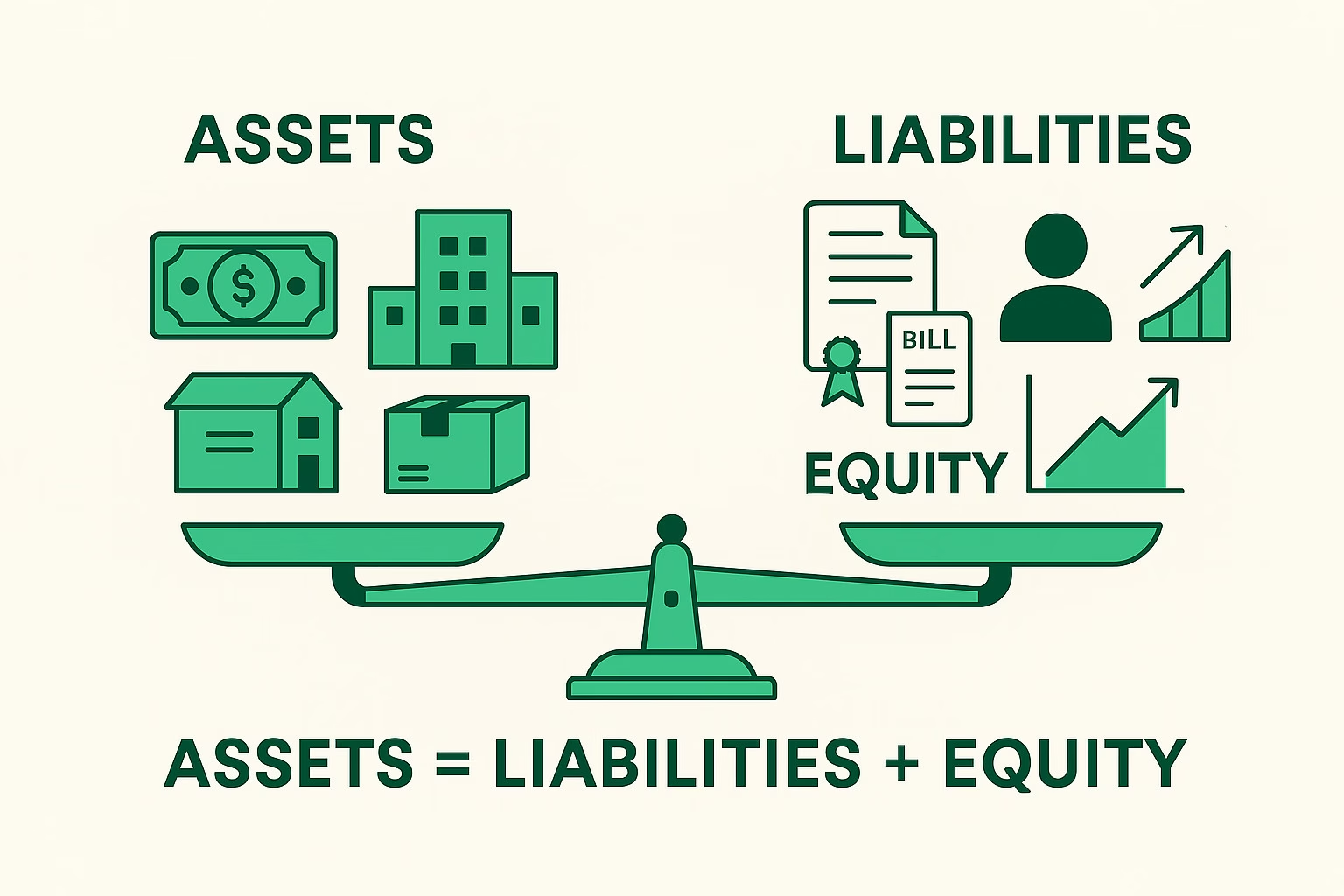

At the heart of accounting lies one simple but powerful idea:

everything a business owns is funded either by borrowing or by the owners themselves.

This idea is captured in the Assets–Liabilities–Equity Equation, the foundation of double-entry accounting and the balance sheet.

Assets = Liabilities + Equity

No matter how complex a business becomes, this equation must always remain in balance.

🔍 What Does the Equation Mean?

Assets

Assets are resources the business controls and expects to generate future economic benefits from.

Examples include:

- Cash and bank balances

- Accounts receivable

- Inventory

- Property, plant, and equipment

- Intangible assets like software or patents

Assets show what the company owns or controls.

Liabilities

Liabilities are obligations the company owes to others — amounts that must be settled in the future.

Examples include:

- Loans and borrowings

- Accounts payable

- Accrued expenses

- Deferred revenue

- Asset retirement obligations

Liabilities represent claims by external parties on the company’s assets.

Equity

Equity represents the owners’ residual interest in the business after all liabilities are settled.

It includes:

- Share capital

- Retained earnings

- Reserves

- Accumulated profits or losses

Equity shows what belongs to the owners.

⚖️ Why the Equation Always Balances

Every business transaction affects at least two accounts.

Example:

- If a company buys equipment using cash:

- One asset (equipment) increases

- Another asset (cash) decreases

Example:

- If a company takes a bank loan:

- Assets (cash) increase

- Liabilities (loan) increase

Because each transaction has a dual effect, the equation always stays in balance.

📊 Real-World Example

Suppose a business has:

- Assets of $1,000,000

- Liabilities of $400,000

Using the equation:

Equity = Assets − Liabilities

Equity = $1,000,000 − $400,000 = $600,000

This means the owners’ claim on the business is $600,000.

🧮 Expanded View

Equity itself can be expanded further:

Equity = Capital + Retained Earnings

And retained earnings can be broken down into:

Retained Earnings = Opening Balance + Profit − Dividends

This shows how daily business operations flow back into the core accounting equation.

📈 Why This Equation Matters

1. Foundation of Financial Statements

The balance sheet is built directly from this equation.

2. Financial Health Indicator

A business with high liabilities relative to assets may be over-leveraged.

3. Decision-Making Tool

Managers, investors, and lenders rely on this equation to assess risk and value.

4. Error Detection

If the equation doesn’t balance, there’s an accounting error.

🧠 Simple Analogy

Think of a house:

- The house is the asset

- The mortgage is the liability

- The homeowner’s stake is the equity

No matter how you look at it, the value of the house equals the mortgage plus the owner’s share.

🪙 Key Takeaway

The Assets–Liabilities–Equity Equation is the backbone of accounting.

It explains where a company’s resources come from and who has a claim on them.

Once this equation is understood, all other accounting concepts — from journal entries to financial analysis — start to make sense.