As companies expand across borders, financial reporting complexity increases rapidly. One of the most common challenges faced by finance teams in multi-entity groups is the need to report under multiple accounting standards—often simultaneously.

Local entities prepare their accounts under local GAAP, while group-level stakeholders may require reporting under IFRS, US GAAP, or UK GAAP. Traditionally, managing this complexity has meant duplicated spreadsheets, parallel adjustments, and manual reconciliations that are difficult to maintain and even harder to audit.

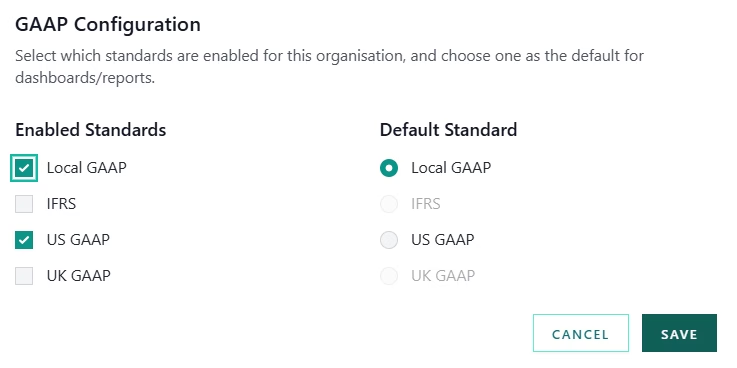

To address this challenge, BrizoSystem now introduces a new feature that allows users to explicitly define which accounting standards are required at the reporting level, bringing clarity, control, and flexibility to multi-standard group reporting.

The Challenge of Multi-Standard Reporting

In most organizations, local finance teams prepare statutory financials according to their local accounting standards. This is both necessary and appropriate for compliance purposes. However, group reporting requirements rarely stop there.

Parent companies, investors, lenders, or regulators may require:

- Consolidated reporting under IFRS

- Management reporting under US GAAP

- Local statutory reporting under country-specific GAAP

Without structured support, finance teams are forced to maintain multiple versions of the same numbers. Adjustments are tracked outside the system, often in spreadsheets, making it difficult to explain differences between standards or ensure consistency over time.

The result is fragmented reporting, increased manual effort, and growing audit risk.

Defining Accounting Standards at the Reporting Level

With the new feature in BrizoSystem, users can now explicitly specify which accounting standards are required for their group reporting.

By default, local GAAP is enabled to reflect the original accounting records coming from source systems. Users can then choose to enable additional standards such as:

- IFRS

- US GAAP

- UK GAAP

This approach acknowledges a critical reality: accounting entries belong in the general ledger, while standard-specific adjustments belong in the reporting and consolidation layer.

Once standards are enabled, BrizoSystem treats them as parallel reporting views—without duplicating source data.

Flagging Journals and Elimination Entries by Accounting Standard

A key part of multi-standard reporting is managing adjustments correctly. Not all journals or eliminations apply to every accounting framework.

With this enhancement, users can now flag journal entries and elimination entries to indicate:

- Which accounting standard they apply to

- Whether they affect local GAAP only

- Or whether they apply to IFRS, US GAAP, UK GAAP, or combinations

This ensures that adjustments are applied only where relevant, avoiding accidental over-adjustment or misstatement.

It also creates a clear, auditable distinction between:

- Local statutory figures

- Group-level accounting standard adjustments

Viewing Reports by Accounting Standard

Once accounting standards are enabled and adjustments are correctly flagged, users gain the ability to view reports under different accounting standards—using the same underlying dataset.

This means finance teams can:

- Review consolidated results under local GAAP

- Instantly switch to IFRS or US GAAP views

- Understand exactly what adjustments drive the differences

Instead of maintaining separate reports or files, BrizoSystem provides a controlled, transparent reporting environment where standard-specific views are generated consistently.

For management and auditors alike, this dramatically improves clarity and confidence in the numbers.

Why This Matters for Group Finance Teams

This feature addresses a long-standing pain point in group reporting: balancing local compliance with global reporting needs.

By separating source accounting data from reporting-level adjustments, finance teams can:

- Reduce manual reconciliation work

- Eliminate duplicated spreadsheets

- Improve audit readiness

- Respond faster to stakeholder reporting requests

Most importantly, it allows finance teams to focus on analysis and insight, rather than mechanics and rework.

A Reporting-Led Approach to Accounting Standards

It’s important to emphasize that this feature does not replace local accounting systems or override statutory accounting. Instead, it provides a structured reporting layer that reflects how modern finance teams actually work.

Local GAAP remains the foundation. Additional accounting standards are layered transparently on top—clearly defined, clearly applied, and clearly reported.

This is exactly where accounting standards should be managed: in reporting, not in spreadsheets.

Final Thoughts

As reporting requirements become more complex, flexibility is no longer optional. Finance teams need tools that respect local accounting realities while supporting global reporting demands.

By allowing users to define accounting standards, flag adjustments appropriately, and view reports by standard, BrizoSystem makes multi-standard reporting clearer, safer, and far more efficient.

It’s not about doing more accounting—it’s about doing better reporting.