Accounting

-

Clean Surplus Accounting: Understanding the Link Between Profit and Equity

—

in AccountingIn financial reporting, most people focus on profit and loss. But profit alone doesn’t tell the full story of how a company’s equity actually changes over time. This gap is…

-

Purchase Price Allocation (PPA): Breaking Down the Cost of an Acquisition

—

in AccountingWhen one company acquires another, the purchase price is rarely just a single number. Behind the headline price lies a detailed accounting exercise called Purchase Price Allocation (PPA), which determines…

-

Embedded Derivative: Hidden Risk Inside Financial Contracts

—

in AccountingSome financial contracts look simple on the surface but contain components that behave like derivatives. These components can significantly change cash flows and risk exposure. In accounting, such features are…

-

Onerous Contract: When a Contract Becomes a Financial Burden

—

in AccountingNot all contracts generate value. Sometimes, changing circumstances turn a previously profitable agreement into a costly obligation. In accounting, such situations are addressed through the concept of an Onerous Contract.…

-

Negative Pledge Clause: Protecting Lenders Without Taking Collateral

—

in AccountingWhen companies borrow money, lenders want assurance that their position won’t be weakened later. One common way to achieve this—without requiring immediate collateral—is through a Negative Pledge Clause. Although it…

-

Off-Balance-Sheet Financing: What It Is and Why It Matters

—

in AccountingNot all financing arrangements appear directly on a company’s balance sheet. Some obligations are structured in a way that keeps certain assets or liabilities outside the balance sheet, while still…

-

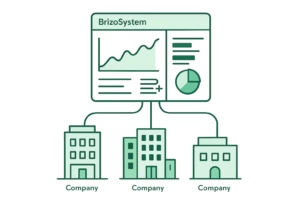

Top Features Needed for Multi-Entity Financial Reporting

—

As organizations grow beyond a single legal entity, financial reporting quickly becomes more complex. Multiple subsidiaries, currencies, charts of accounts, and intercompany transactions introduce challenges that traditional single-entity reporting tools…

-

Understanding the Current Ratio

—

in AccountingLiquidity is one of the most important indicators of a company’s financial health. Even profitable businesses can fail if they are unable to meet short-term obligations when they fall due.…

-

Carbon Accounting for SMEs: What It Is, How It Works, and Why It Matters

—

in AccountingFor many small and medium-sized enterprises (SMEs), carbon accounting still sounds like something meant for large multinationals with sustainability teams and complex reporting frameworks. But that perception is changing —…