Introduction: A CFO’s Dilemma

Imagine this: your group headquarters in London reports under IFRS, but your U.S. subsidiary reports under US GAAP. When quarter-end arrives, you’re staring at two sets of rules, two sets of numbers, and one big question: how do I reconcile them into a single, credible set of consolidated statements?

This is not just an accounting exercise—it’s a strategic issue. The way you consolidate under IFRS vs. US GAAP can influence goodwill, earnings, equity, and even investor perception. For global CFOs, understanding these differences is essential for transparency, compliance, and trust.

Key Differences Between IFRS and US GAAP in Consolidation

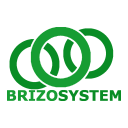

1. Basis of Consolidation: Control vs. Voting Interest

- IFRS: Focuses on control. If a parent can govern financial and operating policies and derive variable returns, consolidation is required—even without majority ownership.

- US GAAP: Primarily based on voting interest. Control usually means majority ownership, though variable interest entity (VIE) rules expand coverage.

💡 Example: A company with 45% ownership but effective control through agreements may be consolidated under IFRS, but not under US GAAP unless VIE conditions apply.

2. Non-Controlling Interest (NCI)

- IFRS: NCI can be measured either at fair value (full goodwill) or proportionate share of net assets (partial goodwill).

- US GAAP: Requires full goodwill method only.

💡 Impact: IFRS offers flexibility—potentially lowering goodwill and reducing balance sheet size. US GAAP may inflate goodwill, affecting ratios like return on assets.

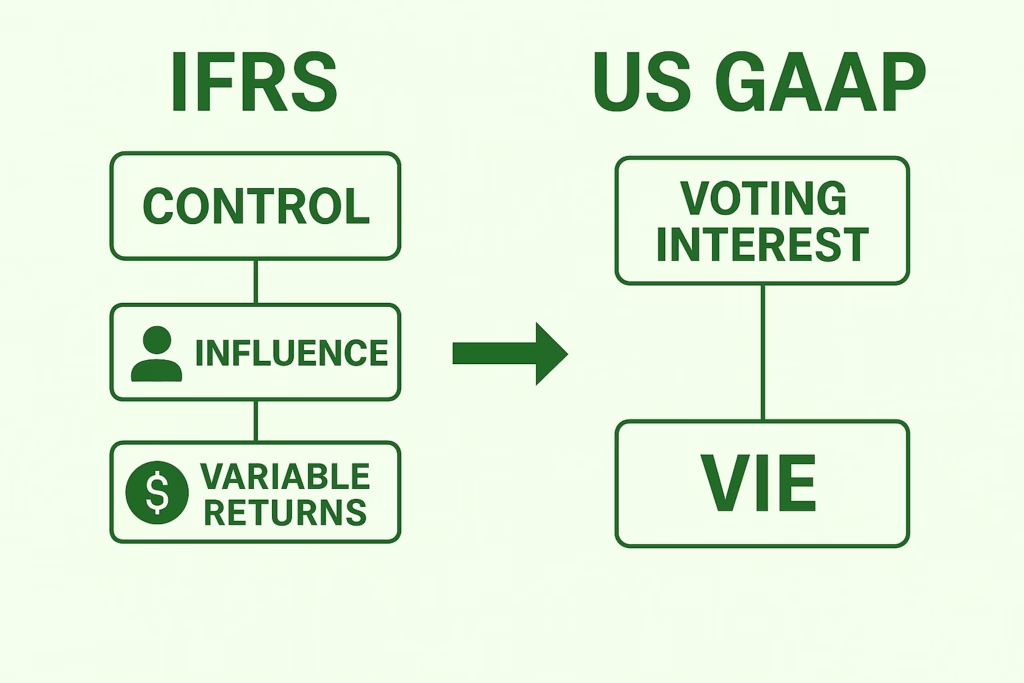

3. Uniform Accounting Policies

- IFRS: Explicitly requires aligning subsidiary policies with the parent.

- US GAAP: No explicit requirement, but consistency is implied in practice.

💡 Challenge: For a multinational group, this means more adjustments under IFRS, particularly when subsidiaries apply local GAAP for statutory purposes.

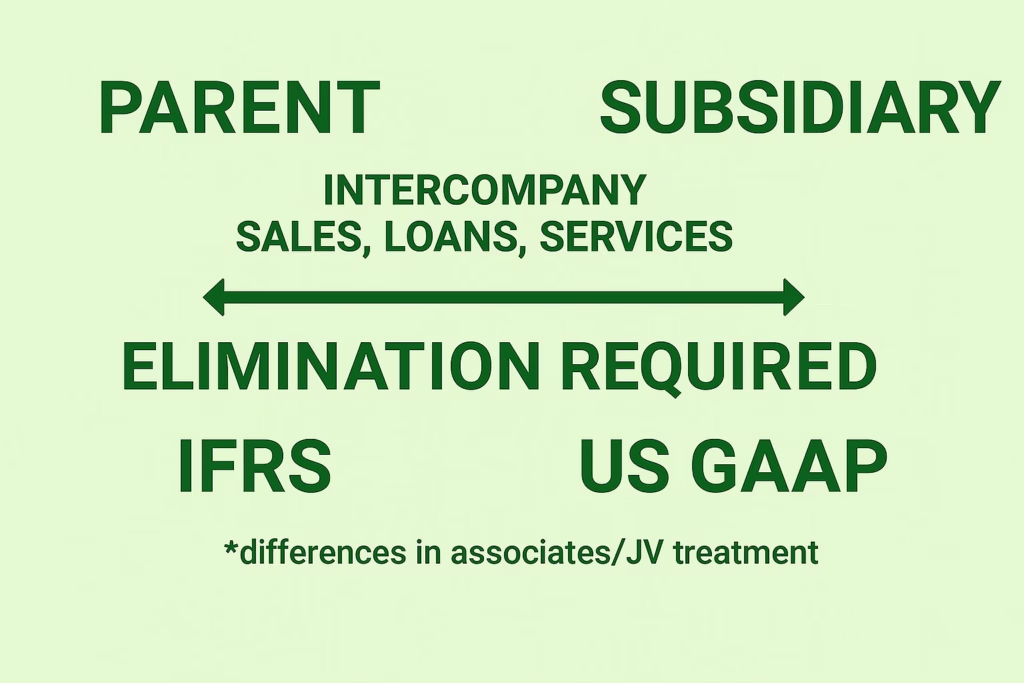

4. Intercompany Transactions & Profits

Both IFRS and US GAAP require elimination of intercompany sales, loans, and balances to avoid double counting.

- IFRS: Special emphasis on eliminating unrealized profits in associates and joint ventures.

- US GAAP: Similar, but rules differ in detail (e.g., upstream vs. downstream transactions).

Common Challenges for Global CFOs

- Dual Reporting Burden

Groups operating in both IFRS and US GAAP jurisdictions often have to prepare two sets of consolidated statements—one for regulators, another for investors. - Goodwill & NCI Adjustments

Reconciling full goodwill vs. partial goodwill can lead to significant swings in reported assets, making year-on-year comparisons messy. - Foreign Subsidiary Policies

Ensuring subsidiaries align with group accounting policies can be costly and time-consuming—especially under IFRS where adjustments are mandatory. - Investor & Analyst Expectations

Investors may benchmark you against peers under different standards. A company showing higher goodwill under US GAAP may look “asset-heavy” compared to an IFRS peer. - Audit & Compliance Pressure

Auditors often require detailed reconciliations between IFRS and US GAAP figures, stretching finance teams at quarter- and year-end.

Best Practices for Navigating IFRS vs. US GAAP Consolidation

- Document Clear Reporting Policies

Develop a group accounting manual that specifies treatments under both IFRS and US GAAP. Include examples (e.g., intercompany loan treatments, revenue recognition policies). - Leverage Technology for Dual Reporting

Consolidation platforms can automate eliminations, currency translations, and parallel reporting structures—reducing manual effort. - Centralize Currency and Policy Decisions

Foreign currency translation is a major source of reconciliation issues. CFOs should enforce consistent FX policies across subsidiaries. - Train Finance Teams Globally

Local finance teams should understand how their reporting choices impact consolidation. Provide targeted training on goodwill, NCI, and policy alignment. - Engage with Stakeholders Proactively

Don’t wait until year-end. Communicate with auditors, regulators, and analysts about differences and their impact on reported results. Transparency builds trust.

Conclusion: Beyond Compliance

Mastering the nuances of IFRS vs. US GAAP consolidation is not just about meeting regulatory requirements. It’s about telling a consistent financial story to stakeholders across the globe.

For CFOs, the challenge is turning what feels like an accounting headache into a strategic advantage—demonstrating governance strength, building investor confidence, and ensuring your group’s financials are audit-ready, everywhere.