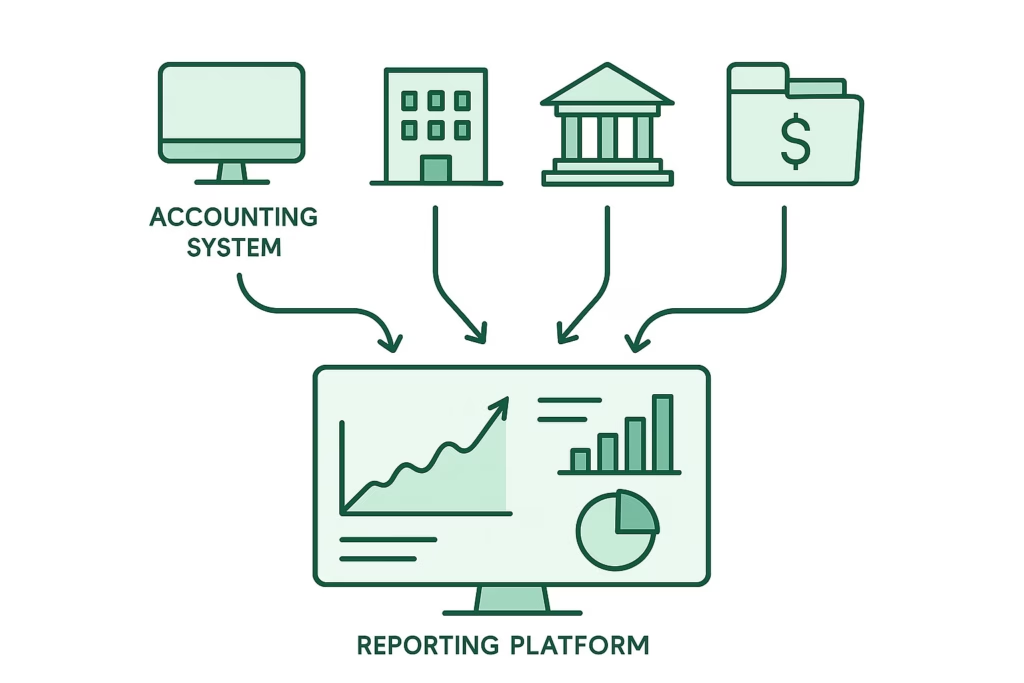

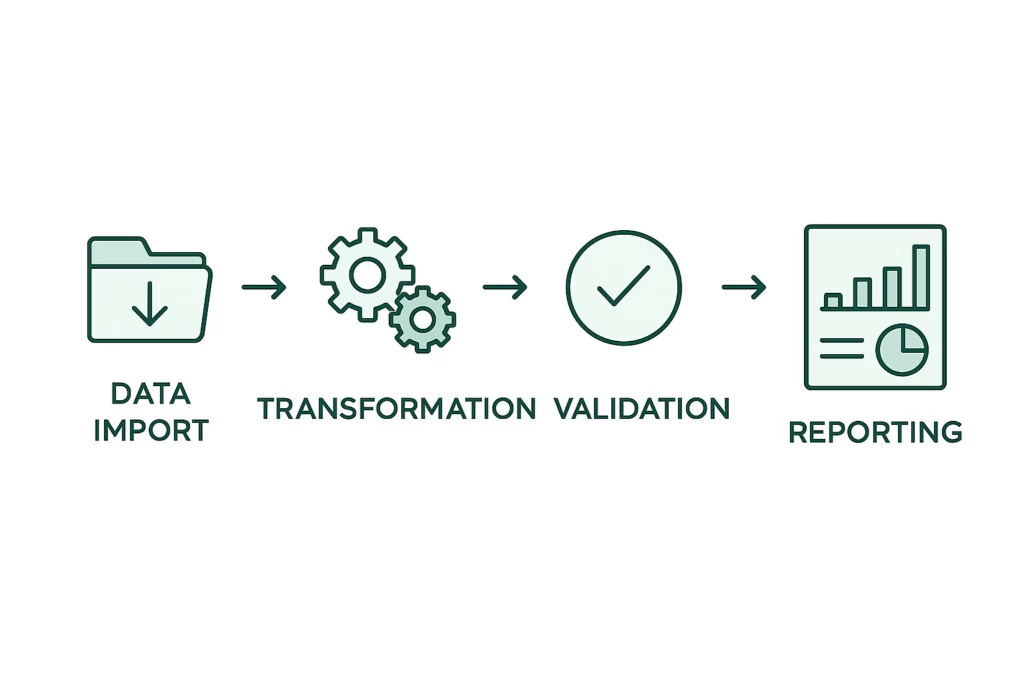

9. Integration with Multiple Accounting Systems

In reality, not all entities use the same accounting software.

An effective reporting platform must:

- Connect to multiple source systems

- Normalize data from different formats

- Reduce manual data uploads

- Support ongoing system changes

Why this matters:

As groups grow through acquisition, system diversity is inevitable. Reporting tools must sit above accounting systems, not replace them.

10. Scalability Without Added Complexity

The best multi-entity reporting solutions scale quietly in the background.

They allow finance teams to:

- Add entities without redesign

- Increase transaction volume without slowdown

- Support new reporting requirements easily

- Maintain performance as complexity grows

Why this matters:

What works for five entities often breaks at fifteen. Scalability protects long-term reporting integrity.

Why These Features Matter More Than Ever

As regulatory requirements increase, stakeholder expectations rise, and businesses expand internationally, multi-entity reporting is no longer a “nice to have.”

It’s a core financial capability.

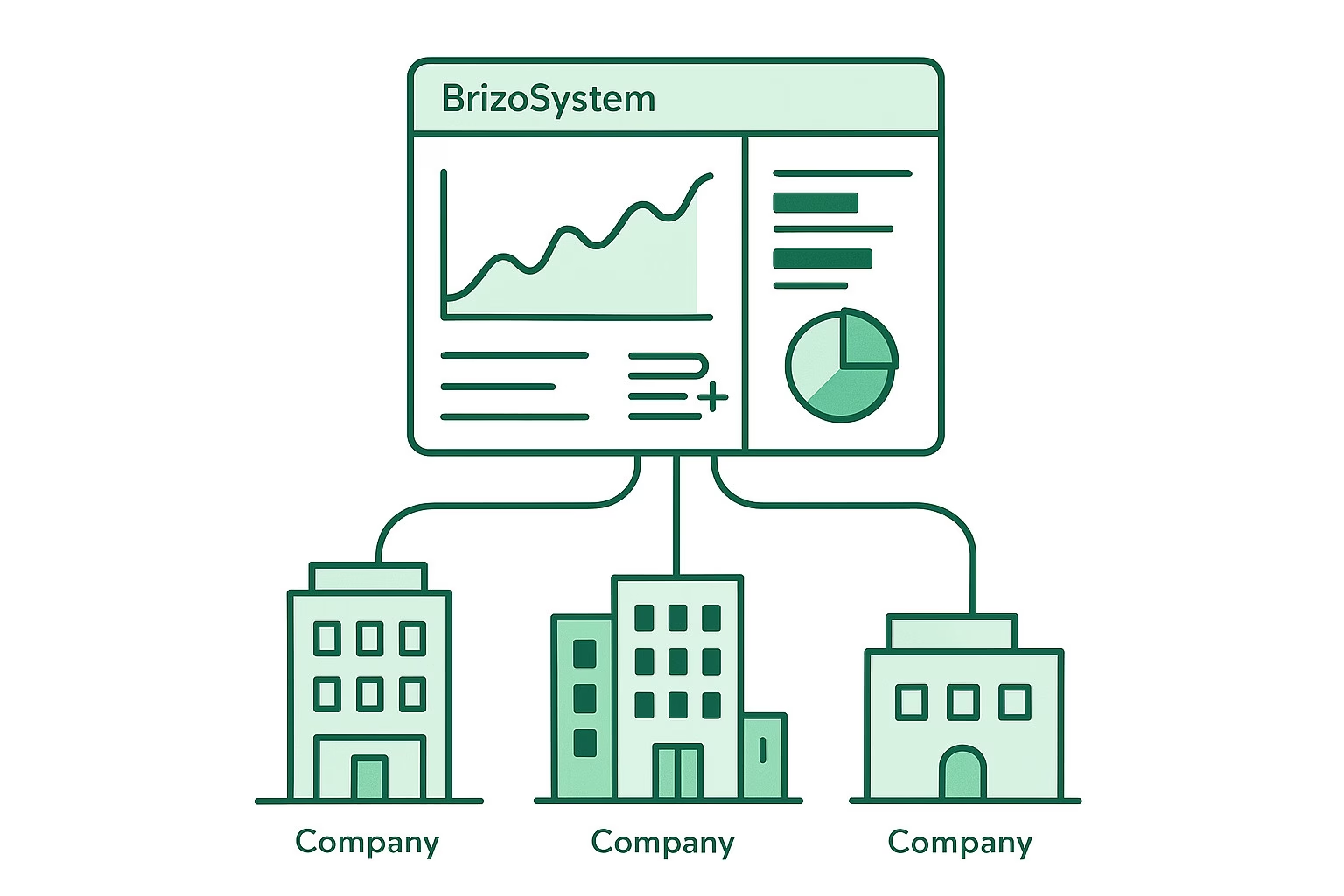

Platforms like BrizoSystem are designed specifically to address these challenges — sitting between accounting systems and final reports to deliver clarity, structure, and confidence at group level.

Conclusion: Strong Reporting Starts with the Right Foundation

Multi-entity reporting doesn’t fail because finance teams lack expertise. It fails because the tools weren’t designed for the job.

By focusing on the right features — structure, automation, transparency, and scalability — organizations can move beyond survival-mode consolidation and toward confident, insight-driven group reporting.

In a complex group environment, the right reporting platform isn’t just a tool — it’s a strategic advantage.