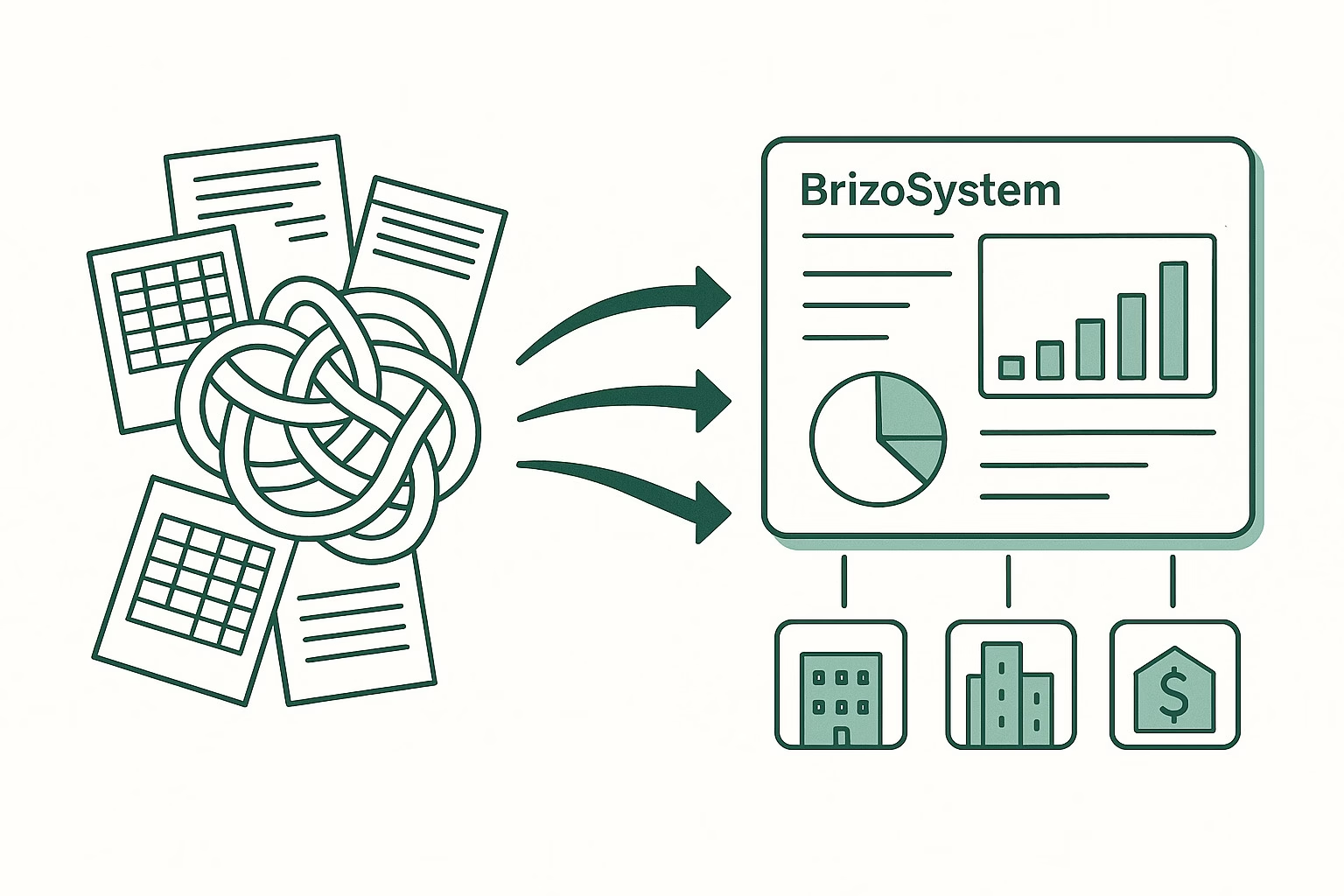

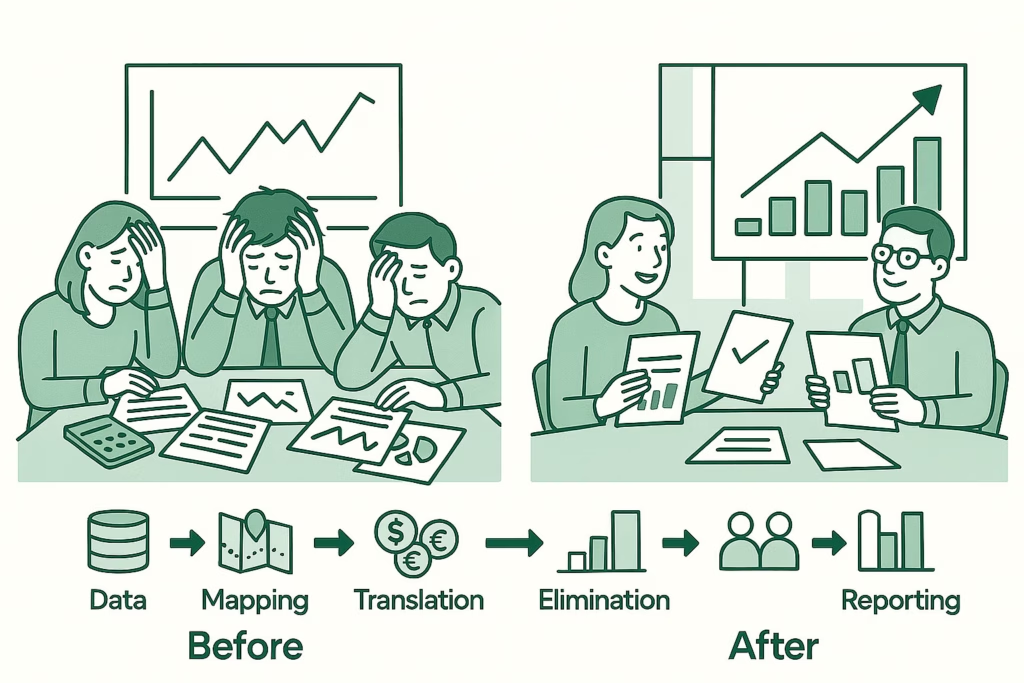

For many finance teams, financial consolidation feels less like an organized process and more like a monthly emergency. Files fly back and forth through email. Multiple versions of spreadsheets stack up in shared folders. Numbers don’t agree. Deadlines creep closer. Confidence drops.

Instead of focusing on analysis and strategy, teams are stuck reconciling, rechecking, and repairing broken data.

This isn’t just inefficient — it’s risky.

Inaccurate consolidation can lead to poor decisions, delayed reporting, audit challenges, and loss of stakeholder confidence. But it doesn’t have to be this way. There is a smarter, structured, and scalable approach to financial consolidation — one that replaces chaos with clarity.

This article breaks down why consolidation becomes so messy, what “clarity” really looks like, and how finance teams can move toward a smarter, more reliable model using modern reporting tools like BrizoSystem.

Why Financial Consolidation Becomes Chaotic

Consolidation rarely starts out complicated. A few entities, a few currencies, a manageable number of intercompany transactions. But as a business grows, the structure becomes more complex:

- New subsidiaries are added

- Multiple currencies come into play

- Intercompany trading increases

- Local accounting practices differ

- Reporting standards must be aligned

That’s when the chaos begins.

Here are the main drivers of consolidation complexity:

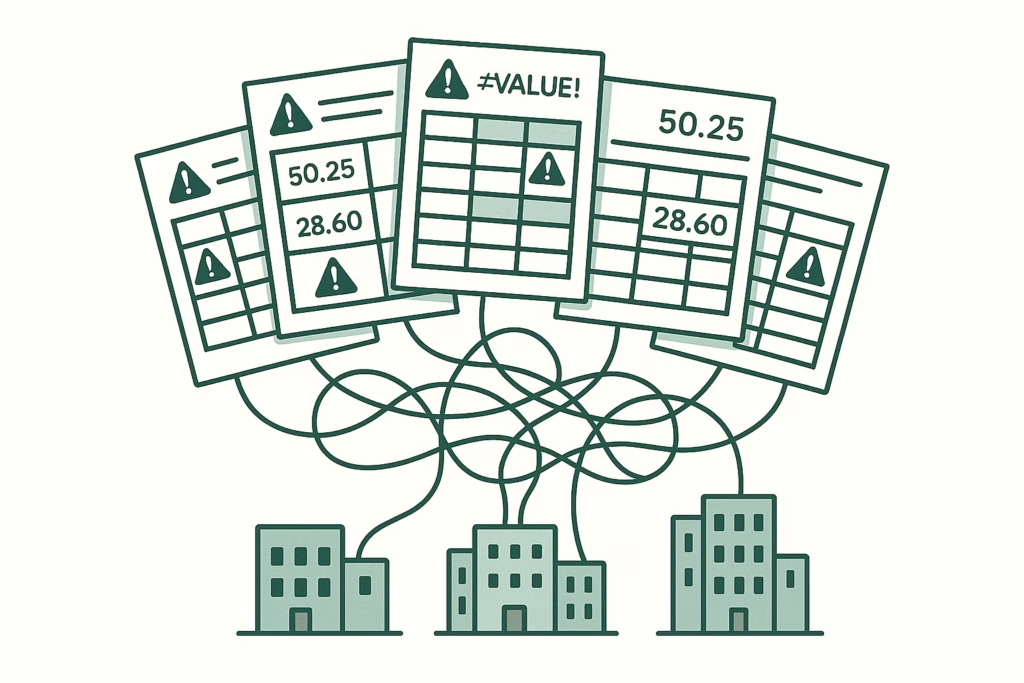

1. Manual Processes and Spreadsheets

Spreadsheets are flexible, familiar, and powerful — but they were never designed to handle enterprise-level consolidation. When spreadsheets become the core infrastructure rather than a supporting tool, problems multiply:

- Version control issues

- Formula errors

- Broken links between files

- No audit trail

- Limited scalability

Teams often end up building a fragile system that only one person fully understands.

2. Inconsistent Data Structures Across Entities

One entity might record expenses in account “6200 – Marketing,” while another uses “7200 – Advertising.” One records intercompany revenue monthly, another quarterly. Different charts of accounts, fiscal calendars, and recognition policies create misalignment from the start.

Without standardization, consolidation is not a calculation problem — it’s a structural one.

3. Complex Intercompany Transactions

The more entities trade with each other, the more eliminations are required:

- Intercompany sales and purchases

- Intercompany loans and interest

- Royalties and service fees

- Shared costs

- Intercompany dividends

If these aren’t recorded and matched consistently, the elimination process becomes slow, confusing, and error-prone.

4. Multiple Currencies and FX Volatility

When foreign entities are involved, exchange rates become another source of conflict:

- Which rate should be used — average, spot, or closing?

- When should translation occur?

- How are unrealized FX gains/losses treated?

Without a defined and automated approach, FX treatment can distort group results.

What “Clarity” in Consolidation Actually Means

Clarity isn’t just about having a final set of numbers. True clarity in consolidation means:

- You trust the figures

- You understand the movement behind them

- You can explain variances

- You can drill down into detail

- You can answer questions quickly and confidently

A clear consolidation process provides:

- A single source of truth

- Consistent structure and mapping

- Strong auditability

- Clear elimination visibility

- Actionable reporting output

Clarity turns reporting from a backward-looking exercise into a forward-looking strategic tool.

The Smarter Way: Rethinking the Consolidation Process

Instead of trying to fix symptoms each month, the smarter approach is to redesign the process itself. That starts with four core shifts:

1. From Manual to Automated

Automation removes repetitive manual tasks:

- Importing trial balances

- Matching intercompany transactions

- Applying exchange rates

- Running elimination logic

- Building group reports

This not only saves time but drastically reduces human error.

BrizoSystem is designed to handle these areas efficiently, giving finance teams more time to analyze and plan instead of cleaning data.

2. From Disconnected Data to Structured Mapping

A smarter consolidation process establishes:

- A standard group chart of accounts

- Defined entity structures

- Clear intercompany coding

- Consistent mapping rules

This allows all data — regardless of source system — to flow into a unified reporting structure.

Instead of fighting different data formats, the system does the translation for you.

3. From Reactive Fixing to Proactive Detection

In a chaotic process, errors are discovered late — during final checks or (worse) after reporting is released.

In a smarter system:

- Mismatches are flagged immediately

- Unbalanced intercompany entries stand out

- Missing data is identified early

- Exceptions are prioritized clearly

Problems become visible before they can damage the final result.

4. From Static Reports to Dynamic Insight

The goal of consolidation isn’t just accuracy. It’s insight.

Modern reporting allows you to:

- View data by entity, region, or business unit

- Compare trends month-over-month

- Identify profit drivers

- Spot performance gaps

- Drill down to transaction level

With tools like BrizoSystem, consolidated data becomes an interactive intelligence source — not a static spreadsheet locked in time.

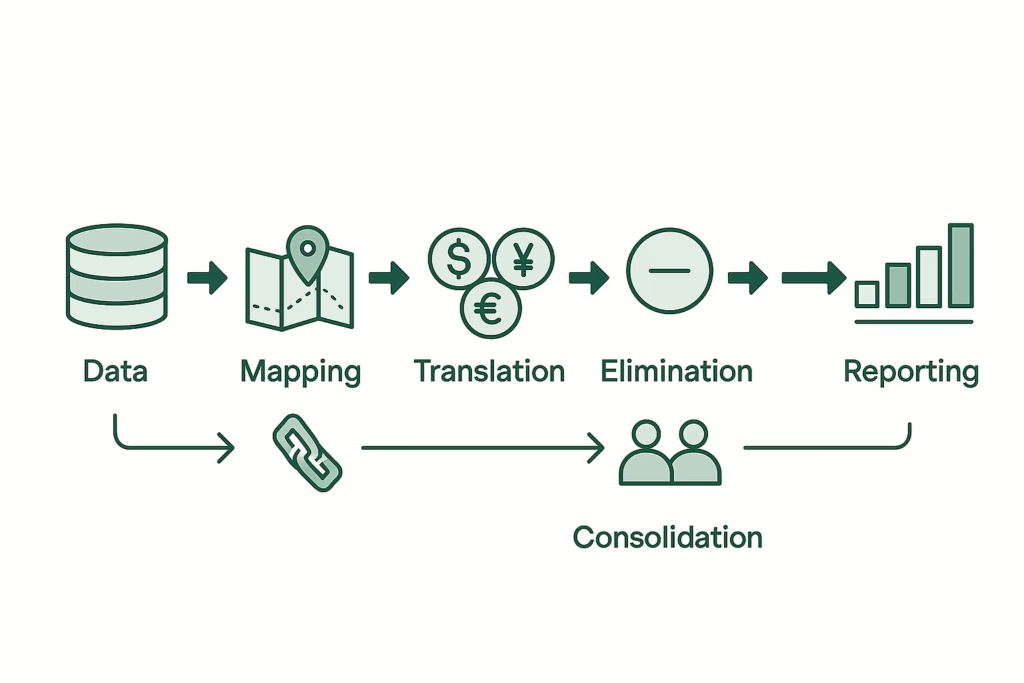

What a Smarter Consolidation Workflow Looks Like

Here is what clarity looks like in practice:

- Data collection

Trial balances and reporting data are imported automatically from source systems. - Standardization & mapping

Local accounts are mapped to the group chart of accounts. - Intercompany matching

Transactions between entities are automatically paired and checked for differences. - Currency translation

Values are converted using defined exchange rate rules. - Elimination processing

Intercompany balances, revenue, profit and dividends are systematically removed. - Consolidated reporting

Clean group-level statements are generated — BS, P&L, and Cash Flow. - Analysis & presentation

Finance teams can now focus on trends, insights and forward-looking decisions.

No more juggling files. No more endless cross-checking. No more guesswork.

Just clarity.

Real Impact: What Finance Teams Gain

When consolidation is done the smart way, organizations see real transformation:

- Shorter close cycles

- More accurate financials

- Lower audit risk

- Improved confidence from leadership

- Higher value contribution from finance teams

Instead of being seen as a reporting function, the finance team becomes a strategic partner to the business.

Conclusion: Chaos Is Optional

Financial consolidation is complex — but it doesn’t have to be chaotic.

Chaos happens when outdated tools and inconsistent processes are forced to handle modern business complexity. Clarity happens when structure, automation, and intelligent design come together.

A smarter way to consolidate financials is no longer a future vision. It’s already possible.

And with platforms like BrizoSystem, it’s also accessible.

If your team is still buried in spreadsheets, emails, and last-minute fixes, maybe it’s time to ask the real question:

Is the problem your data — or the way you’re consolidating it?