Group reporting often tells a compelling story — but not always the right one.

When entities within a group trade with each other, profits are recorded at the local level. Yet, from a group perspective, those profits might not exist at all.

These are unrealized profits — internal gains that inflate earnings and distort performance until the goods or services are sold outside the group.

If left unadjusted, they can mislead decision-makers, overstate profitability, and complicate regulatory compliance.

That’s why eliminating unrealized profit is one of the most critical, and often overlooked, steps in financial consolidation.

1. What Is Unrealized Profit in Consolidation?

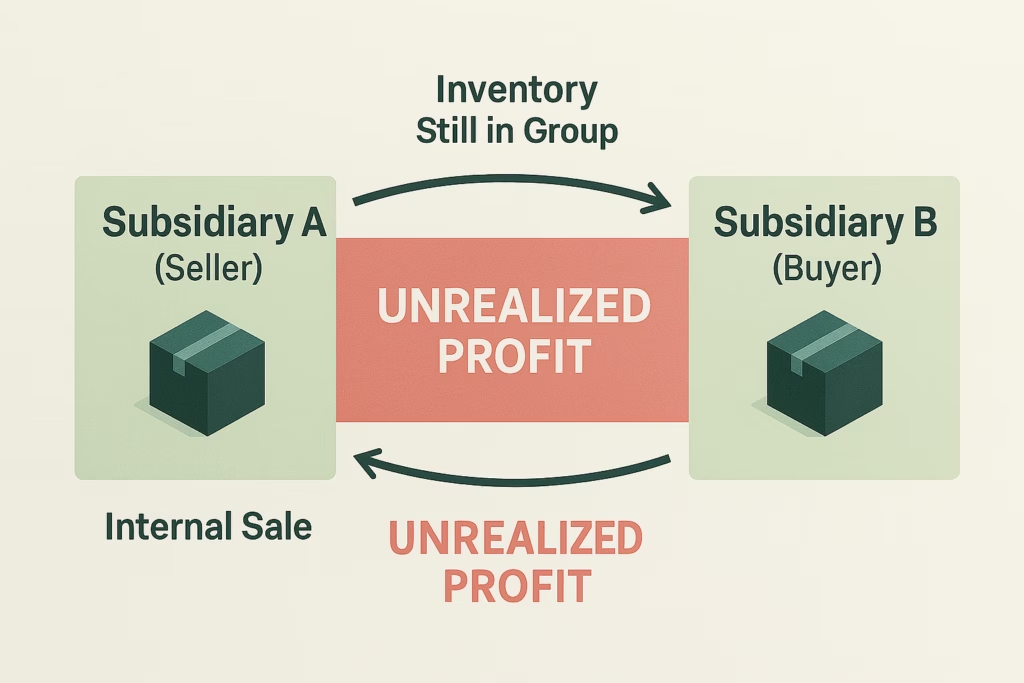

Unrealized profit arises when one group entity sells goods or services to another entity within the same corporate group at a profit, but the transaction isn’t yet completed from the group’s perspective.

Example:

Subsidiary A sells inventory to Subsidiary B at a markup.

- For A, the sale is recorded with revenue and profit.

- For B, the inventory is recorded at the marked-up cost.

But since the goods are still held within the group, the profit hasn’t been realized externally.

From a group perspective, that gain is unrealized and needs to be eliminated to avoid overstating consolidated profit and assets.

2. Common Scenarios That Create Unrealized Profit

Unrealized profit doesn’t just occur in inventory transactions. It can arise across several areas of consolidation:

a. Inventory Transfers

The most common source — one entity sells goods to another within the group before those goods are sold to external customers.

b. Fixed Asset Transfers

When a fixed asset is sold internally at a profit, depreciation will be based on an inflated value. The unrealized gain must be eliminated, and depreciation adjusted accordingly.

c. Intercompany Services

Service transactions (e.g., IT support, management fees) can create unrealized profit when they are charged above cost and not yet consumed in full.

d. Upstream and Downstream Transactions

When parent and subsidiary exchange goods or assets, the direction of the transaction affects which entity’s share of profit needs to be adjusted — particularly when non-controlling interests (NCI) are involved.

3. Why Unrealized Profit Matters to Group Reporting

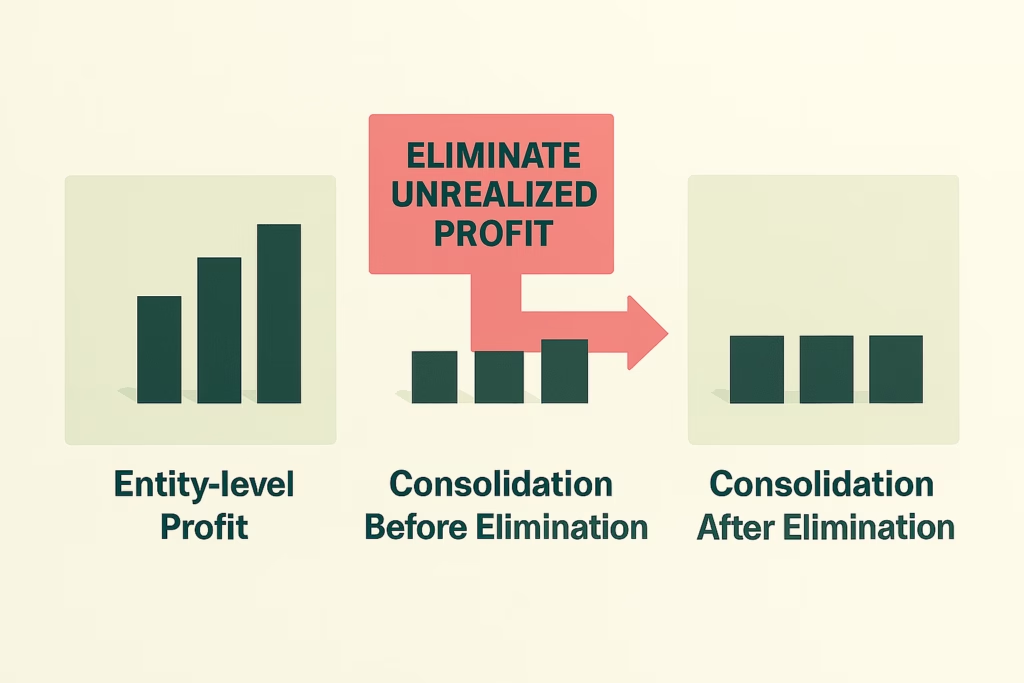

Failing to eliminate unrealized profit can have significant consequences:

- Inflated Revenue and Profit: The group appears more profitable than it truly is.

- Overstated Assets: Inventory or fixed assets are carried above their true group value.

- Misleading Performance Indicators: EBITDA, margins, and other KPIs become unreliable.

- Audit and Compliance Risks: Misstatements may trigger questions from auditors or regulators.

For CFOs and consolidation teams, properly identifying and eliminating these profits ensures the group’s performance reflects only external economic reality.

4. Step-by-Step: Eliminating Unrealized Profit

Here’s how finance teams typically handle unrealized profit elimination in consolidation:

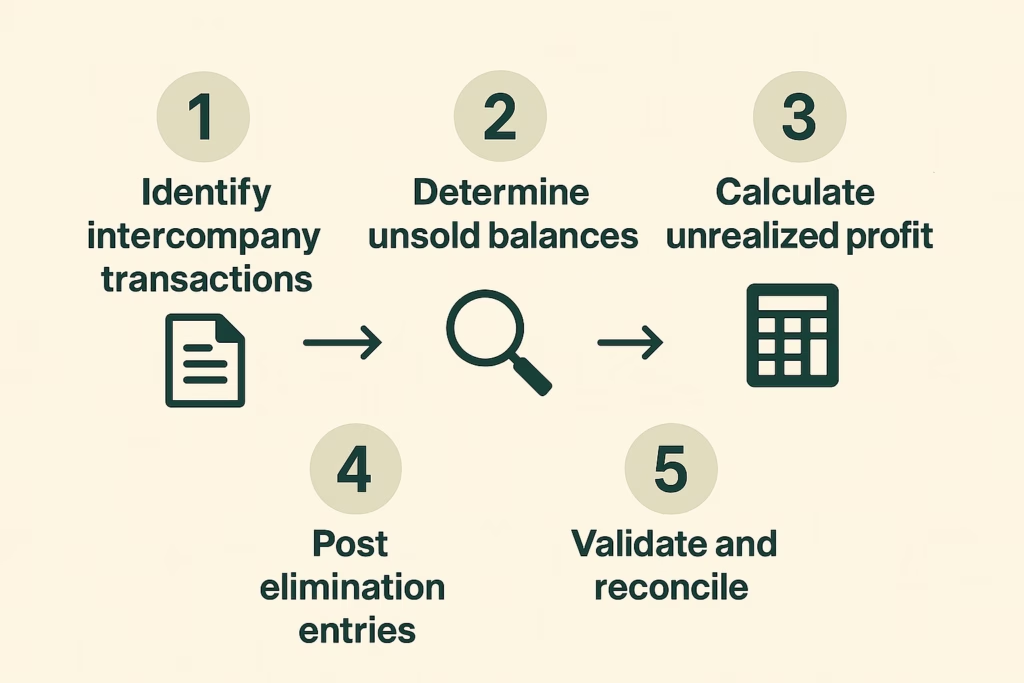

Step 1: Identify Intercompany Transactions

Start by mapping all intercompany sales and purchases across entities. This is easiest when intercompany codes or counterparties are standardized.

Step 2: Determine Unsold Balances

Identify what portion of the intercompany goods or assets remains within the group (e.g., closing inventory still held internally).

Step 3: Calculate the Unrealized Profit Portion

Apply the markup or margin to the unsold portion to compute the unrealized profit to be eliminated.

Formula Example:

Unrealized Profit = Unsold Inventory × Markup Percentage

Step 4: Post Elimination Entries

Reverse the profit by adjusting consolidated revenue and cost of sales (for inventory) or accumulated depreciation (for fixed assets).

Step 5: Validate and Reconcile

Ensure the elimination is reversed once the goods are sold externally or the asset is used up. This keeps group profit aligned with actual business activity.

5. Common Challenges in Unrealized Profit Elimination

Despite being conceptually simple, unrealized profit elimination is often one of the most painful consolidation tasks for finance teams.

a. Lack of Detailed Intercompany Data

Many accounting systems don’t capture the breakdown of intercompany balances by transaction type or counterparties.

b. Timing Mismatches

Entities may recognize sales and purchases in different periods, causing reconciliation gaps.

c. Manual Tracking in Spreadsheets

Excel-based tracking of inventory movements and profit margins is error-prone and time-consuming.

d. Complexity with Multi-Tier Groups

In large corporate structures, one transaction may flow across multiple subsidiaries, making it difficult to trace the original selling entity’s profit.

6. Best Practices for Accurate and Efficient Elimination

To move from reactive cleanup to proactive control, top-performing consolidation teams adopt the following practices:

1️⃣ Standardize Intercompany Coding

Ensure every intercompany transaction is tagged with counterparties and transaction types to simplify identification and matching.

2️⃣ Align Accounting Policies

All entities should apply consistent revenue recognition, cost capitalization, and inventory valuation methods to reduce mismatches.

3️⃣ Automate Intercompany Matching

Use systems that automatically detect reciprocal transactions, match balances, and flag variances. This saves time and reduces human error.

4️⃣ Integrate Elimination Logic into Consolidation

Build predefined rules into your consolidation tool to automatically eliminate unrealized profit once intercompany transactions are identified.

5️⃣ Reconcile Continuously

Track unrealized profit reversals as goods are sold externally — not just at period-end — for greater accuracy and transparency.

7. How BrizoSystem Simplifies Unrealized Profit Elimination

With BrizoSystem, finance teams can handle unrealized profit with speed and clarity.

The platform:

- Consolidates intercompany data from multiple entities and systems.

- Applies elimination rules for inventory and asset transfers.

- Provides transparent reporting and audit trails for every adjustment.

Instead of chasing down spreadsheets, BrizoSystem users focus on explaining performance — not reconciling it.

Conclusion: Seeing the True Picture

Unrealized profit may be invisible in day-to-day operations, but it can quietly distort how a group’s performance is perceived.

By systematically identifying and eliminating these internal gains, finance leaders can reveal what truly drives profitability — real economic performance, not accounting noise.

When powered by automation and clear reporting, unrealized profit elimination transforms from a tedious compliance step into a foundation of financial transparency.

In consolidation, clarity is everything — and unmasking unrealized profit is how you achieve it.