BrizoSystem

-

Managing Multiple Accounting Standards in Group Reporting: A Smarter, More Flexible Approach

—

in NewsAs companies expand across borders, financial reporting complexity increases rapidly. One of the most common challenges faced by finance teams in multi-entity groups is the need to report under multiple…

-

Budget & Forecast: Turning Planning into Actionable Group Reporting

—

in NewsBudgeting and forecasting are not just planning exercises — they are essential tools for steering the business. Yet for many finance teams, budgets and forecasts live outside the reporting process,…

-

Clean Surplus Accounting: Understanding the Link Between Profit and Equity

—

in AccountingIn financial reporting, most people focus on profit and loss. But profit alone doesn’t tell the full story of how a company’s equity actually changes over time. This gap is…

-

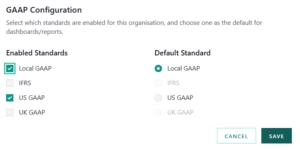

IFRS and GAAP Compliance with Modern Software

—

in CFO InsightsFinancial reporting compliance has never been more demanding. As businesses grow across borders, finance teams are expected to comply with IFRS, US GAAP, or sometimes both — while delivering faster…

-

Entities in Reports: Bringing Entity-Level Visibility into Group Reporting

—

in NewsAs group structures grow, consolidated numbers alone are often not enough. Finance teams need to understand where the numbers come from, not just what the final total is. To improve…

-

Purchase Price Allocation (PPA): Breaking Down the Cost of an Acquisition

—

in AccountingWhen one company acquires another, the purchase price is rarely just a single number. Behind the headline price lies a detailed accounting exercise called Purchase Price Allocation (PPA), which determines…

-

Top Integration Options for Cloud Accounting

—

Cloud accounting has transformed how businesses record transactions, manage day-to-day finance operations, and close their books. But for growing companies, accounting data alone is not enough. As organizations add entities,…

-

Auto Elimination Log: Bringing Control and Transparency to Intercompany Eliminations

—

in NewsIntercompany eliminations are essential to producing accurate consolidated financial statements — but they are rarely straightforward. Differences in timing, FX, rounding, or posting practices often mean balances don’t match perfectly.…

-

Embedded Derivative: Hidden Risk Inside Financial Contracts

—

in AccountingSome financial contracts look simple on the surface but contain components that behave like derivatives. These components can significantly change cash flows and risk exposure. In accounting, such features are…