Pulse is BrizoSystem’s newest sidebar feature, designed specifically for small and medium enterprises. Rather than juggling multiple reports, Pulse delivers four core indicators—Key Metrics, Cashflow, Receivables, and Payables—in one dynamic view. It’s your business at a glance, empowering you to spot trends, mitigate risks, and drive growth without digging through spreadsheets.

What Is Pulse?

Pulse consolidates critical financial insights into a single interface:

- Key Metrics: Choose and track the KPIs that matter most to your business.

- Cashflow: See real-time inflows, outflows, and net change, plus a short-term forecast.

- Receivables: Monitor outstanding invoices and aging buckets.

- Payables: Review upcoming bills and vendor-aging summaries.

This unified approach surfaces your business’s vital signs instantly, so you can act quickly when numbers shift.

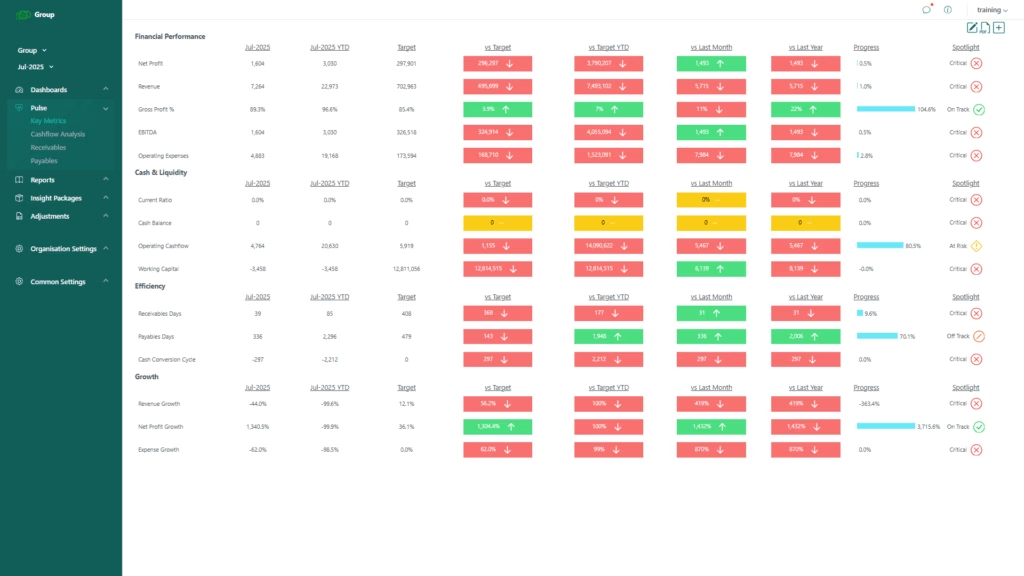

Customizable Key Metrics

On the Key Metrics page, you can:

- Select any combination of KPIs—revenue growth, gross margin, customer churn, or custom metrics.

- Define monthly or quarterly targets directly in the interface.

- Instantly visualize performance against targets with intuitive gauges and color-coded alerts.

Your selection is fully configurable. We recommend collaborating with your CFO, accountant, or Xero Advisor to pick the metrics that align with your strategy and to set realistic targets.

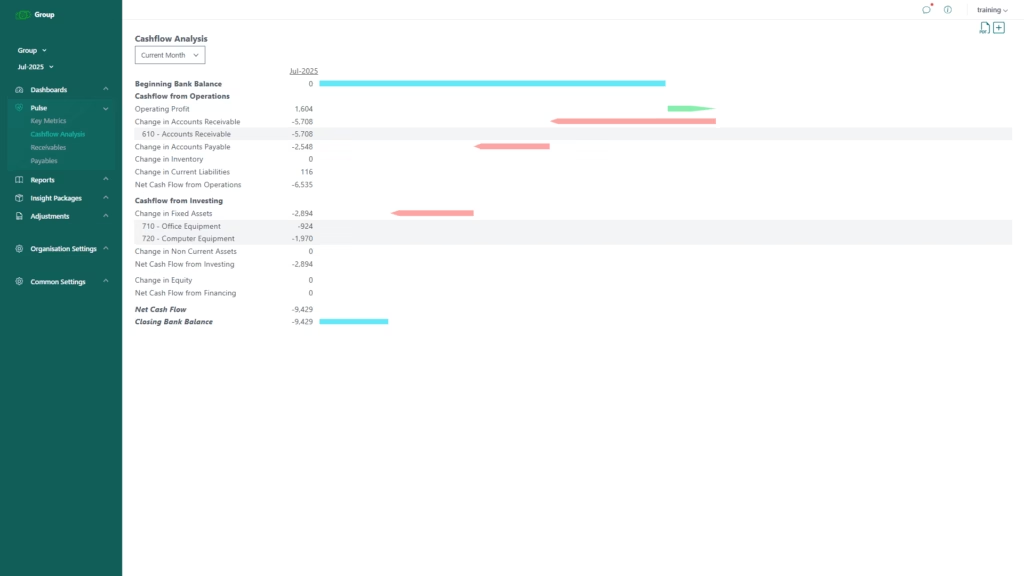

Real-Time Cashflow Insights

Pulse’s Cashflow panel keeps you ahead of liquidity challenges by offering:

- A live line chart comparing cash inflows versus outflows over your selected period.

- Your current cash balance alongside a short-term forecast based on historical data and pending transactions.

- A summary of net cash change that highlights surges or shortfalls at a glance.

With these insights front and center, you’ll never be blindsided by a sudden cash squeeze.

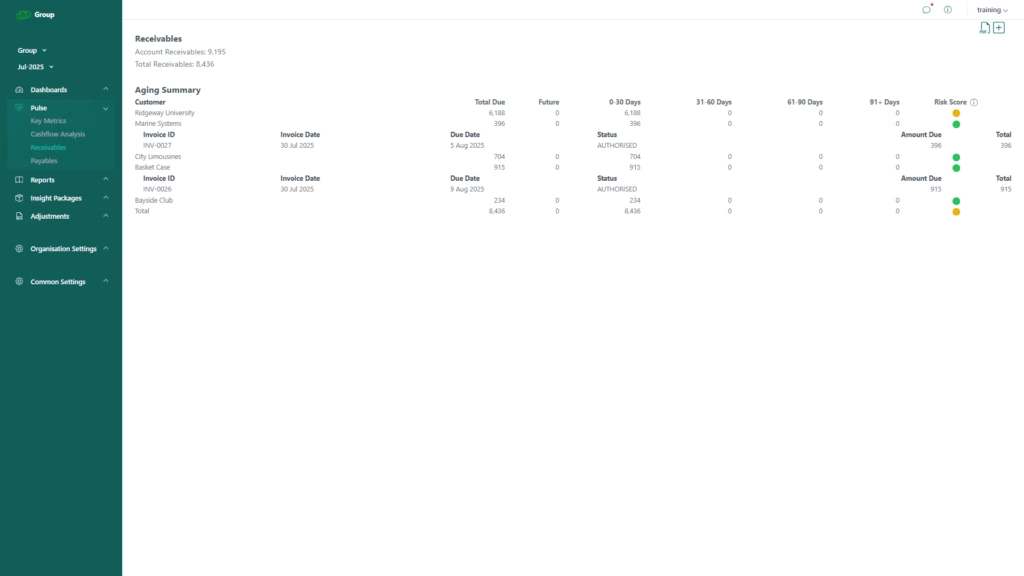

Receivables & Payables at a Glance

Pulse streamlines working-capital management through two dedicated sections:

Receivables

- Total outstanding invoices

- Aging buckets (30, 60, 90+ days)

- Top slow-paying customers

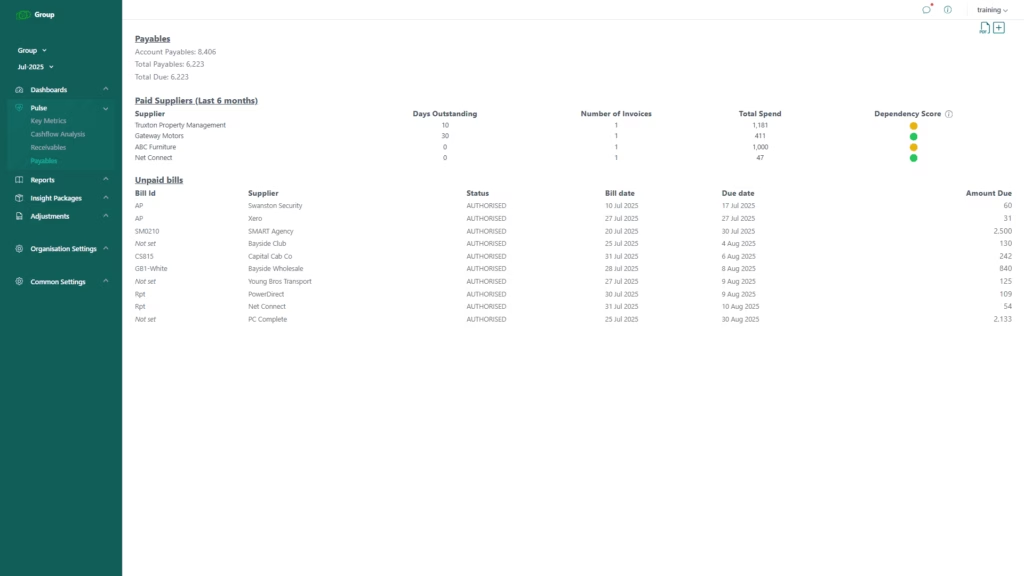

Payables

- Total outstanding bills

- Aging buckets (30, 60, 90+ days)

- Vendor-aging summaries

These snapshots help you prioritize collections, renegotiate payment terms, and maintain strong vendor relationships.

Collaborate with Your Experts

Pulse is most powerful when used in partnership. We suggest:

- Reviewing your chosen KPIs and targets with your CFO or accountant.

- Ensuring your Xero integration is up to date for accurate data.

- Scheduling monthly Pulse check-ins to recalibrate targets as your business evolves.

This collaborative workflow turns Pulse into an active planning tool, not just a reporting dashboard.

By making Pulse a regular part of your routine, you’ll cultivate proactive financial management.

Pulse isn’t just a new screen—it’s a mindset shift toward real-time, data-driven decision-making. Ready to dive deeper? Let me know if you’d like help crafting social-media posts, refining the blog title, or adding a punchy intro to captivate your readers.