Introduction

Intercompany loans are a common financing tool within corporate groups. A parent may lend funds to a subsidiary, or two subsidiaries may arrange a loan between themselves. On the surface, these transactions provide flexibility in managing liquidity across the group. But when it comes to preparing consolidated financial statements, these loans — along with the interest income and expense they generate — must be eliminated.

Why? Because they do not represent external transactions. From the perspective of the group as a whole, you cannot owe money to yourself, nor can you generate interest income internally. Eliminating these balances is critical for presenting a true and fair view of the group’s financial position and performance.

This guide provides a deep dive into the types of intercompany loans, how interest is handled, common challenges, and a step-by-step process for eliminating them.

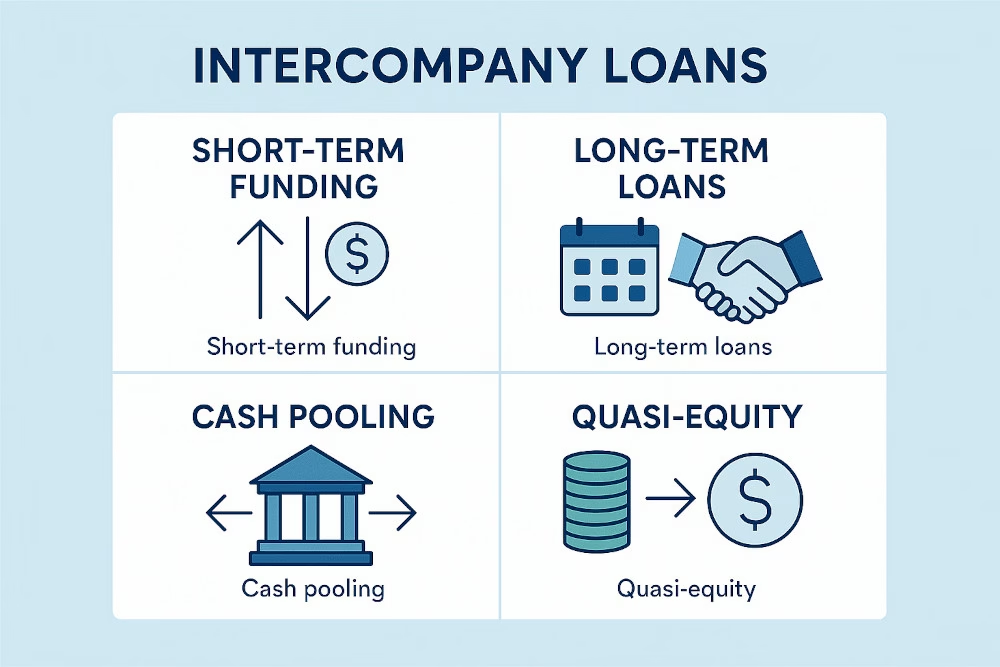

Types of Intercompany Loans

Not all intercompany loans are the same. They can differ in purpose, terms, and accounting treatment. Below are the most common types:

1. Short-Term Funding Arrangements

These are temporary loans to manage working capital or liquidity shortfalls. For example, a parent may advance funds to a subsidiary at month-end to cover payroll or supplier payments.

- Purpose: Maintain liquidity in the short term.

- Consolidation Impact: Loan receivable and payable balances cancel out; interest (if charged) must also be eliminated.

2. Long-Term Intercompany Loans

These loans are structured with longer repayment horizons and may carry interest at market or transfer-pricing compliant rates. Sometimes they substitute for equity financing.

- Purpose: Provide funding without issuing additional equity.

- Consolidation Impact: Loan receivable and payable balances cancel; accumulated interest income and expense are eliminated.

3. Cash Pooling Arrangements

In centralized treasury models, cash is pooled across group entities. Surpluses from one entity are loaned to others, often through a “header account.”

- Purpose: Optimize group-wide liquidity and minimize external borrowing.

- Consolidation Impact: Numerous intercompany receivables/payables need elimination; net external borrowing remains.

4. Quasi-Equity Loans

Sometimes intercompany loans are structured without fixed repayment terms and are in substance closer to equity than debt.

- Purpose: Provide flexible, long-term capital support.

- Consolidation Impact: May require reclassification as equity in consolidation before elimination.

5. Intercompany Interest Income and Expense

Regardless of loan type, one entity records interest income while the counterparty records interest expense.

- Purpose: Reflect cost of funds internally and comply with transfer pricing.

- Consolidation Impact: Must always be eliminated to avoid inflating revenue/expenses.

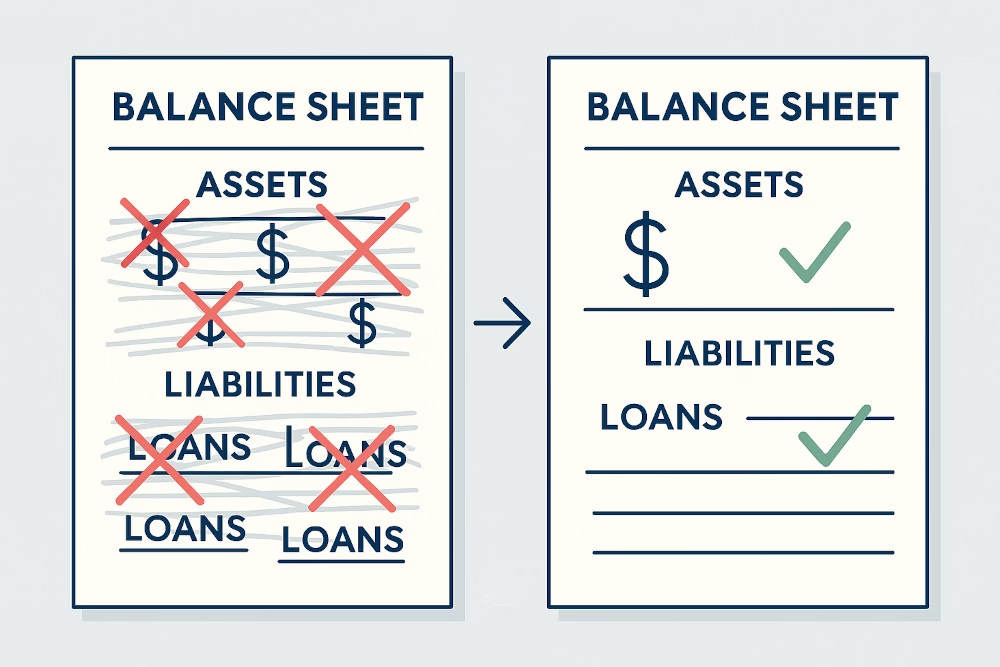

Why Elimination Is Necessary

Without elimination:

- Balance Sheet distortion → Assets (loan receivable) and liabilities (loan payable) are overstated.

- P&L distortion → Group revenue (interest income) and expenses (interest expense) are overstated.

- Ratios misrepresented → Debt-to-equity ratios and profitability measures are artificially skewed.

The consolidated financial statements should reflect only transactions with third parties, not internal activities.

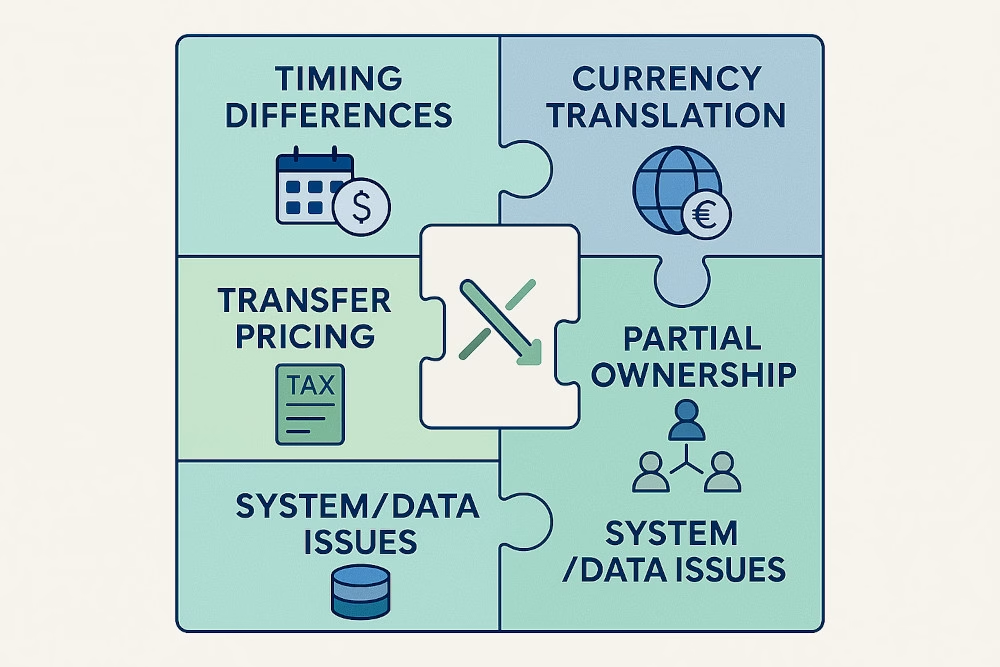

Common Challenges in Eliminating Intercompany Loans

- Timing Differences

- One entity records the loan in January, but the counterparty books it in February.

- Leads to mismatched balances.

- Currency Translation

- Loans denominated in foreign currencies create FX gains/losses in individual books.

- These must also be eliminated in consolidation.

- Transfer Pricing Compliance

- Loans must be at arm’s length. Eliminating interest does not eliminate the need for documentation and compliance with tax authorities.

- Partial Ownership

- If a subsidiary is not 100% owned, eliminations affect non-controlling interests.

- Interest elimination reduces the share of profit available to NCI.

- System and Data Issues

- Manual consolidations often result in mismatches between counterparties due to differences in GL coding, cut-offs, or reporting processes.

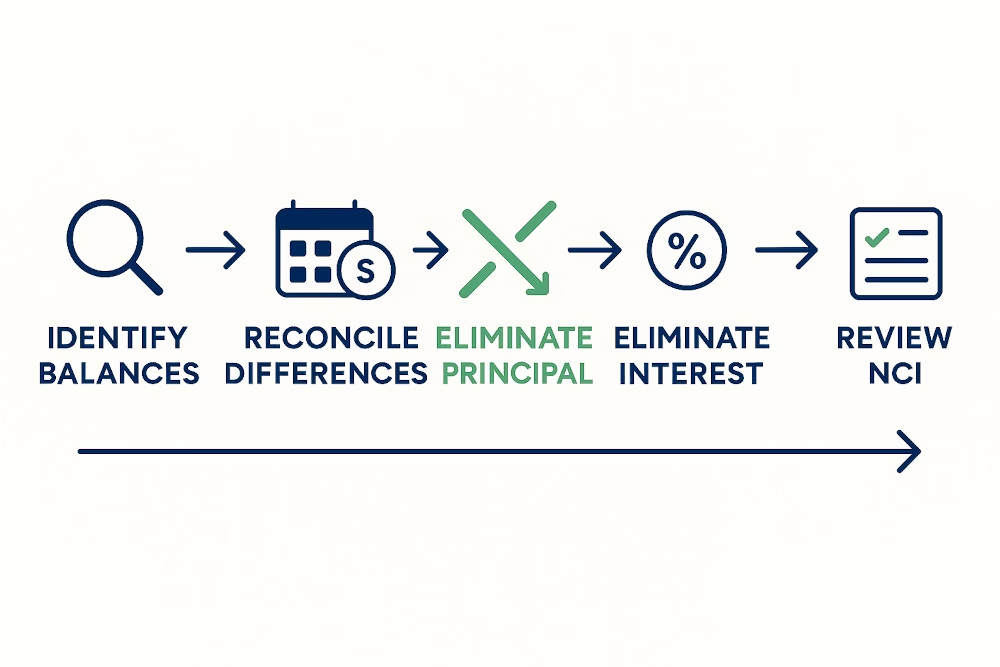

Step-by-Step Process to Eliminate Intercompany Loans and Interest

Step 1: Identify Intercompany Loan Balances

- Extract intercompany receivables/payables from the trial balance of each entity.

- Match counterparties, currencies, and terms.

Example:

- Parent Co. shows a loan receivable of $5M from Subsidiary A.

- Subsidiary A shows a loan payable of $5M to Parent Co.

- These must cancel in consolidation.

Step 2: Reconcile Differences

- Ensure loan balances match in both entities’ books.

- If differences arise due to FX, timing, or errors, adjustments must be made.

Detailed Example:

- Parent books loan on Jan 1 at $5M.

- Subsidiary records on Jan 2 at $4.95M due to FX.

- In consolidation, a $50K adjustment is required to align.

Step 3: Eliminate Principal Balances

- Debit: Intercompany Loan Payable

- Credit: Intercompany Loan Receivable

- Net impact: Balance sheet shows only external loans.

Step 4: Eliminate Interest Income/Expense

- Debit: Interest Income (Parent)

- Credit: Interest Expense (Subsidiary)

- Net impact: P&L reflects only external interest.

Step 5: Address FX Gains/Losses

- Any unrealized FX gains/losses on intercompany loans are eliminated.

- Exception: If loan is considered permanent (quasi-equity), FX may remain in equity (translation reserve).

Step 6: Review NCI Impact

- For partially owned subsidiaries, ensure eliminations are allocated correctly between parent equity and non-controlling interest.

Best Practices for Managing Intercompany Loan Eliminations

- Automate Matching

- Use consolidation systems that auto-match intercompany balances, reducing manual reconciliations.

- Standardize Processes

- Require consistent GL codes for intercompany loans and interest.

- Align cut-off dates for month-end closing.

- Regular Reconciliations

- Perform intercompany reconciliations monthly, not just at year-end.

- Resolve mismatches proactively.

- Document Transfer Pricing

- Even though interest is eliminated in consolidation, maintain transfer-pricing support for tax compliance.

- Clear Policies for Quasi-Equity

- Define criteria for when intercompany loans should be treated as equity.

- Communicate these policies across the group.

- Audit Trail

- Maintain clear elimination entries for auditors, showing counterparties, amounts, and rationale.

Conclusion

Intercompany loans and related interest can complicate the consolidation process, especially in multinational groups with multiple currencies and complex financing structures. By understanding the types of loans, following a structured elimination process, and implementing best practices, finance teams can ensure their consolidated statements reflect a true economic picture of the group.

Getting this right not only ensures compliance but also builds confidence with stakeholders — from auditors to investors — who rely on accurate consolidated accounts.