Consolidation

-

Entity Structures and Reporting Lines: How They Shape Consolidated Results

—

When most people think about financial consolidation, they think of journals, eliminations, FX translation, and reporting deadlines. But before any of that can happen, there’s a more fundamental layer that…

-

Unmasking Unrealized Profit: The Key to True Group Performance

—

Group reporting often tells a compelling story — but not always the right one.When entities within a group trade with each other, profits are recorded at the local level. Yet,…

-

Foreign Exchange Impact Explained: Turning FX Volatility into Transparent Reporting

—

Foreign exchange (FX) volatility has always been a double-edged sword for multinational companies. While it reflects global business reach, it also brings unpredictability to financial results.When currencies swing, reported revenues,…

-

Foreign Currency Translation in Consolidation: Techniques and Best Practices

—

Introduction In today’s global business landscape, most corporate groups operate across multiple countries — and therefore, multiple currencies. While this diversification brings opportunity, it also introduces one of the most…

-

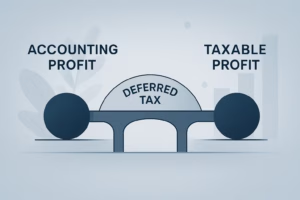

Deferred Taxes in Consolidation: Simplifying a Complex Accounting Area

—

Introduction Deferred taxes are among the most complex and misunderstood areas in financial consolidation. They bridge the gap between accounting profit and taxable profit — reflecting timing differences that reverse…

-

Intercompany Loans and Interest: Accounting, Elimination, and Common Mistakes

—

Introduction: The Hidden Complexity Behind Simple Loans At first glance, intercompany loans appear straightforward — one entity within a group lends money to another. However, when it comes to financial…

-

The Role of Consolidation in IFRS vs. US GAAP: Key Differences for Global CFOs

—

Introduction: A CFO’s Dilemma Imagine this: your group headquarters in London reports under IFRS, but your U.S. subsidiary reports under US GAAP. When quarter-end arrives, you’re staring at two sets…

-

Foreign Currency in Consolidation: Best Practices for Eliminating FX Noise

—

Introduction For multinational groups, foreign currency is more than just an accounting technicality — it’s one of the biggest sources of complexity in consolidation. Exchange rate fluctuations can create FX…

-

Intercompany Reconciliations: How to Streamline the Most Time-Consuming Step in Consolidation

—

Introduction If you ask any group finance team what slows down the consolidation process the most, the answer is almost always the same: intercompany reconciliations. Each entity records transactions with…