Intercompany transactions are a natural part of any growing business group. When subsidiaries trade goods, provide services, or lend funds to one another, these transactions must be recorded and later eliminated during consolidation. However, many finance teams struggle with intercompany mismatches — situations where the sender’s records do not align with the receiver’s. These mismatches are one of the most common causes of reconciliation headaches, reporting delays, and inaccurate consolidated results.

In this article, we’ll explore why intercompany mismatches occur, how they impact your group reporting, and what practical steps you can take to fix and prevent them.

What Is an Intercompany Mismatch?

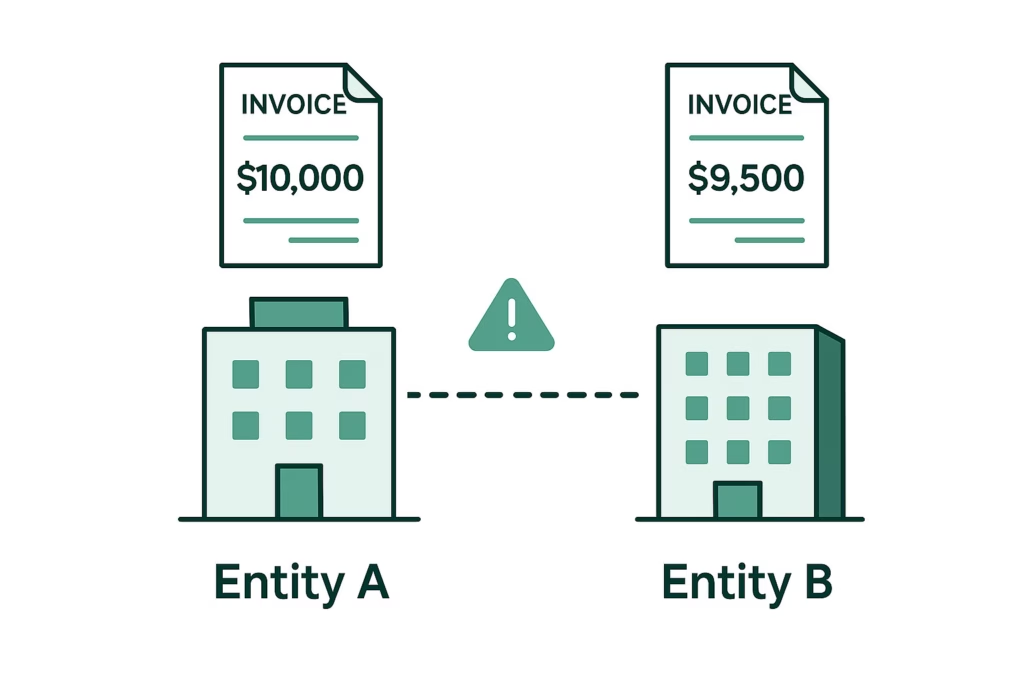

An intercompany mismatch occurs when two entities within the same group record the same transaction differently. For example:

- One entity records a sale, while the other doesn’t record a purchase

- Amounts don’t match (e.g., $10,000 vs $9,500)

- Different currencies are used

- Different accounting periods are selected

During consolidation, these differences prevent clean eliminations and result in:

- Inaccurate group revenue and expenses

- Imbalanced intercompany balances

- Longer month-end close processes

- Increased risk of audit findings

Mismatches aren’t just accounting errors — they are process and system breakdowns.

The Most Common Root Causes

1. Timing Differences

One entity may recognize the transaction in May, while the counterparty posts it in June. This is especially common with goods in transit, delayed invoicing, or manual processes.

Result: The transaction doesn’t match during consolidation, even though it is “correct” in isolation.

2. Currency & FX Rate Differences

If one entity uses a different exchange rate than the other, the numbers will never perfectly match.

Example:

- Subsidiary A uses 1 USD = 1.35

- Subsidiary B uses 1 USD = 1.38

This creates mismatched balances even if the original USD amount is identical.

3. Different Account Mappings

One entity may post the transaction to Cost of Goods Sold, while the other records it under Intercompany Expenses or another category.

This creates classification mismatches, which are harder to detect but can distort group margins and segment reporting.

4. Missing Intercompany References

Without consistent intercompany codes (e.g. IC_Company01), your system cannot automatically match transactions between entities.

This results in:

- Manual searching

- Spreadsheet matching

- High risk of human error

5. Manual Data Entry Errors

Even a single digit typo can cause mismatches across a large volume of transactions. Complexity grows as your group expands and more entities are added.

6. Different Recognition Rules

One subsidiary may recognize revenue on delivery, another on invoicing. These differences in policy lead to systemic mismatches every period.

The Hidden Impact on Group Reporting

Intercompany mismatches don’t just affect accounting teams — they influence how management and stakeholders view performance.

They can cause:

- Overstated or understated margins

- Incorrect regional or entity-level performance views

- False profit trends

- Reduced trust in reports

- Audit complications

In short: If your intercompany data is inconsistent, your consolidated truth is unreliable.

How to Identify Mismatches Early

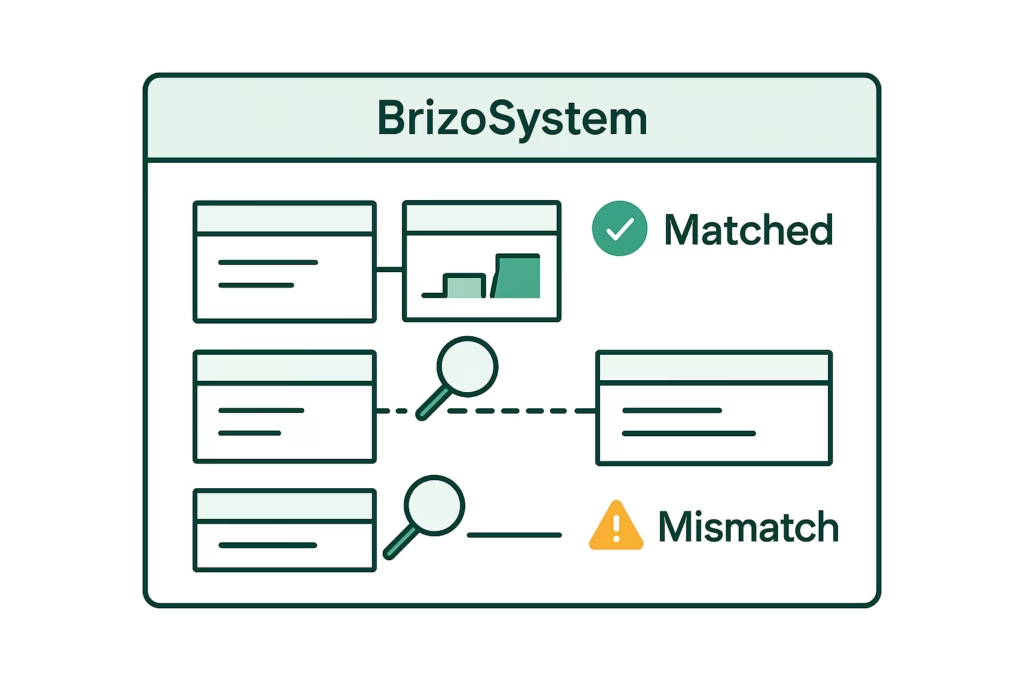

A best-in-class consolidation process should include:

✅ Intercompany aging and matching reports

✅ Automated mismatch detection

✅ Transaction-level drill-down

✅ Clear audit trail

✅ Entity-by-entity comparison

The faster you identify mismatches, the less effort is required to resolve them.

Practical Fixes That Actually Work

Here are proven strategies used by high-performing finance teams:

1. Standardize Intercompany Policies

Create clear rules for:

- Timing of recognition

- Pricing and markups

- Currency conversion

- Account classifications

One group = one playbook.

2. Use Consistent Intercompany Codes

Every intercompany transaction should include:

- Counterparty ID

- Transaction type

- Matching reference number

This makes automated reconciliation possible.

3. Centralize FX Policy

Set a group FX rate table that all entities must follow for intercompany transactions.

This alone can eliminate a large portion of mismatches.

4. Automate Matching & Reconciliation

Manual spreadsheets don’t scale. Automation tools can:

- Highlight differences instantly

- Suggest matching transactions

- Flag anomalies

- Reduce close time significantly

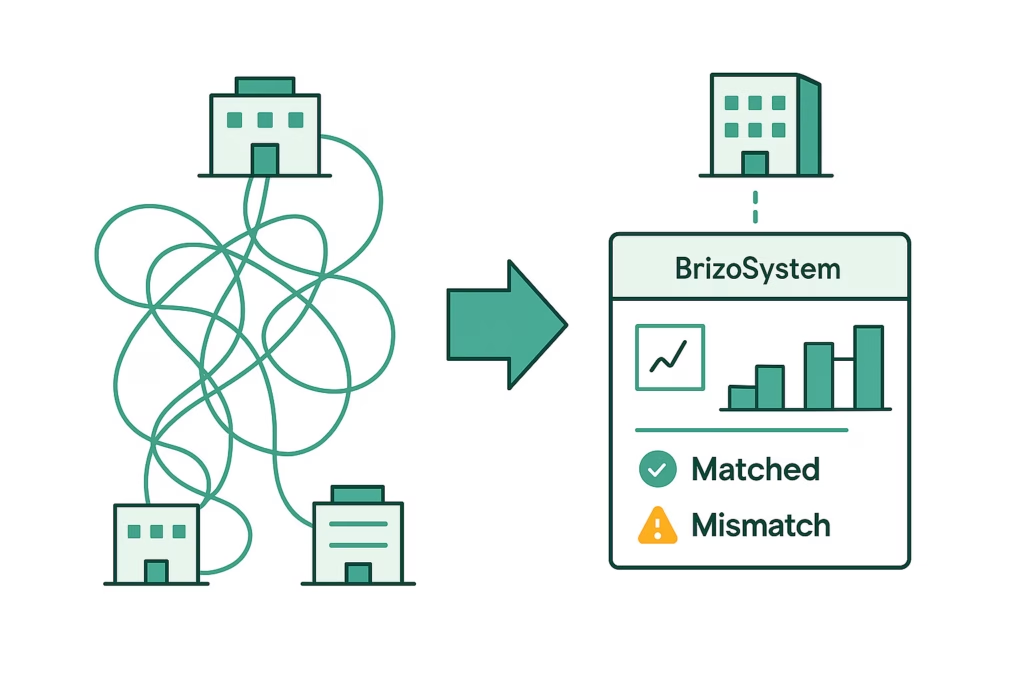

This is especially important when dealing with dozens or hundreds of entities.

5. Move to Real-Time Visibility

Instead of discovering mismatches at month-end, aim for continuous intercompany monitoring. This allows teams to resolve issues before they snowball into bigger problems.

Final Thought

Intercompany mismatches are not just an accounting nuisance — they are a signal that your finance processes need alignment and transparency.

By identifying root causes, standardizing group-wide rules, and supporting your workflow with the right reporting tools, you can turn a painful process into a streamlined, confident close.

In today’s complex, multi-entity environment, the goal is simple:

One version of truth. No more guesswork.

And that’s exactly what strong intercompany reporting enables.