In group accounting, one of the biggest challenges is ensuring that financial statements present an accurate and fair picture of the business as a whole. This means more than simply consolidating numbers from multiple entities—it also requires eliminating intercompany transactions.

If left unadjusted, intercompany activities can inflate revenue, expenses, assets, and liabilities, leading to misleading financials. To avoid this, accountants perform intercompany eliminations as part of the consolidation process.

In this article, we’ll walk through a step-by-step guide to managing these eliminations effectively.

🔹 Why Intercompany Eliminations Matter

When companies under the same group transact with each other, the consolidated financials must treat the group as if it were one single entity.

Without eliminations, your financial statements could:

- Double count revenue and expenses

- Overstate assets or liabilities

- Mislead stakeholders on group performance

The goal is simple: remove the effect of intra-group activities so only external transactions remain.

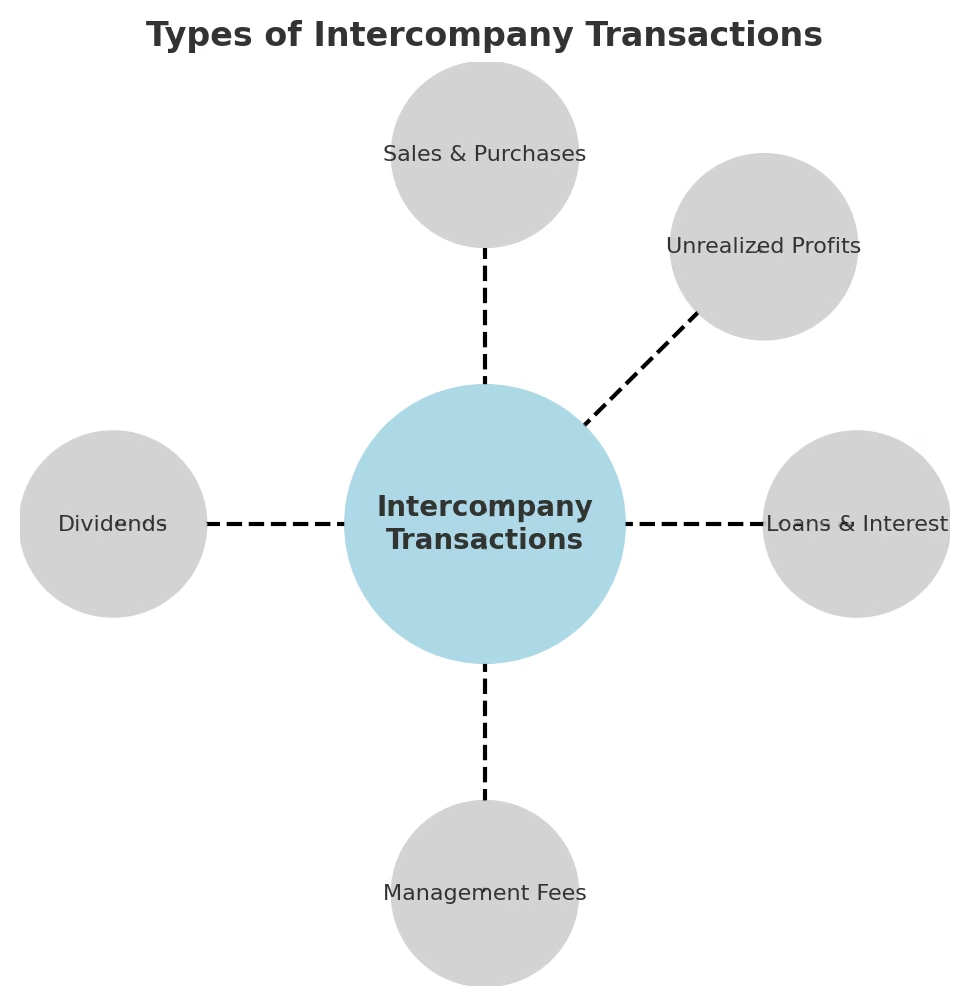

🔹 Common Types of Intercompany Transactions

1. Intercompany Sales and Purchases

This is one of the most frequent transactions, where one entity sells goods or services to another within the same group. For example, a manufacturing subsidiary may transfer raw materials to a distribution company under the same parent. If not eliminated, group revenue and cost of sales are overstated. Eliminations ensure that only sales to external customers are reported.

2. Intercompany Loans and Interest

Subsidiaries often borrow funds from a parent or sister company to manage liquidity. While necessary at the entity level, these balances must be eliminated at consolidation. Otherwise, the group’s liabilities and assets would appear inflated, and interest income/expenses would distort performance.

3. Management Fees or Service Charges

Head office often charges subsidiaries for shared services such as HR, IT, or legal support. These costs are valid for entity-level P&L but are purely internal from a group perspective. Eliminating them avoids overstating both income (for head office) and expenses (for subsidiaries).

4. Intercompany Dividends

When subsidiaries pay dividends to the parent, it increases income at the parent level but has no effect at the group level—since the source is internal equity. These must be eliminated against retained earnings to avoid overstating group profit.

5. Unrealized Profits on Inventory or Fixed Assets

If one subsidiary sells goods to another at a profit, and the inventory is unsold to an external customer at period-end, the profit is “unrealized.” Similarly, if assets are transferred between entities, any gain needs to be eliminated. This ensures the group does not record profit until realized externally.

🔎 Round-up:

All these transaction types share one principle: what makes sense for standalone books does not always reflect group reality. Intercompany eliminations realign the numbers so that the consolidated financials represent the group as a single economic unit, without double counting or artificial profit.

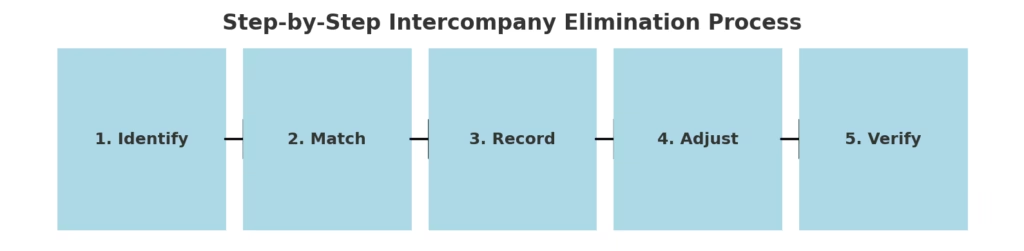

🔹 Step-by-Step Process for Intercompany Eliminations

Step 1: Identify Intercompany Transactions

Start by gathering all transactions between group entities. This includes invoices, loan agreements, interest charges, and allocations. A clear mapping of accounts and counterparties is essential.

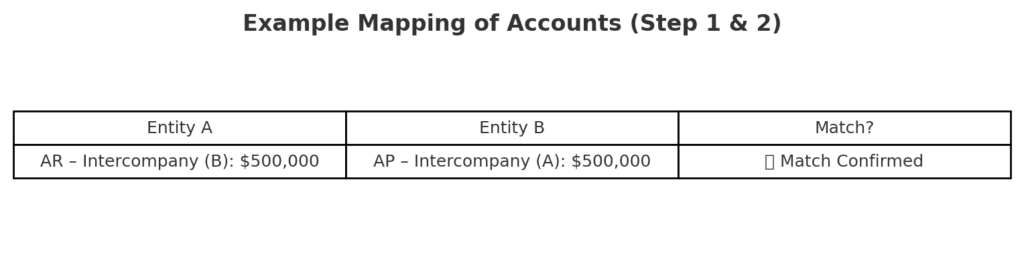

Example:

- Entity A: Accounts Receivable – Intercompany (Subsidiary B) → $500,000

- Entity B: Accounts Payable – Intercompany (Subsidiary A) → $500,000

This mapping shows both sides of the same transaction and provides the foundation for elimination entries.

Step 2: Match and Confirm Balances

Entities must reconcile intercompany balances. For example, if Entity A records a receivable of $500,000, Entity B should record a payable of $500,000.

Detailed Example:

Suppose Entity A invoices Entity B on March 28, but Entity B records the liability on April 2 due to different cut-off policies. At consolidation, one entity shows a balance, and the other does not—leading to mismatches. Finance teams must identify these timing differences, agree on cut-off policies, and align balances before elimination.

Step 3: Record Eliminations in the Consolidation System

Adjusting entries are posted in the consolidation process, not in the standalone ledgers. Typical entries include:

- Eliminating intercompany sales/purchases:

- Dr. Revenue

- Cr. Cost of Sales

- Eliminating intercompany balances:

- Dr. Intercompany Payables

- Cr. Intercompany Receivables

- Eliminating intercompany interest:

- Dr. Interest Income

- Cr. Interest Expense

- Eliminating intercompany dividends:

- Dr. Dividend Income

- Cr. Retained Earnings

Step 4: Adjust for Unrealized Profits

If inventory or fixed assets are transferred within the group at a profit, the profit must be eliminated until sold to an external party. For example:

- Dr. Cost of Sales

- Cr. Inventory (to reduce inflated inventory value)

This ensures the group does not recognize profit twice—once internally and once externally.

Step 5: Verify Consolidated Financial Statements

After all eliminations, review the consolidated statements to ensure:

- Group revenue and expenses exclude intra-group transactions

- Assets and liabilities are not overstated

- Equity and retained earnings reflect only external results

🔹 Common Challenges in Intercompany Eliminations

- Timing Differences – Subsidiaries may record transactions in different periods, creating mismatches.

- Currency Exchange Mismatches – When entities operate in different currencies, FX rate variations can lead to discrepancies.

- Complex Multi-Entity Structures – The more subsidiaries and intercompany flows, the harder it becomes to track and reconcile.

- Manual Processes – Reliance on spreadsheets increases the risk of human error, duplication, and delayed close cycles.

- Inconsistent Policies – Lack of standardization on cut-offs, allocation methods, or FX rates can make reconciliation time-consuming.

🔹 Best Practices for Smooth Eliminations

- Standardize Intercompany Policies

Create clear group-wide rules on cut-offs, FX rates, and documentation to reduce mismatches. - Centralize Reconciliations

Use a single platform to track, approve, and reconcile balances across entities. This reduces duplication and ensures consistency. - Automate Where Possible

Automation tools can match intercompany balances, post elimination entries, and flag discrepancies, saving significant time during month-end close. - Enhance Communication

Strong collaboration between subsidiaries and the head office ensures discrepancies are resolved quickly. Regular review meetings help prevent surprises at consolidation. - Leverage Consolidation Software

Modern solutions like BrizoSystem provide built-in workflows for intercompany matching and eliminations, reducing reliance on error-prone spreadsheets.

🔹 Final Thoughts

Intercompany eliminations are not just a compliance requirement—they’re essential for presenting a true and fair view of group performance.

By following a structured, step-by-step process and applying best practices, finance teams can reduce reconciliation headaches, improve accuracy, and build stakeholder confidence in consolidated results.

At BrizoSystem, we help finance teams simplify intercompany reconciliations and automate elimination entries, ensuring accuracy and saving time at every close.

📩 Contact us at info@brizosystem.com to learn how we can help.