In group reporting, accuracy isn’t just about having numbers that add up. It’s about confidence — confidence that leadership can rely on the data to make decisions, that finance teams can explain movements clearly, and that auditors won’t uncover unpleasant surprises.

Unfortunately, many organizations rely on consolidated reports that look polished but hide serious data issues underneath. If left unchecked, these issues can lead to wrong decisions, delayed closes, and loss of trust in finance.

This article outlines five clear reporting signals that your group data may not be reliable — and what those signals reveal about deeper structural problems.

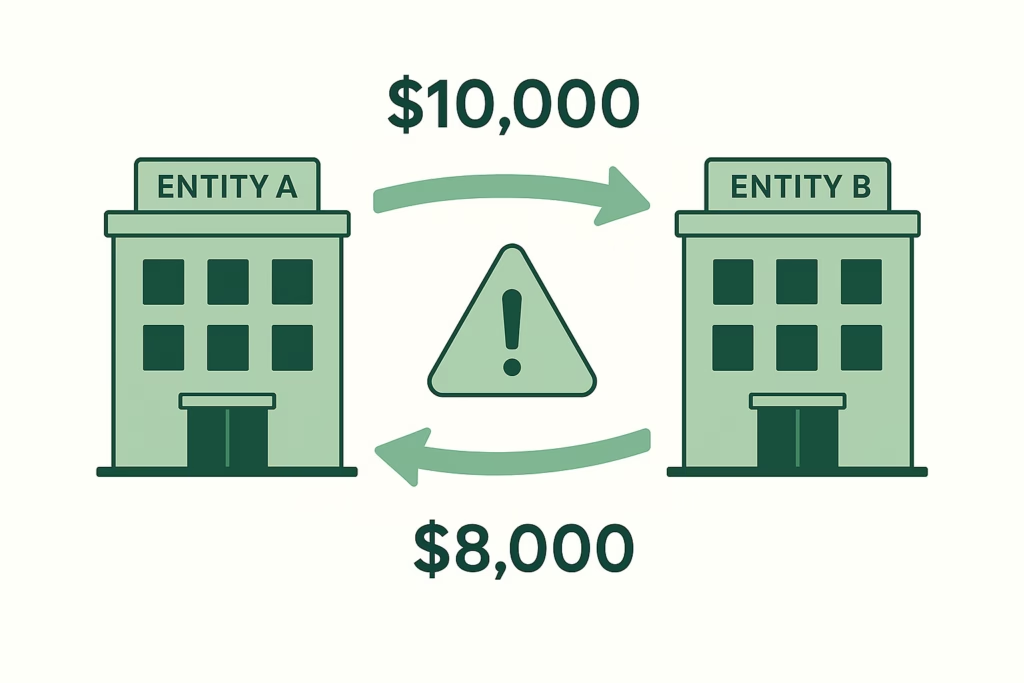

Signal 1: Intercompany Balances Never Fully Reconcile

If intercompany balances regularly require manual “plug” adjustments just to balance, it’s a red flag.

Common symptoms include:

- Intercompany receivables and payables not matching

- One entity shows revenue while the counterparty shows no expense

- Differences rolled forward every month instead of resolved

This usually indicates deeper issues such as inconsistent posting timing, missing counterparty references, or different FX rates being applied. When unresolved balances are accepted as “normal,” data reliability slowly erodes.

What it really means:

Your group lacks a controlled intercompany matching and reconciliation process.

Signal 2: The Close Process Depends on a Few Key Individuals

When consolidated reporting can only be completed by one or two people who “know the spreadsheet,” your data is fragile.

Signs include:

- Highly complex Excel files no one else understands

- Manual journal logic that lives only in someone’s head

- Fear of changes because “it might break something”

This isn’t efficiency — it’s operational risk. If those individuals are unavailable, the entire reporting process can stall.

What it really means:

Your reporting process isn’t system-driven — it’s person-dependent.

Signal 3: Numbers Change After Reports Are Shared

If management receives revised versions of the same report days after initial delivery, trust drops quickly.

Typical reasons:

- Late data submissions from subsidiaries

- Last-minute FX adjustments

- Intercompany issues discovered after consolidation

- Manual fixes applied under time pressure

Even small changes undermine confidence. Stakeholders begin questioning whether any version is truly final.

What it really means:

Your controls and validation checks are happening too late in the process.

Signal 4: You Can’t Easily Explain Variances

A trusted report isn’t just accurate — it’s explainable.

If finance teams struggle to answer:

- Why margins moved

- Why one region outperformed another

- Why inventory or cash shifted significantly

then the data may not be as reliable as it looks. This often happens when consolidation adjustments are layered manually without transparency or traceability.

What it really means:

Your reporting lacks drill-down visibility and audit clarity.

Signal 5: Audits Take Longer Every Year

When auditors repeatedly question:

- Intercompany eliminations

- Manual adjustments

- FX treatments

- Consistency across entities

it signals that the reporting process is becoming harder to validate.

Longer audit cycles often reflect:

- Poor documentation

- Inconsistent methodologies

- Heavy reliance on spreadsheets

- Limited system controls

Auditors don’t just test numbers — they test process integrity.

What it really means:

Your group reporting framework isn’t scaling with the business.

Why These Signals Are Often Ignored

Many finance teams recognize these warning signs but accept them as “part of consolidation.” Deadlines are met, reports are delivered, and issues are patched each month.

But over time, this creates:

- Increasing close pressure

- Growing technical debt

- Reduced analytical capacity

- Lower confidence from leadership

The cost isn’t just inefficiency — it’s credibility.

How to Restore Trust in Group Reporting

Trust is rebuilt when reporting moves from reactive to structured.

Key principles include:

- Standardized group data structures

- Clear intercompany identification and matching

- Centralized FX and consolidation logic

- Early validation and exception detection

- Transparent audit trails

- Reduced reliance on manual spreadsheets

Modern reporting platforms like BrizoSystem support these principles by transforming raw financial data into structured, validated, and explainable group reports.

BrizoSystem doesn’t replace your accounting systems — it strengthens what comes after them.

Conclusion: Trusted Data Is a Strategic Advantage

When group data can’t be trusted, decision-making slows, risks increase, and finance teams lose influence.

But when reporting is consistent, explainable, and timely, finance becomes a strategic partner — not just a number checker.

If you’re seeing any of these five signals, it may be time to look beyond fixing individual issues and start strengthening the foundation of your group reporting.

Because in consolidated reporting, trust isn’t optional — it’s essential.