Introduction

Deferred taxes are among the most complex and misunderstood areas in financial consolidation. They bridge the gap between accounting profit and taxable profit — reflecting timing differences that reverse in future periods.

For group accountants, consolidating deferred tax assets (DTAs) and liabilities (DTLs) can be challenging, especially when dealing with multiple entities, jurisdictions, and accounting standards.

This article breaks down the key concepts, common challenges, and best practices for handling deferred taxes efficiently in a group consolidation process — and how automation can simplify the journey.

1. Understanding Deferred Taxes in Consolidation

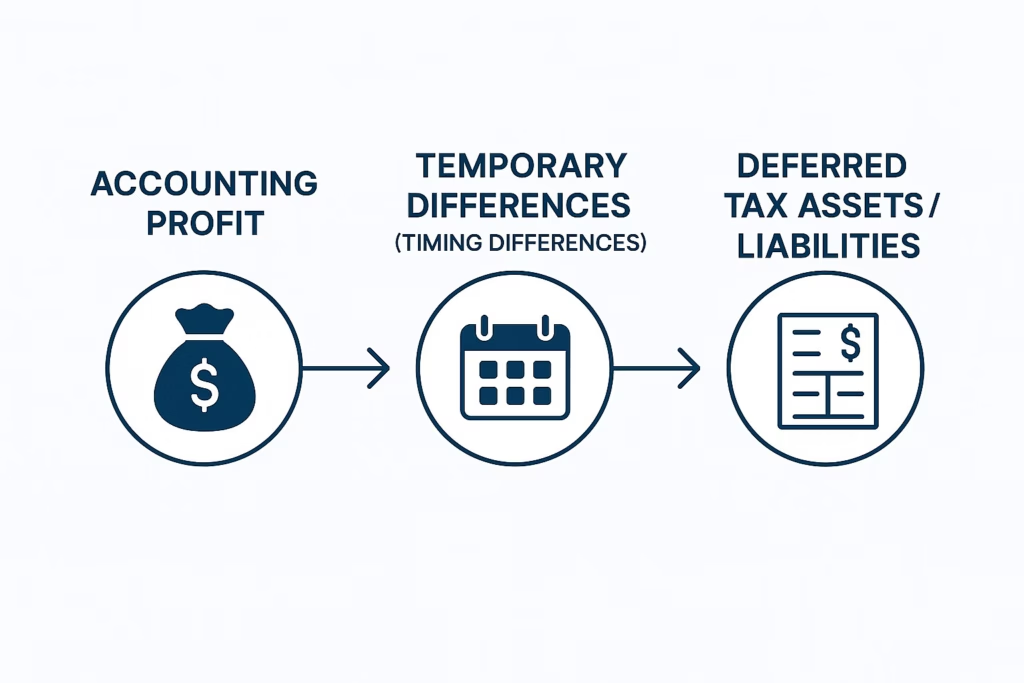

Deferred taxes arise when the recognition of income or expenses differs between accounting and tax reporting.

For example, an asset might be depreciated faster for tax purposes than for accounting, creating a temporary difference that leads to a deferred tax liability.

In consolidation, these timing differences must be aggregated across all subsidiaries and adjusted for:

- Intragroup transactions that affect profit but have no tax effect.

- Fair value adjustments from acquisitions.

- Temporary differences from consolidation adjustments.

The key principle is simple: group-level deferred tax should reflect future tax consequences of temporary differences recognized in the consolidated financial statements.

2. Common Scenarios Creating Deferred Taxes

Some common consolidation adjustments that give rise to deferred taxes include:

- Unrealized intercompany profit (e.g., goods sold but not yet sold to external parties).

→ The seller’s profit is eliminated, but the tax authority still recognizes taxable income. This leads to a deferred tax asset. - Fair value adjustments on acquisition.

→ When assets are revalued during purchase price allocation, the difference between the fair value and the tax base creates deferred tax balances. - Depreciation and amortization differences.

→ Subsidiaries may use different depreciation methods or rates, creating timing differences. - Tax losses carried forward.

→ Deferred tax assets may arise from unused tax losses or credits.

3. Common Challenges in Consolidating Deferred Taxes

a. Multiple Jurisdictions and Tax Rates

Each subsidiary may operate in a different tax regime. Applying correct tax rates to temporary differences while ensuring consistency at the group level is often complex.

b. Tracking Temporary Differences Across Entities

Without centralized tracking, it’s easy to lose visibility into which differences have reversed and which are still outstanding.

c. Intercompany Transactions and Unrealized Profits

Intercompany eliminations can distort deferred tax calculations if not properly aligned. Tax and accounting timing rarely match perfectly.

d. Post-Acquisition Adjustments

Purchase accounting often introduces fair value adjustments that generate new deferred tax balances — which must be monitored through subsequent periods.

e. Manual Consolidation and Spreadsheet Errors

Manually calculating deferred taxes in Excel increases the risk of errors and inconsistencies, especially when rates, bases, or adjustments change.

4. Step-by-Step Approach to Handling Deferred Taxes in Consolidation

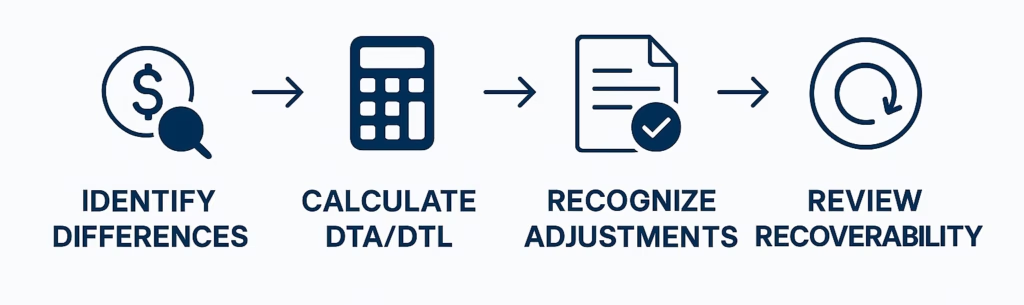

Step 1: Identify Temporary Differences

Determine differences between the carrying amounts of assets and liabilities in the consolidated financial statements and their respective tax bases.

Examples:

- Fair value uplift on property.

- Unrealized profit in inventory.

- Accelerated depreciation.

Step 2: Determine the Tax Base and Applicable Rate

For each jurisdiction, identify the relevant corporate tax rate and tax base. These rates may vary significantly across countries.

Step 3: Calculate Deferred Tax Assets and Liabilities

Apply the tax rate to each temporary difference:

- Temporary difference × tax rate = Deferred tax balance

Step 4: Recognize Deferred Tax Adjustments in Consolidation

Adjust group-level entries for:

- Intercompany eliminations

- Fair value adjustments

- Intragroup profit eliminations

Step 5: Review for Recoverability

Deferred tax assets should only be recognized if future taxable profits are probable. Group accountants must assess this at both entity and consolidated levels.

Step 6: Automate the Process (Best Practice)

Automation systems can streamline the entire process by:

- Linking tax rates to entities automatically.

- Tracking temporary differences over time.

- Automatically recalculating deferred tax balances after consolidation adjustments.

5. Best Practices for Managing Deferred Taxes in Consolidation

a. Maintain a Centralized Deferred Tax Register

Create a group-level register that lists all temporary differences, tax rates, and related movements by entity.

→ This enables transparency, traceability, and efficient audit review.

b. Align Accounting and Tax Reporting Timelines

Synchronize close processes between accounting and tax teams to avoid discrepancies in reporting dates and rates.

c. Leverage Automation and Rule-Based Adjustments

Use a consolidation system that can:

- Automatically detect changes in carrying values.

- Apply consistent logic for temporary difference calculations.

- Recalculate deferred tax impacts instantly after eliminations or revaluations.

d. Regularly Validate Tax Rates and Rules

Monitor updates in tax laws or group structure (e.g., mergers or new subsidiaries) and update your system accordingly.

e. Integrate Audit Trail and Disclosure Management

Deferred tax disclosures are often heavily scrutinized by auditors. A system-generated audit trail ensures every movement is supported and traceable.

6. How Automation Simplifies Deferred Tax Management

Accounting system automates the entire deferred tax process by embedding it directly into the consolidation engine.

With automated data flow, every consolidation adjustment — from eliminations to revaluations — triggers an instant deferred tax recalculation.

Finance teams can:

- Eliminate manual Excel models.

- Achieve faster, error-free close cycles.

- Generate transparent, auditable deferred tax notes.

The result? Accuracy, speed, and compliance — without the late-night spreadsheet chaos.

Conclusion

Deferred tax in consolidation doesn’t need to be a painful, manual process. While the accounting principles can be intricate, the path to simplification lies in structure, consistency, and automation.

By maintaining a centralized deferred tax register, enforcing consistent logic across entities, and automating calculations with systems, finance teams can turn a complex consolidation task into a streamlined, audit-ready process.

Deferred taxes may never be simple — but managing them can be.