Introduction: The Hidden Complexity Behind Simple Loans

At first glance, intercompany loans appear straightforward — one entity within a group lends money to another. However, when it comes to financial consolidation, these transactions are one of the most error-prone and audit-sensitive areas.

Mismatched loan schedules, unaligned interest accruals, and foreign currency translation differences can easily distort consolidated statements. A small oversight can cascade into material misstatements at the group level.

This article explores how intercompany loans should be accounted for, how to eliminate them properly during consolidation, and the common pitfalls finance teams should watch out for.

What Are Intercompany Loans?

Intercompany loans are internal financing arrangements between entities under common control. They may arise for many reasons: working capital support, funding for investment, or treasury cash optimization.

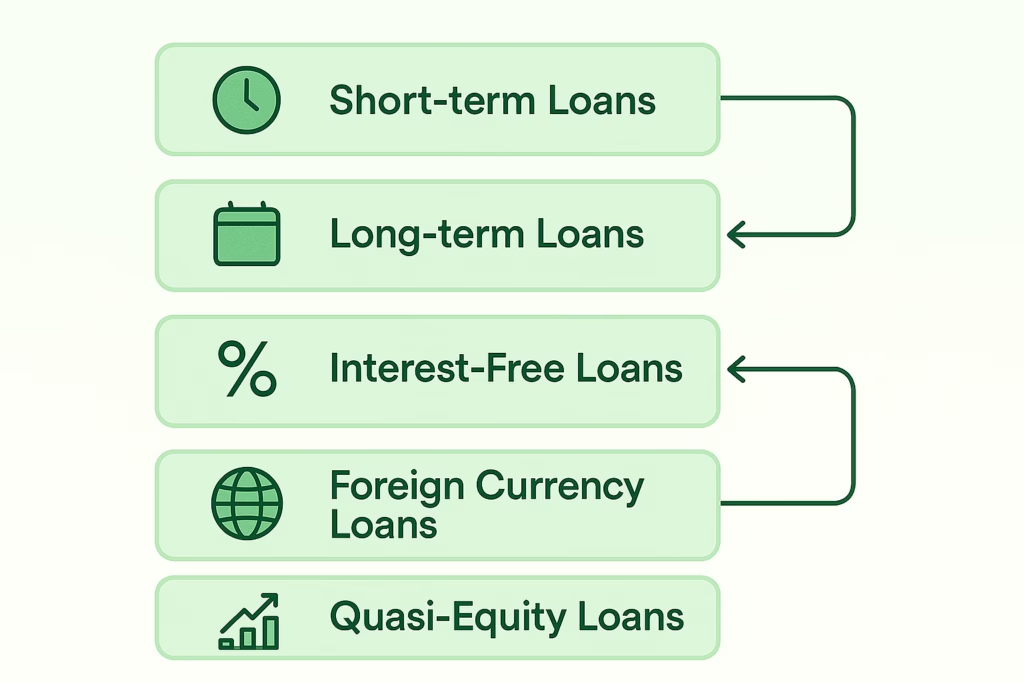

Common types include:

- Short-term advances – to manage liquidity or settle invoices.

- Long-term loans – for capital expenditure or investment purposes.

- Revolving balances – treasury-managed current accounts between entities.

From the group’s perspective, these are internal transactions — meaning they don’t represent true external assets or liabilities. Therefore, during consolidation, both the loan balance and any related interest must be eliminated.

Accounting for Intercompany Loans

In the individual books of each entity:

- The lender records a loan receivable and interest income.

- The borrower records a loan payable and interest expense.

In standalone reporting, this is correct. But on consolidation, the two must offset perfectly — otherwise, the group financials will overstate both assets and liabilities, as well as income and expenses.

Types of Intercompany Loans and Their Accounting Implications

a. Trading or Short-Term Loans

Often linked to operating activities such as intercompany sales or temporary funding.

- Typically repaid within a few months.

- May overlap with trade payables if not properly tracked.

Tip: Ensure trading balances and loans are clearly separated in your chart of accounts.

b. Long-Term Intercompany Loans

Formal arrangements with defined terms, interest, and repayment schedules.

- Under IFRS 9, these may require fair value measurement and expected credit loss (ECL) assessment.

- US GAAP typically records them at cost unless impaired.

Tip: Both sides must use the same principal, FX rate, and interest accruals.

c. Interest-Free or Below-Market Loans

These create potential fair value and tax implications.

- IFRS requires discounting to present value when terms are off-market.

- The difference may be treated as an equity contribution or income.

Tip: Establish a consistent policy for fair value recognition and amortization.

d. Foreign Currency Loans

When loans are in a foreign currency, FX movements affect both sides differently.

- The lender may record an unrealized FX gain.

- The borrower may record an unrealized FX loss.

Tip: Use a centralized FX rate table to ensure both entities revalue consistently.

e. Subordinated or Quasi-Equity Loans

These behave more like capital than debt.

Tip: Review the substance of the arrangement — it may need to be reclassified as equity rather than eliminated as a loan.

The Elimination Process in Consolidation

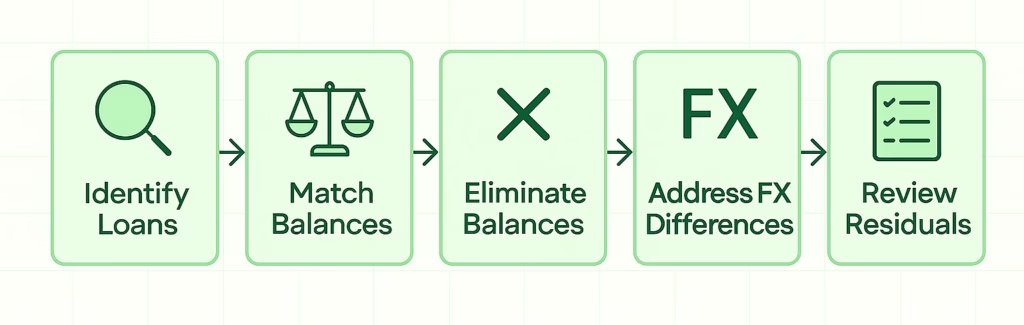

Step 1: Identify Intercompany Loans

Compile a list of all intercompany relationships — including both the principal and accrued interest. Assign a unique loan ID or counterparty code for automated reconciliation.

Step 2: Match Balances

Match receivables and payables by:

- Counterparty

- Currency

- Principal amount

- Interest accrual date and rate

Automation tools like BrizoSystem can simplify this step, detecting mismatches instantly through rule-based matching.

Step 3: Eliminate the Balances

Once confirmed:

- Debit the loan payable (borrower)

- Credit the loan receivable (lender)

- Eliminate interest income and interest expense in P&L

Step 4: Address FX Differences

Use the same exchange rate during elimination to prevent residuals.

Any remaining translation differences should be adjusted through other comprehensive income (OCI) or FX reserve, depending on the reporting framework.

Step 5: Review Residual Differences

Residuals can arise from:

- Rounding

- Timing differences in postings

- Inconsistent FX rates

These should be reviewed and adjusted via a centralized “intercompany clearing” account when immaterial.

Common Pitfalls and How to Avoid Them

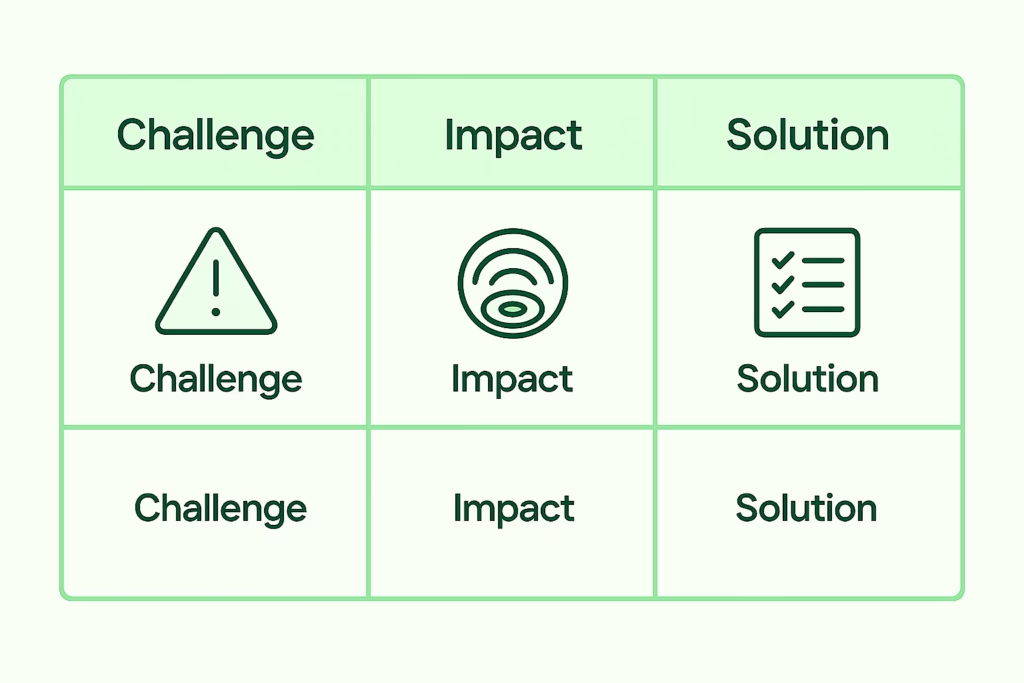

| Challenge | Impact | Solution |

|---|---|---|

| Timing differences | Interest not aligned across entities | Enforce month-end cut-offs |

| FX rate inconsistencies | Residual balances after elimination | Use group-wide FX tables |

| Misclassified loans | Loans buried under trade balances | Use dedicated account codes |

| Below-market loans | Incorrect fair value adjustments | Apply consistent discounting |

| Manual matching | Human errors and time loss | Automate matching and elimination |

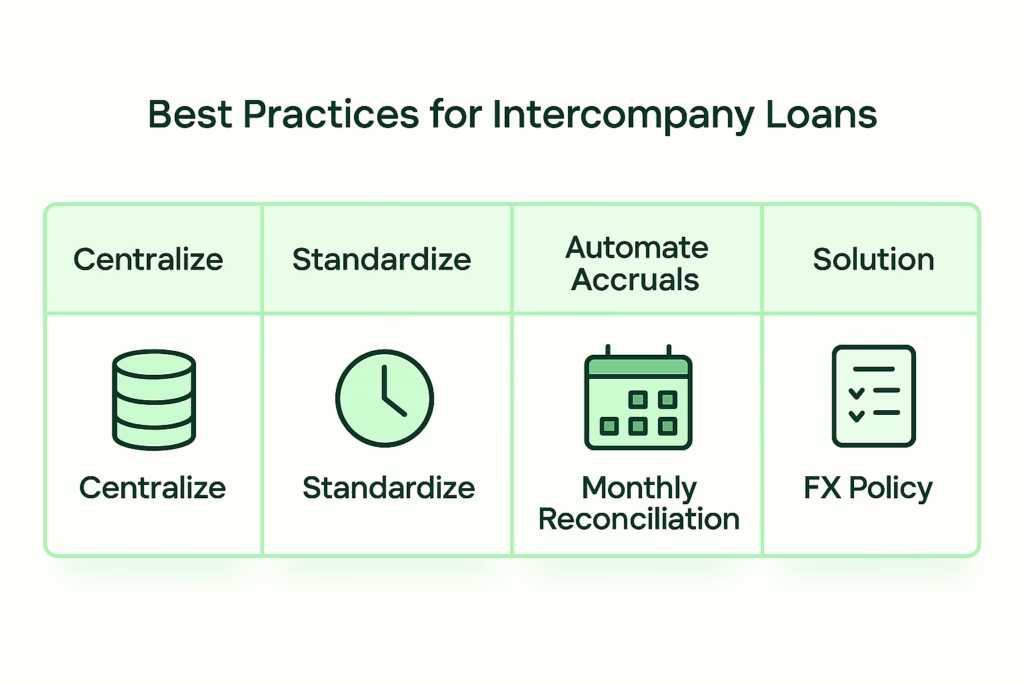

Best Practices for Managing Intercompany Loans

- Centralize loan data – Store details (amount, term, FX rate, interest) in a shared database.

- Standardize loan agreements – Use consistent documentation and account codes.

- Automate interest accruals – Reduces human error and improves timing alignment.

- Reconcile monthly – Don’t wait for year-end; frequent checks reduce surprises.

- Align FX policies – Use one source of truth for foreign exchange rates.

- Govern with clear policies – Document approval, recording, and elimination processes.

The Role of Automation in Consolidation

Modern consolidation tools streamline the elimination process by:

- Automatically detecting unmatched loan pairs.

- Reconciling interest accruals and FX differences.

- Generating elimination journals instantly.

- Providing transparent audit trails for compliance.

Automation ensures accuracy while freeing finance teams from repetitive manual reconciliation — a key step toward faster and more reliable group close cycles.

Conclusion: Turning Intercompany Loans into a Strength, Not a Risk

IIntercompany loans are more than just balance sheet items — they’re the financial arteries that keep a group’s entities connected and liquid. But when not managed carefully, they can also become one of the biggest sources of reconciliation pain, FX noise, and audit tension during consolidation.

By implementing a structured process — identifying loans early, maintaining standardized documentation, and automating interest accruals and eliminations — finance teams can transform what was once a manual burden into a smooth, auditable workflow. Automated systems not only help ensure that loans and interest are matched and eliminated accurately, but also provide transparency into intercompany positions across currencies and entities in real time.

For group CFOs, the true opportunity lies beyond compliance. When intercompany loans are well-managed, they become a powerful tool for treasury optimization — enabling better liquidity management, funding allocation, and risk mitigation. With a centralized and automated approach, your finance team can spend less time untangling mismatched accounts and more time understanding the story behind the numbers.

In an era of increased scrutiny and global reporting complexity, mastering intercompany loan elimination is not just good housekeeping — it’s a foundation for strategic finance leadership.