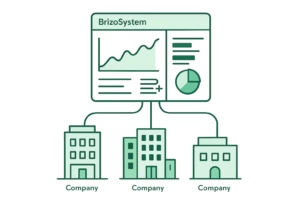

BrizoSystem

-

Why Mid-Sized Companies Need Consolidation Tools

—

For many mid-sized companies, financial reporting starts out simple. A few legal entities, a manageable volume of transactions, and spreadsheets that seem to “do the job.” But growth changes everything.…

-

Onerous Contract: When a Contract Becomes a Financial Burden

—

in AccountingNot all contracts generate value. Sometimes, changing circumstances turn a previously profitable agreement into a costly obligation. In accounting, such situations are addressed through the concept of an Onerous Contract.…

-

Automated Financial Consolidation Explained

—

Financial consolidation is meant to deliver clarity — a single, reliable view of group performance.Yet for many finance teams, consolidation remains one of the most time-consuming, error-prone parts of the…

-

Negative Pledge Clause: Protecting Lenders Without Taking Collateral

—

in AccountingWhen companies borrow money, lenders want assurance that their position won’t be weakened later. One common way to achieve this—without requiring immediate collateral—is through a Negative Pledge Clause. Although it…

-

Cloud vs On-Premise Consolidation Tools: What Mid-Sized Companies Should Know

—

As mid-sized companies grow — adding subsidiaries, multiple currencies, and increasingly complex reporting requirements — the choice of consolidation tool becomes critical. A key decision is whether to adopt a…

-

Off-Balance-Sheet Financing: What It Is and Why It Matters

—

in AccountingNot all financing arrangements appear directly on a company’s balance sheet. Some obligations are structured in a way that keeps certain assets or liabilities outside the balance sheet, while still…

-

Top Features Needed for Multi-Entity Financial Reporting

—

As organizations grow beyond a single legal entity, financial reporting quickly becomes more complex. Multiple subsidiaries, currencies, charts of accounts, and intercompany transactions introduce challenges that traditional single-entity reporting tools…

-

Understanding the Current Ratio

—

in AccountingLiquidity is one of the most important indicators of a company’s financial health. Even profitable businesses can fail if they are unable to meet short-term obligations when they fall due.…

-

BrizoSystem × Zoho Books: Seamless Data Connectivity for Smarter Group Reporting

—

in NewsFor finance teams using Zoho Books, getting accurate, timely group reports has often meant one thing: manual data extraction.CSV exports, spreadsheet clean-ups, mapping exercises, and repeated reconciliation — every reporting…