When companies grow into multiple entities, transactions between those entities become inevitable. But when it comes time to prepare consolidated financial statements, these intercompany balances can distort the true financial picture. That’s where intercompany eliminations come in.

In this guide, we’ll walk through what intercompany eliminations are, the challenges finance teams face, the different types of eliminations, and best practices to make the process smoother.

What Are Intercompany Eliminations?

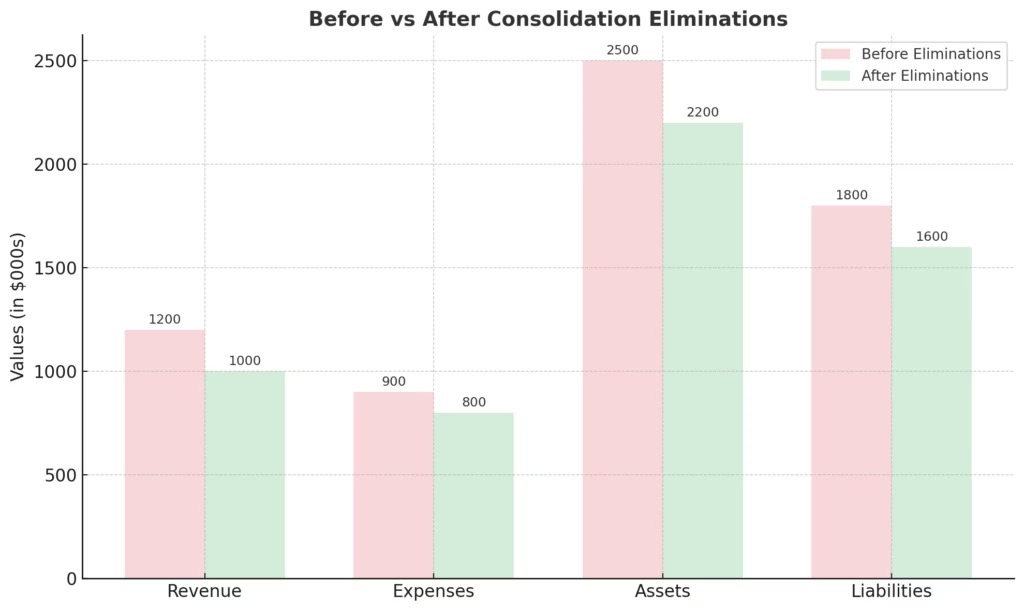

Intercompany eliminations are adjustments made during the consolidation process to remove the effects of transactions between entities within the same group.

Without these eliminations, your consolidated financial statements would:

- Double-count revenues and expenses

- Inflate assets or liabilities

- Misrepresent the group’s overall performance

Example:

- Company A sells goods worth $100,000 to Company B (within the same group).

- If not eliminated, Group revenue would appear $100,000 higher than actual.

Common Challenges in Intercompany Eliminations

Even though the principle sounds simple—“remove intra-group transactions”—finance teams often face roadblocks:

- Data Silos Across Subsidiaries

Each entity may use a different accounting system (Xero, QuickBooks, MYOB, SAP, etc.), making it difficult to align data. - Multi-Currency Complexities

Transactions across currencies require careful FX translation. Timing mismatches in FX rates between entities often cause reconciliation issues. - Timing Differences

Subsidiary A records a sale in December, but Subsidiary B records the purchase in January. Without alignment, intercompany accounts won’t reconcile. - Inconsistent Coding

One entity books a transaction as “intercompany receivable,” while another books it under “accounts payable.” This lack of standardization complicates elimination. - Manual Processes

Heavy reliance on spreadsheets introduces errors, slows month-end close, and makes audits painful. - Unrealized Profits in Inventory or Assets

Eliminating only the transaction isn’t enough—profits embedded in intra-group inventory or assets also need adjustment.

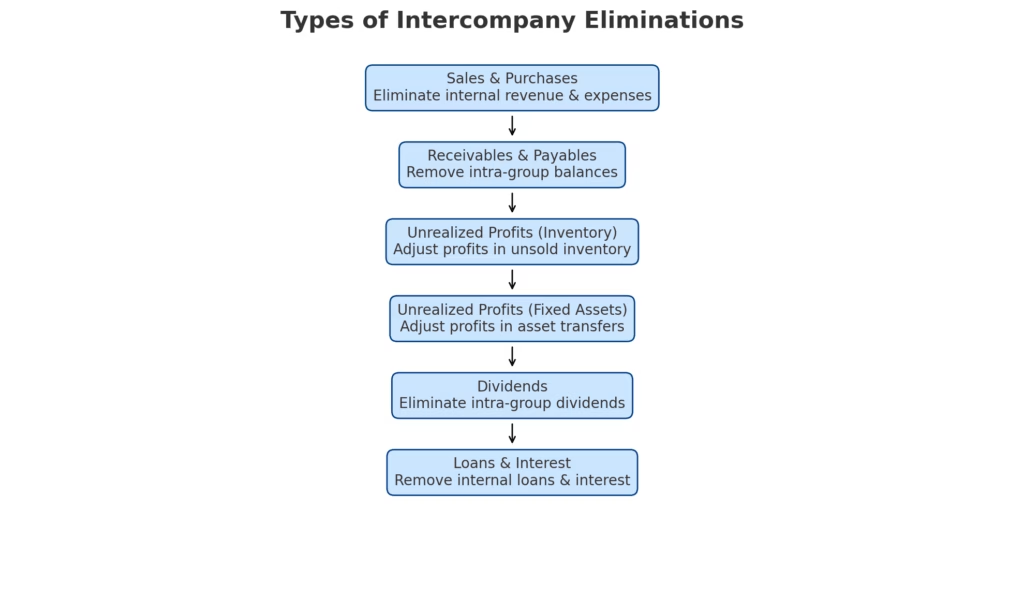

Types of Intercompany Eliminations

Intercompany eliminations cover different categories of intra-group activity. Each requires its own treatment.

1. Intercompany Sales & Purchases

Purpose: Eliminate internal revenue and expenses to prevent double counting. The purpose of eliminating intercompany sales and purchases is to prevent the artificial inflation of group revenue and expenses. When one entity within the group sells to another, no real value is created for the consolidated entity as a whole—it is simply a transfer of resources within the group. If these internal sales are left in the consolidated accounts, the financial statements will show higher turnover and costs than what actually occurred with external customers. Eliminating these transactions ensures that the consolidated revenue reflects only genuine sales to outside parties, providing stakeholders with an accurate picture of the group’s true operating performance.

Example:

- Subsidiary A sells raw materials worth $500,000 to Subsidiary B.

- If left unadjusted, consolidated revenue and expenses both appear overstated by $500,000.

Journal Elimination Entry (Consolidation Level):

- Dr Revenue (Group) $500,000

- Cr Cost of Goods Sold (Group) $500,000

2. Intercompany Balances (Receivables & Payables)

Purpose: Remove artificial assets/liabilities created by internal lending or settlements. The purpose of eliminating intercompany receivables and payables is to remove internal balances that do not represent assets or liabilities of the group as a whole. When one entity records an intercompany receivable and another entity records the corresponding payable, these cancel each other out on consolidation. If they remain, the consolidated balance sheet would incorrectly suggest that the group owes money to itself or has money owed by itself, which is misleading. Eliminating these balances ensures the consolidated financial position reflects only the group’s obligations to, and receivables from, external parties.

Example:

- Subsidiary A records a receivable from Subsidiary B for $200,000.

- Subsidiary B records the payable for the same amount.

Journal Elimination Entry:

- Dr Intercompany Payable $200,000

- Cr Intercompany Receivable $200,000

3. Unrealized Profits in Inventory

Purpose: Remove profits from inventory sold internally but not yet sold to external customers. The purpose of eliminating unrealized profits in inventory is to ensure that the consolidated statements reflect inventory at its true cost to the group, not at an inflated price resulting from internal mark-ups. When goods are sold within the group at a profit but remain unsold to external customers at period-end, that profit is not yet realized from the perspective of the group as a whole. Recognizing it prematurely would overstate consolidated profits and assets. Eliminating these unrealized profits ensures both the income statement and the balance sheet reflect only realized profits earned from third parties.

Example:

- Subsidiary A sells inventory to Subsidiary B at a profit of $50,000.

- At year-end, Subsidiary B still holds that inventory.

- Profit must be eliminated until the goods are sold externally.

Journal Elimination Entry:

- Dr Group Retained Earnings $50,000

- Cr Inventory $50,000

4. Unrealized Profits in Fixed Assets

Purpose: Adjust profits embedded in intra-group asset transfers. The purpose of eliminating unrealized profits in fixed assets is to prevent artificial gains from distorting group results and asset values. When one entity within a group sells an asset to another at a profit, no actual gain has been realized externally—it is simply an internal transfer. If these gains remain, consolidated financial statements will show inflated profits and overvalued assets. Eliminating them ensures assets are reported at their original cost to the group, and depreciation charges are aligned with true economic value, resulting in fairer presentation of performance and financial position.

Example:

- Subsidiary A sells equipment to Subsidiary B at a gain of $100,000.

- That gain must be eliminated, and depreciation adjusted based on original cost.

Journal Elimination Entry:

- Dr Gain on Sale of Asset $100,000

- Cr Asset (Net Book Value Adjustment) $100,000

5. Intercompany Dividends

Purpose: Eliminate dividends paid from one group company to another. The purpose of eliminating intercompany dividends is to avoid double counting income within the group. When one subsidiary pays a dividend to its parent or another group company, that payment is merely a movement of funds within the group, not income generated from external sources. If not eliminated, consolidated profit would be overstated by including income that has already been recognized in the group’s results. Removing intercompany dividends ensures that consolidated profit reflects only returns generated from external operations, providing a fair measure of group-wide profitability.

Example:

- Subsidiary A declares dividend of $1,000,000 to Parent.

- In consolidation, this must be eliminated to avoid overstating group income.

Journal Elimination Entry:

- Dr Dividend Income $1,000,000

- Cr Dividend Declared $1,000,000

6. Intercompany Loans & Interest

Purpose: Eliminate intra-group financing activities. The purpose of eliminating intercompany loans and related interest is to prevent group financial statements from showing internal financing as if it were external. Loans advanced by one entity to another do not increase the group’s overall resources or obligations—they are simply internal reallocations of funds. Similarly, interest income and expenses arising from these loans are internal transfers of value, not transactions with third parties. By eliminating them, consolidated accounts focus solely on external debt, cash positions, and financing costs, giving a more accurate reflection of the group’s true leverage and financial health.

Example:

- Parent lends Subsidiary $5,000,000 with annual interest of $250,000.

- Consolidated accounts must eliminate both the loan and the interest income/expense.

Journal Elimination Entry:

- Dr Interest Income $250,000

- Cr Interest Expense $250,000

- Dr Intercompany Loan Payable $5,000,000

- Cr Intercompany Loan Receivable $5,000,000

Best Practices for Intercompany Eliminations

Getting eliminations right is critical for accuracy, compliance, and speed. Here are best practices to follow:

1. Standardize Chart of Accounts Across Entities

The foundation of accurate intercompany eliminations is consistency in how transactions are recorded. If each subsidiary or entity uses its own chart of accounts, reconciling intercompany balances becomes unnecessarily complicated and prone to error. By implementing a standardized chart of accounts across the group, every intercompany transaction can be identified, coded, and tracked in the same way. This not only simplifies the elimination process but also improves transparency, reduces manual mapping work, and provides auditors with clearer, more reliable data.

- Use consistent coding for intercompany accounts.

- Set up dedicated intercompany accounts (not “miscellaneous”).

2. Centralize Policies & Procedures

A common challenge in consolidation is that each entity may apply different accounting policies or use varying procedures to record intercompany transactions. This creates inconsistencies that make eliminations harder to manage. Establishing centralized policies and clear documentation on how intercompany transactions should be recognized, valued, and reported ensures that all subsidiaries follow the same rules. For example, standardizing exchange rate sources or defining uniform cutoff dates for recording sales and purchases helps align the timing and valuation of transactions. This consistency greatly reduces reconciliation issues during consolidation.

- Document how each type of intercompany transaction should be recorded.

- Ensure all entities follow the same policy (e.g., same FX rate source, same cutoff dates).

3. Perform Regular Reconciliations

Waiting until year-end or quarter-end to reconcile intercompany accounts often leads to bottlenecks, last-minute adjustments, and stressful closing cycles. Instead, finance teams should adopt a practice of reconciling intercompany balances on a monthly or even more frequent basis. Regular reconciliations allow mismatches to be spotted and corrected early, rather than compounding into large discrepancies at year-end. This proactive approach builds confidence in the accuracy of group financials, speeds up the closing process, and provides management with reliable interim results throughout the year.

- Don’t wait until year-end. Reconcile intercompany balances monthly or even weekly.

- Use intercompany confirmation processes between entities to resolve mismatches early.

4. Leverage Technology for Automation

Manual eliminations performed in spreadsheets are time-consuming, error-prone, and difficult to audit. As a group grows and the volume of intercompany transactions increases, automation becomes essential. Consolidation software can apply elimination rules automatically, ensuring consistent treatment of recurring entries such as intercompany receivables, payables, or loan balances. Advanced systems also integrate directly with different accounting platforms (e.g., Xero, QuickBooks, MYOB), reducing data silos and providing a single source of truth. Automation frees finance teams from repetitive tasks, reduces risk of errors, and allows more time to be spent on analysis rather than data entry.

- Use consolidation software (like BrizoSystem) to apply elimination rules consistently.

- Automate recurring eliminations such as intercompany receivables/payables.

- Integrate with source systems (Xero, QuickBooks, MYOB, etc.) to reduce data silos.

5. Track Unrealized Profits Separately

One of the trickiest aspects of intercompany eliminations is dealing with unrealized profits in inventory and fixed assets. These adjustments often need to be reversed in subsequent periods when goods are sold externally or assets are depreciated. To avoid confusion, finance teams should maintain detailed schedules that track unrealized profits separately, including information on which entity recorded the profit, the type of transaction, and the expected reversal timeline. This level of granularity not only ensures accuracy but also provides a clear audit trail that supports transparency and compliance.

- Maintain schedules for intra-group profits in inventory and fixed assets.

- Automate reversals once goods are sold externally or assets are depreciated fully.

6. Audit Trail & Transparency

Strong governance requires that all elimination entries are traceable and well-documented. Maintaining a clear audit trail—complete with supporting documentation and references—helps auditors verify eliminations and strengthens the credibility of consolidated reports. Transparency also means avoiding opaque adjustments: every elimination should have a clear rationale and source. Whether through system-generated reports or structured documentation, building audit readiness into the elimination process reduces the risk of surprises during external reviews and builds trust with stakeholders.

- Ensure every elimination entry has documentation.

- Provide clear audit trails for regulators, auditors, and management.

7. Invest in Training & Alignment

Even with the right systems and policies in place, intercompany eliminations can only be effective if the people responsible for recording transactions understand their role. Training finance staff at the subsidiary level ensures they know how to properly code intercompany transactions, which accounts to use, and how to follow group-wide procedures. Regular workshops or internal knowledge-sharing sessions can reinforce alignment across entities. A culture of collaboration between local finance teams and group consolidation teams reduces friction, improves data quality, and ensures that eliminations are accurate from the start.

- Train finance teams in subsidiaries on proper coding and booking practices.

- Establish communication channels for intercompany queries and reconciliation.

How BrizoSystem Helps

At BrizoSystem, we know intercompany eliminations are one of the biggest bottlenecks in financial consolidation. That’s why we’ve built automation features that:

- Consolidate data from multiple accounting systems (Xero, QuickBooks, MYOB, etc.)

- Handle multi-currency conversions automatically

- Apply elimination rules consistently across all entities

- Deliver accurate, board-ready reports in minutes, not days

💡 One client reduced their month-end close from 7 days to 2 days by automating intercompany eliminations with BrizoSystem.

Final Thoughts

Intercompany eliminations are essential for presenting a true, accurate, and trustworthy financial picture. By understanding the different types of eliminations, applying best practices, and leveraging automation, finance teams can move from manual reconciliations to strategic analysis.

Want to see how BrizoSystem can simplify your intercompany eliminations?

Contact us at info@brizosystem.com or visit our Demo Page