Introduction

For multinational groups, foreign currency is more than just an accounting technicality — it’s one of the biggest sources of complexity in consolidation. Exchange rate fluctuations can create FX “noise” in the consolidated financials: artificial gains, losses, and mismatches that don’t reflect the underlying business performance.

Without careful handling, FX noise can distort revenue, margins, and even equity. This blog explores where the noise comes from, common challenges, and the best practices finance teams can adopt to minimize unnecessary volatility in their consolidated results.

Why FX Noise Matters in Consolidation

FX noise arises when different exchange rates, mismatched timing, or inconsistent methods lead to artificial variances. These variances:

- Obscure real business performance.

- Complicate comparisons across subsidiaries.

- Trigger unnecessary questions from auditors, boards, and investors.

The goal is not to eliminate FX impact entirely — exchange rates do affect financials — but to ensure only the real, unavoidable impact flows through, while eliminating avoidable mismatches.

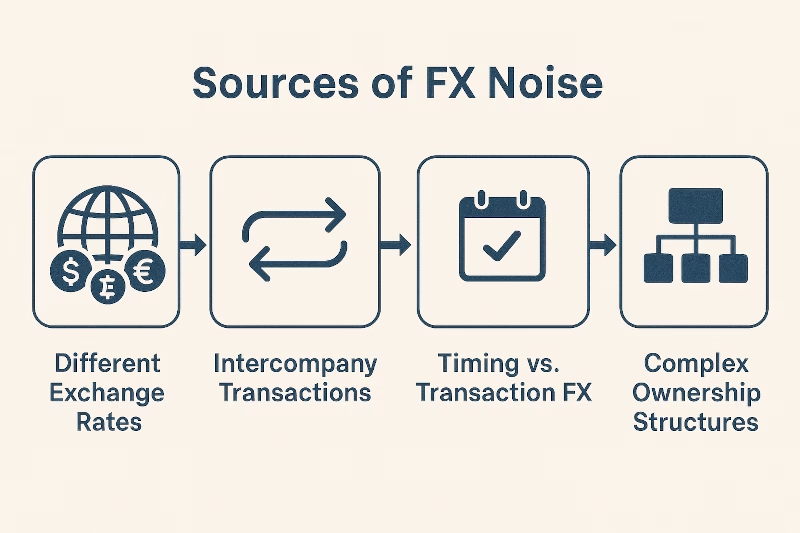

Common Sources of FX Noise

1. Different Exchange Rates Applied

Subsidiaries may use slightly different rates for the same period (e.g., Parent uses group rate, Subsidiary uses local bank rate).

2. Intercompany Transactions in Foreign Currency

Loans, sales, or charges booked in one currency can create FX gains/losses at one entity but not matched at the counterparty.

3. Timing Differences

When one entity books a transaction in one month and its counterparty in the next, exchange rates differ, creating artificial mismatches.

4. Translation vs. Transaction FX

Some mismatches occur because translation differences (re-measuring subsidiary accounts into group currency) are mixed with realized/unrealized transaction FX.

5. Complex Ownership Structures

Partial ownerships or multi-tiered holding structures amplify FX effects, especially when consolidating non-controlling interests.

Step-by-Step Best Practices to Eliminate FX Noise

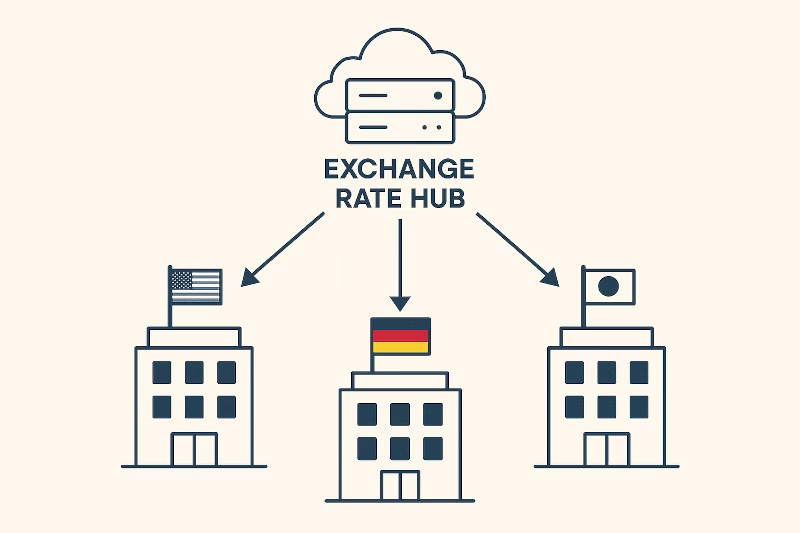

1. Centralize Exchange Rate Management

- Provide group-wide exchange rates (spot, average, closing) from a central source.

- Require all subsidiaries to use the same rate table.

- Automate distribution of rates through consolidation software.

2. Align Intercompany Policies

- Ensure intercompany loans, sales, and charges are consistently denominated and recorded.

- Mandate use of agreed exchange rates for intercompany settlements.

- Encourage monthly reconciliations to avoid mismatches.

3. Distinguish Transaction FX vs. Translation FX

- Transaction FX: Gains/losses on settling actual transactions (should be eliminated if intercompany).

- Translation FX: Re-measuring subsidiary financials into group currency (remains in consolidated statements).

- Separating the two avoids confusion and ensures proper elimination entries.

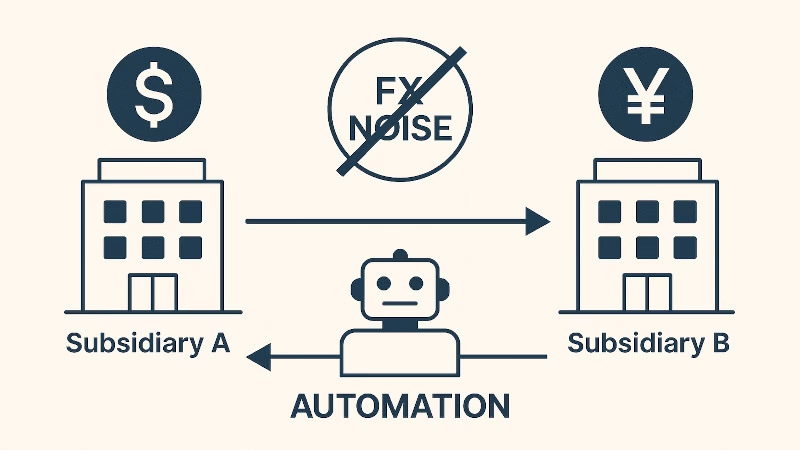

4. Automate Intercompany Eliminations

- Use consolidation systems that automatically eliminate both the principal and FX impact of intercompany balances.

- Set tolerance rules to auto-clear small FX variances (e.g., within $100).

- Exception reporting ensures finance teams only review material issues.

5. Apply Consistent Cut-Offs

- Require all subsidiaries to close on the same timetable.

- Misaligned cut-offs (e.g., one entity closing on the 30th, another on the 31st) can create unnecessary FX mismatches.

6. Monitor FX Impact in Dashboards

- Build management dashboards that highlight FX variances separately from operating performance.

- Provides clarity to the CFO, board, and investors about what’s “real” performance vs. currency-driven fluctuations.

Common Challenges in Managing FX Eliminations

- Local Resistance: Subsidiaries may prefer local rates for compliance or ease.

- Manual Processes: Spreadsheets are error-prone when dealing with multiple exchange rates and currencies.

- Audit Scrutiny: FX eliminations are a common audit adjustment area.

- System Limitations: Legacy ERP systems often lack proper multi-currency support.

Conclusion

Foreign currency consolidation doesn’t have to be a noisy process. By centralizing exchange rate management, enforcing consistent intercompany policies, and leveraging automation, finance teams can minimize artificial FX noise while still accurately reflecting the real currency impacts on the business.

The result: consolidated statements that are cleaner, faster to prepare, and easier for stakeholders to interpret.