Introduction

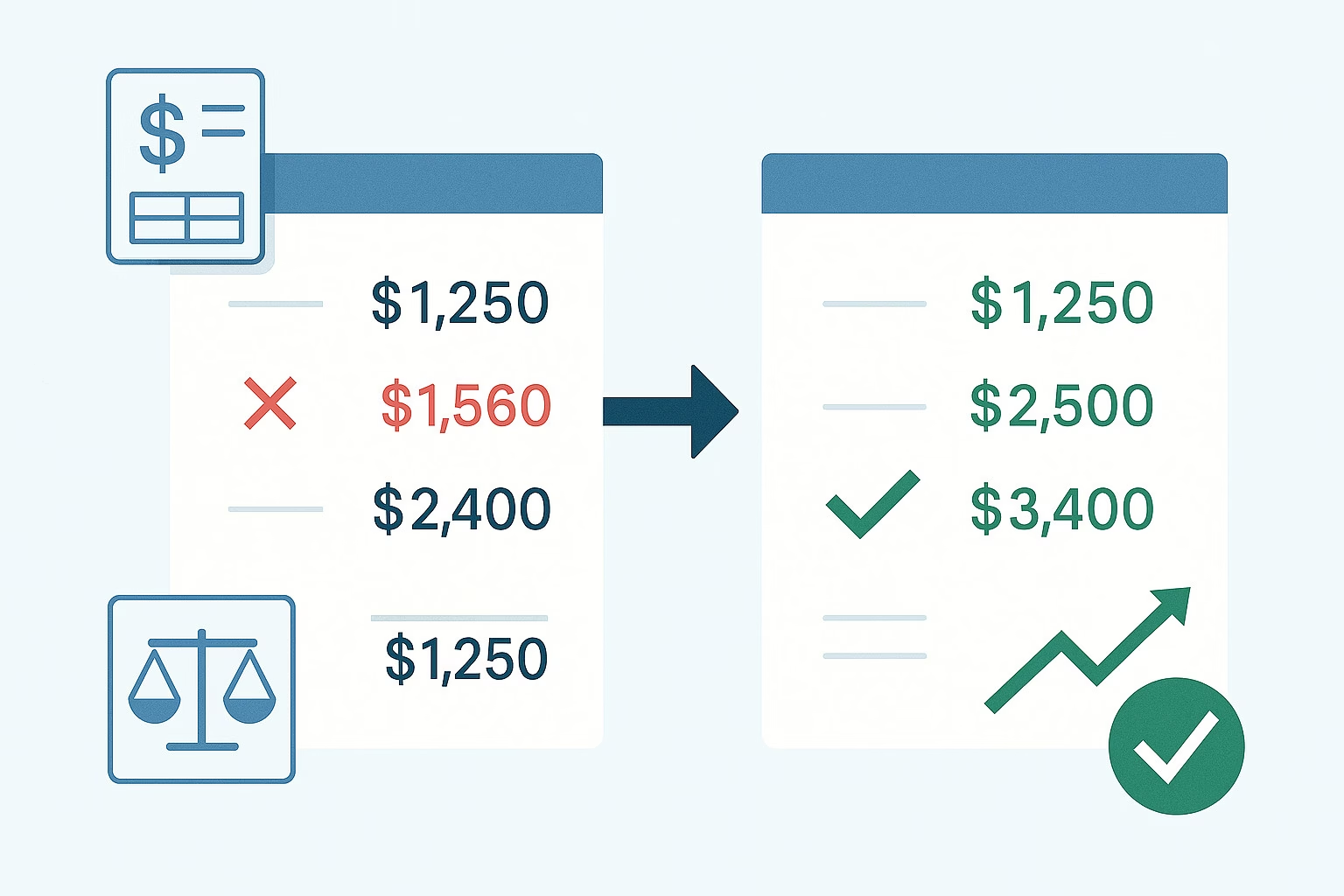

If you ask any group finance team what slows down the consolidation process the most, the answer is almost always the same: intercompany reconciliations.

Each entity records transactions with its group counterparts — loans, sales, charges, dividends — but by the time month-end or year-end rolls around, the numbers often don’t line up. What should cancel out perfectly ends up requiring hours (sometimes days) of back-and-forth emails, spreadsheets, and manual adjustments.

This blog explores why intercompany reconciliations are so painful, the common challenges finance teams face, and how to streamline the process with best practices and technology.

Why Intercompany Reconciliations Matter

In consolidated financial statements, transactions between group companies must be eliminated. Otherwise, the group risks:

- Overstated revenues and expenses (from intercompany sales and charges).

- Inflated assets and liabilities (from intercompany loans and payables).

- Misleading cash flow positions.

Accurate intercompany reconciliation ensures that consolidated financials reflect only third-party activity, giving stakeholders a true picture of the group’s performance.

Common Challenges in Intercompany Reconciliations

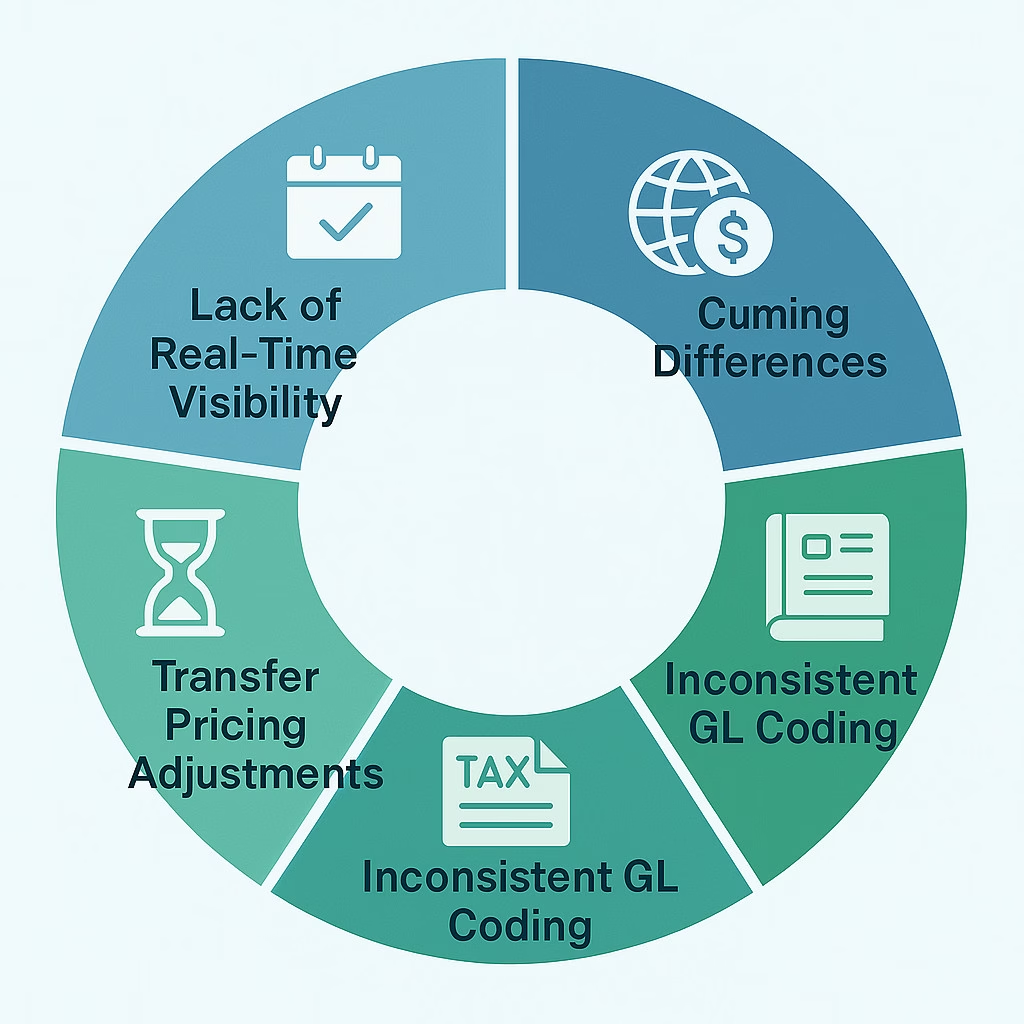

1. Timing Differences

- Problem: One entity records an invoice in March, while the counterparty books it in April.

- Impact: Mismatched balances that don’t eliminate.

- Example: Subsidiary A books $100k sales to Subsidiary B in March; Subsidiary B records the payable in April.

2. Currency Mismatches

- Problem: Transactions denominated in foreign currencies create discrepancies once converted at different exchange rates.

- Impact: Even when the underlying transaction is identical, reported balances may not agree.

3. Inconsistent GL Coding

- Problem: Different entities use different GL accounts for the same type of intercompany transaction.

- Impact: Hard to match data, requiring manual mapping.

4. Transfer Pricing Adjustments

- Problem: Entities apply mark-ups, management fees, or interest charges differently.

- Impact: Balances don’t align without additional adjustments.

5. Lack of Real-Time Visibility

- Problem: Many groups rely on after-the-fact spreadsheets to reconcile intercompany transactions.

- Impact: Errors go undetected until late in the close cycle, creating last-minute fire drills.

Step-by-Step Approach to Streamlining Intercompany Reconciliations

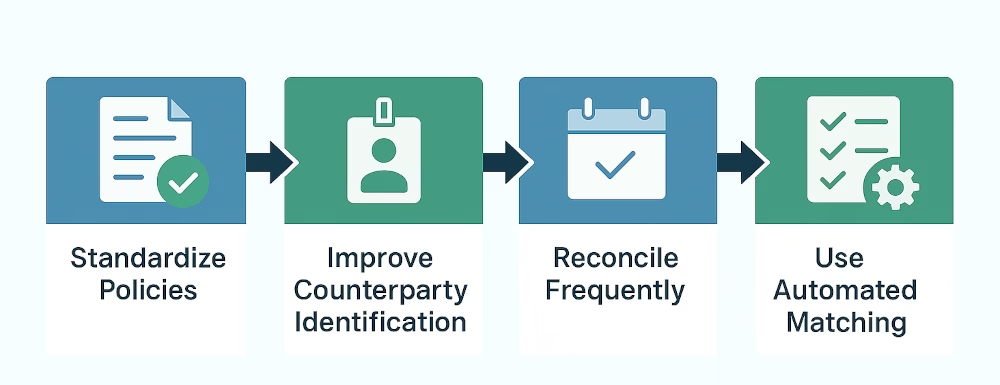

Step 1: Standardize Intercompany Policies

- Define which transactions qualify as intercompany.

- Establish consistent cut-off dates, exchange rates, and GL coding rules.

- Document policies so every subsidiary follows the same process.

Step 2: Improve Counterparty Identification

- Use unique counterparty codes across the group.

- Require both sides of a transaction to reference the same code.

- Example: If Parent charges “Management Fee P001 → S010,” Subsidiary S010 must record “Payable P001.”

Step 3: Reconcile Frequently, Not Just at Month-End

- Move away from once-a-month reconciliations.

- Run mid-month reconciliations or even weekly checks to catch discrepancies early.

- Benefits: Fewer last-minute surprises, smoother close cycle.

Step 4: Use Automated Matching Rules

- Deploy a system that automatically matches intercompany transactions based on:

- Amounts

- Currency

- Counterparty codes

- Tolerance thresholds for FX or rounding differences

- Exceptions are flagged automatically, letting finance teams focus only on mismatches.

Step 5: Create Clear Audit Trails

- Document eliminations and reconciliation adjustments.

- Store supporting data centrally, not in scattered spreadsheets.

- Makes audits faster and reduces compliance risk.

Best Practices for Sustainable Intercompany Reconciliation

- Early Alignment: Agree on balances with counterparties before final close.

- Group-Wide Training: Ensure local teams understand intercompany rules.

- Leverage Technology: Invest in consolidation tools that automate reconciliation and elimination.

- Governance: Assign accountability — every intercompany balance should have an “owner” on both sides.

- Continuous Monitoring: Build dashboards to track outstanding mismatches in real time.

Conclusion

Intercompany reconciliations may always be one of the more complex parts of financial consolidation — but they don’t have to be the bottleneck.

With standardized policies, frequent reconciliations, automation, and clear governance, finance teams can dramatically reduce the time and stress involved. The result is faster closes, more reliable consolidated statements, and more time spent analyzing results rather than chasing mismatches.