Consolidation

-

Top Integration Options for Cloud Accounting

—

Cloud accounting has transformed how businesses record transactions, manage day-to-day finance operations, and close their books. But for growing companies, accounting data alone is not enough. As organizations add entities,…

-

Why Mid-Sized Companies Need Consolidation Tools

—

For many mid-sized companies, financial reporting starts out simple. A few legal entities, a manageable volume of transactions, and spreadsheets that seem to “do the job.” But growth changes everything.…

-

Automated Financial Consolidation Explained

—

Financial consolidation is meant to deliver clarity — a single, reliable view of group performance.Yet for many finance teams, consolidation remains one of the most time-consuming, error-prone parts of the…

-

Cloud vs On-Premise Consolidation Tools: What Mid-Sized Companies Should Know

—

As mid-sized companies grow — adding subsidiaries, multiple currencies, and increasingly complex reporting requirements — the choice of consolidation tool becomes critical. A key decision is whether to adopt a…

-

Top Features Needed for Multi-Entity Financial Reporting

—

As organizations grow beyond a single legal entity, financial reporting quickly becomes more complex. Multiple subsidiaries, currencies, charts of accounts, and intercompany transactions introduce challenges that traditional single-entity reporting tools…

-

Five Reporting Signals Your Group Data Can’t Be Trusted

—

In group reporting, accuracy isn’t just about having numbers that add up. It’s about confidence — confidence that leadership can rely on the data to make decisions, that finance teams…

-

From Chaos to Clarity: A Smarter Way to Consolidate Financials

—

For many finance teams, financial consolidation feels less like an organized process and more like a monthly emergency. Files fly back and forth through email. Multiple versions of spreadsheets stack…

-

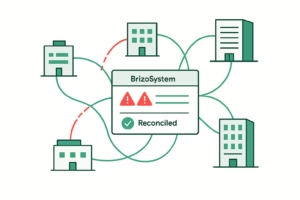

Why Intercompany Mismatches Happen: A Deep Dive into Root Causes and Fixes

—

Intercompany transactions are a natural part of any growing business group. When subsidiaries trade goods, provide services, or lend funds to one another, these transactions must be recorded and later…

-

Intercompany Markups, Unrealized Profit, and Their Effect on Group Margins

—

When groups scale across entities, countries, or business units, intercompany transactions become unavoidable. But these internal transactions often introduce a hidden distortion: unrealized profit embedded in intercompany markups. If not…